What you need to know about new property tax valuations hitting your mailbox

For the third year in a row, homeowners are having sticker shock as they open their recently mailed 2023 property valuation notices from the El Paso Central Appraisal District.

This is the third straight year the appraisal district conducts a mass reappraisal of properties in El Paso County. Residential property owners began receiving their property valuations at the end of March, with the remaining batches expected to be mailed in April and May.

“Ours went up $99,500. Ugh,” said one Westside resident on the Nextdoor app, an online platform where neighbors connect.

Another asked for help on how to contest the new appraisal.

“We just got our 2023 Taxable Value on our home. And it’s absurd!,” said another neighbor, adding she is hoping for help and a “good outcome.”

Home prices have been steadily climbing in El Paso, according to data compiled by the Texas Real Estate Research Center at Texas A&M University. The research center shows that home prices were up 11% annualized for the fourth quarter of 2022.

Following last year’s appraisals, average home valuations in El Paso County shot up nearly 20% to $189,709 in 2022, El Paso Central Appraisal District certified numbers show.

Meanwhile, state lawmakers are trying to find ways to ease the burden on taxpayers by either increasing homestead exemptions for school taxes or tightening a cap on home appraisal increases. No set plan has been put in place though as the state’s 88th Legislative Session is continuing.

El Paso Matters asked El Paso Central Appraisal District Assistant Chief Appraiser David Stone to answer questions about what property owners need to know regarding the latest round of appraisals and what they can do to protest them if they feel the valuation is too high.

El Paso Matters: How does El Paso Central Appraisal District create a valuation for a property?

Stone: The El Paso Central Appraisal District mass appraises property according to the Uniform Standards of Professional Appraisal Practice (USPAP) and the Texas Property Tax Code.

There are 3 methods of appraising property: the market approach, the income approach, and the cost approach.

Most non-income producing property is appraised using the market approach, which compares the property to similar properties that have recently sold.

Income producing property is appraised using the income approach, based on the rental income it generates. Although residential rental property produces income, it is typically appraised by the market approach.

If sales and income information is not available, a property will be appraised using the cost approach – how much it would cost to build the property under current economic conditions.

What’s the trend you’re seeing for valuations so far?

Stone: Property values are increasing again this year, but overall not as much as last year. Properties appraised using the cost approach are seeing larger increases due to increased costs of construction.

What’s your schedule for sending out valuation notices?

Stone: The notices for most residential property were mailed March 31. Most commercial real property notices will be mailed April 14. Business personal property notices will be mailed in late April and May because of rendition deadline dates. Almost all notices should be mailed by the end of May.

El Paso Central Appraisal District used to do valuations of homes every three years. Why are you doing it every year now?

Stone: State law requires a reappraisal at least every three years. State law also requires properties to be appraised at market value. When property values are stable, a reappraisal every three years is all that is required; but the appraisal district has never had a year that we didn't reappraise some properties.

Over the last several years, we have seen large increases in the real estate market in El Paso. To keep up with the appreciating market, the appraisal district has had to annually reappraise properties. Our property values are tested every two years by the Texas State Comptroller's office, and state funding for local school districts may be adversely affected if our appraised values are not at market value.

This is the third year in a row El Pasoans have received significantly higher property valuations. What’s going on?

Stone: The real estate market in El Paso has been hot for several years now. A recent study has identified El Paso as the fourth best real estate market in the country. Six months of home inventory is typical for a real estate market in equilibrium. In 2022, El Paso had less than a month's inventory. As of January 1, El Paso had about two months inventory. Although the market is slowing down, demand is still outpacing supply.

I haven’t done anything to my property. Why does my valuation keep rising?

Stone: Even if you haven't done anything to your property, it is still desirable to potential home buyers. When demand for houses outpaces supply, home prices will rise.

Does a higher valuation mean my property taxes are going up?

Stone: Property taxes are based on property value and the tax rates set by taxing entities. Whether your property taxes go up is just as dependent on what tax rates the taxing entities set as the value increases. The closer taxing entities set their tax rate to the No New Revenue Rate each year, the more likely your property taxes won't increase.

State law says the valuation for tax purposes for a residential property with a homestead exemption can only go up 10% a year. What does that mean?

Stone: Generally speaking, properties with an existing homestead exemption may not have their appraised value for property tax purposes increase by more than 10% per year.

As an example, if your property's market value was $200,000 in 2022 and it was reappraised at $230,000 in 2023, its appraised value would be "capped" at $220,000 for 2023 – $200,000 *10% = $20,000 increase.

In future years, your appraised value would increase by up to 10% every year until your appraised value equals your market value even if your market value doesn't increase. If the example property kept the same market value of $230,000 for 2024, its appraised value would rise to $230,000 – catching the appraised value up to the market value.

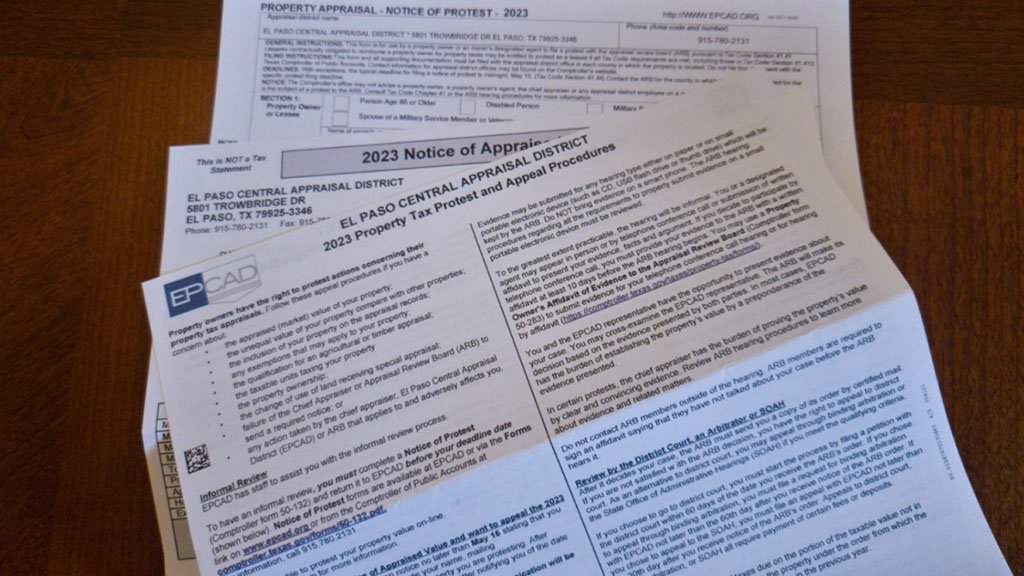

How do people protest their valuation if they think it is too high?

Stone: They must file a written protest with the appraisal district by May 15 or 30 days after the date on their notice of appraised value – whichever is later. The easiest way is to go to our website www.epcad.org and look up your property.

Click on "property services" and then "protest form" to fill out a protest and submit it online. A protest form is also included with your appraisal notice. You can fill it out and drop it off at our offices, mail it, fax it, or email it.

What sort of evidence can help get a valuation lowered? And what kind of evidence do people often present that isn’t helpful?

Stone: Good evidence includes:

- A comparable market analysis, CMA, on your property from a real estate professional

- Pictures of any problems with your property and professional estimates of cost to repair – above normal wear and tear

- Property appraisals

Any evidence submitted will be evaluated by CAD appraisers at informal hearings and the Appraisal Review Board at formal hearings, and they will determine how much weight to give it.

A property owner should check our website to make sure that the appraisal district has the correct characteristics and proper exemptions for their property.

A property owner can request the evidence the appraisal district has for their property, which may support a reduction in value.

This article first appeared on El Paso Matters and is republished here under a Creative Commons license.![]()