Which US cities are most popular for different age groups to settle down?

Tricia Daniel // Shutterstock

Which US cities are most popular for different age groups to settle down?

New garden court houses in the Mueller neighborhood in Austin, TX.

The American dream of homeownership is changing, particularly for younger generations. According to the Berkeley Institute for Young Americans, individuals under 44 are purchasing homes at a slower rate than those over 60 did at their age. They’re also selecting different locations to settle down.

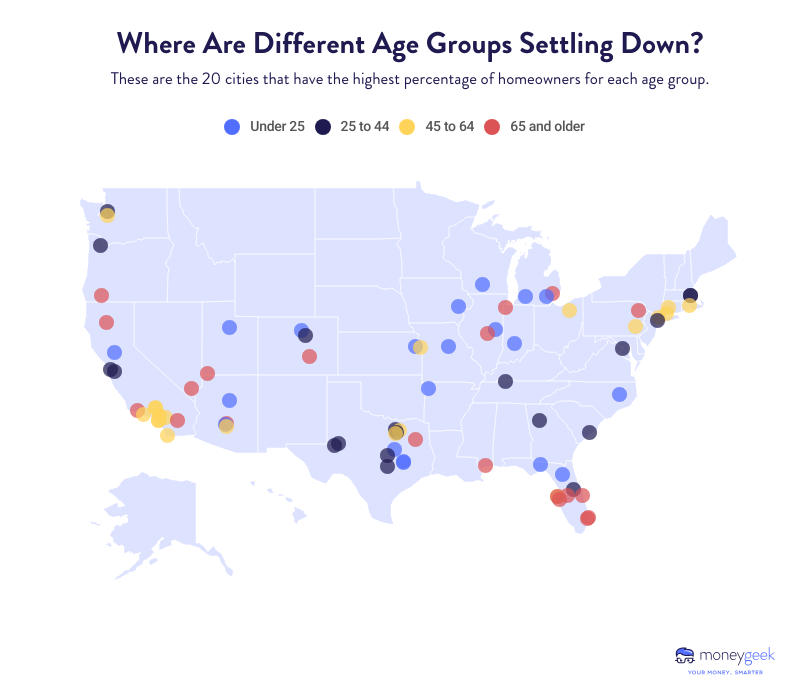

To identify cities where each age group is putting down roots, MoneyGeek analyzed household data from the U.S. Census Bureau and found that all age groups share a preference for cities in the South or West.

Key findings

- Provo, Utah, has the highest rate of homeowners under 25 in the U.S., with nearly 40% of homes owned by young adults, almost ten times the national figure of 4%.

- Three Southern cities — Austin and Killeen, Texas, and Clarksville, Tennessee — have some of the highest rates of homeownership among 25- to 44-year-olds, with this age group making up half of this region’s homeowners.

- The five cities with the highest homeownership rates among 45- to 65-year-olds are all in California, with Palmdale having the highest rate at 48%.

- Texas dominates the list of cities with the highest increase in homeowners aged 25 to 44, with four cities experiencing over 50% growth from 2012 to 2022.

- The 10 most populous U.S. cities averaged a 24% increase in young adult homeowners over the last decade, but Western cities like Los Angeles and San Diego lagged with declines of 5% and 1%, respectively.

![]()

MoneyGeek

Cities With the Highest Concentration of Homeowners by Age Group

Map showing where different age groups are settling down.

Provo, Utah; Somerville, Massachusetts; Palmdale, California; and Boca Raton, Florida, are the cities with the highest percentage of homeowners in the young adult, 25 to 44, 45 to 64 and 65 and over age groups, respectively. Although each age group has its own preferred cities for settling down, the South and West attract the most residents across all demographics. These regions consistently rank among the top five cities with the highest proportion of homeowners from each age group.

MoneyGeek

Top Cities Where Homeowners Are Under 45

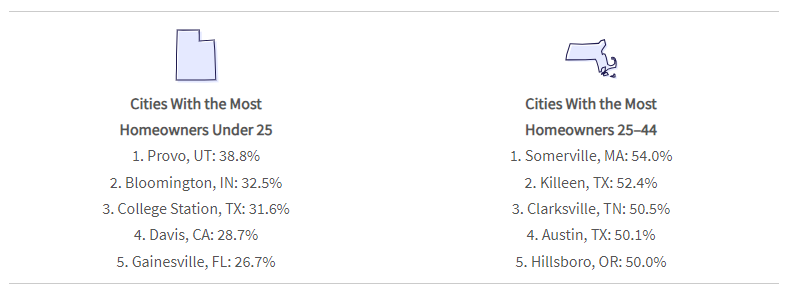

Graphic showing two top 5 lists, cities with the most homeowners under 25 and cities with the most homeowners 25–44.

Based on nationwide data from the U.S. Census Bureau, only 4% of all homeowners are under 25. However, the percentage of homeowners in this age group significantly increases in certain Southern and Western cities. In Provo, Utah, 39% of homeowners are under 25, representing 13,518 households in 2022. Davis, California, has 29% of its householders under 25. In the South, College Station, Texas, has 32% of its homeowners under 25, while Gainesville, Florida, sees 27%.

The Southern U.S. shows particularly strong homeownership for those 25 to 44 years old, with three cities — Killeen and Austin, Texas, and Clarksville, Tennessee — making it into the top five. In these cities, homeowners from this age group make up just over half of all homeowners. However, the highest homeownership rate within this age group is in Somerville, Massachusetts, with a rate of 54%.

MoneyGeek

Top Cities Where Individuals 45 and Over Are Settling Down

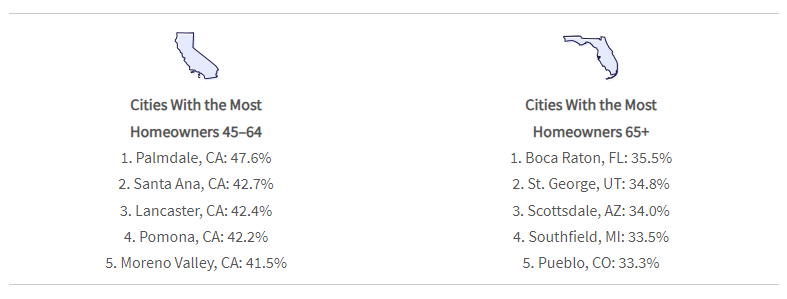

Graphic showing two top 5 lists, cities with the most homeowners 45–64 and cities with the most homeowners 65+.

The 45 to 64 age group represents just over a third of all U.S. homeowners, the largest of all the other age groups. The five cities with the highest percentage of homeowners in this age bracket are all located in California. In Palmdale, 48% of homeowners (about 21,700 out of 43,388) fall within this age group. Santa Ana follows with a homeownership rate of 43% among this demographic. Lancaster, Pomona and Moreno Valley round out the rest of the top five, with each city reporting over 41% homeownership in this demographic.

Boca Raton, Florida, ranks highest in homeownership for people aged 65 and older (36%). St. George, Utah, comes in a close second, with 35% of homeowners in this age range. Scottsdale, Arizona; Pueblo, Colorado; and Southfield, Michigan, follow, each having at least 33% of homeowners over 65 years old.

Cities With the Greatest 10-Year Growth in Homeowner Rates by Age Group

From 2012 to 2022, the total number of homeowners in the U.S. increased by 12%. Somerville, Massachusetts; Temple, Texas; St. George, Utah; and McKinney, Texas, recorded the highest increases in homeownership across the young adult, 25 to 44, 45 to 64 and 65 and over age groups, respectively. Among those 25 to 64, the fastest-growing cities saw an increase ranging from 40% to 75%. For householders under 25 and over 65, the growth rates in the fastest-growing cities reached triple digits.

MoneyGeek

Cities With Highest Household Growth for Individuals Under 45

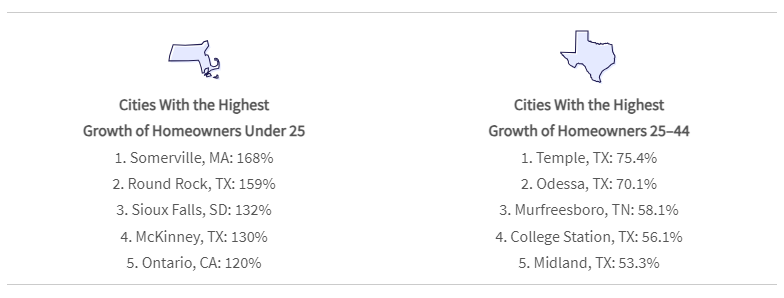

Graphic showing two top 5 lists, cities with the highest growth of homeowners under 25 and cities with the highest growth of homeowners 25–44.

In the past decade, Somerville, Massachusetts, has seen a 168% increase in homeowners under 25, the highest among the cities studied. This is followed by Round Rock, Texas, with a 159% increase, and Sioux Falls, South Dakota, with a 132% increase.

For homeowners aged 25 to 44, Temple, Texas, experienced a 75% increase, the highest in this age group. Three other Texas cities — Odessa, College Station and Midland — have seen significant growth, surpassing 53% in the same period.

MoneyGeek

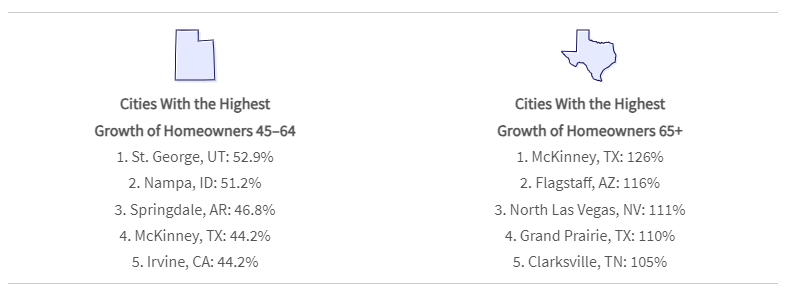

Southern and Western Regions Experienced the Highest Householder Growth for Individuals 45 and Older

Graphic showing two top 5 lists, cities with the highest growth of homeowners 45–64 and cities with the highest growth of homeowners 65+.

Looking at a 10-year analysis among individuals 45 and older, we found that cities in the Southern and Western regions of the U.S. are seeing the most growth. At 53% growth, St. George, Utah, has seen the most significant increase in homeowners aged 45 to 64. That city is followed by Nampa, Idaho, and Springdale, Arkansas, with increases of 51% and 47%, respectively.

Over the last decade, the number of homeowners aged 65 and older increased 126% in McKinney, Texas, the highest for this age group. Flagstaff, Arizona, and North Las Vegas, Nevada, rank next highest, with increases of 116% and 111%, respectively.

MoneyGeek

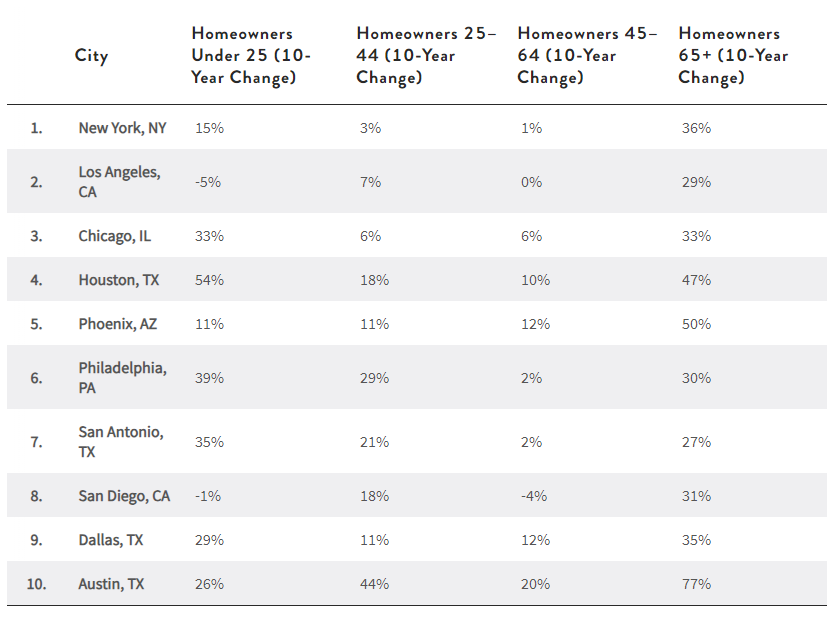

Homeowner Trends in the Most Populous US Cities

Table showing trends in biggest cities

From 2012 to 2022, the number of homeowners under 25 rose by 15% nationwide. Diving into specific regions, the Northeast’s most populous cities (New York and Philadelphia) saw a 27% increase in young homeowners. Chicago homeownership under 25 grew by 33% in the same period. The South had a similar upward trend, with a 36% average increase seen in San Antonio, Houston, Dallas and Austin, Texas.

This trend did not carry over to the West, which saw average growth of just 2%. Notably, Los Angeles and San Diego saw declines in rates of young homeowners, dropping by 5% and 1%, respectively.

One common trend among the ten most populous U.S. cities, however, is the significant 40% rise in homeownership among those aged 65 and over. Each city had at least 27% growth in this age group. Austin, Texas, surpassed all the big cities we studied with a 77% increase in homeownership among those 65 and older, nearly doubling the average rate of the other cities.

Mortgage Tips For New Homebuyers

If you’re eyeing a home in a different city, understanding how to manage mortgage or rent costs is crucial. No matter your age, these costs take up a large part of most people’s monthly budget. Here are actions new homeowners can take to lower their housing costs and stretch their income:

- Mortgage refinancing could be one way to decrease monthly payments and provide extra breathing room in your budget for other essentials, but only if the going interest rate is lower than your current one.

- Conventional home loans can benefit new homeowners, as they may offer loan terms that better suit your financial circumstances. Unlike government-backed mortgages, these loans are not federally insured, allowing for flexibility in aspects like interest rates and down payments. Borrowers can choose from different loan types — including fixed-rate mortgages, adjustable-rate mortgages or jumbo loans — based on their individual profiles.

- Cost of living calculators can be utilized to give you quick insights into how much you’ll spend on housing, utilities, groceries and other expenses in a specific city.

Methodology

MoneyGeek analyzed householder data for 320 cities from the 2022 American Community Survey conducted by the U.S. Census Bureau, focusing on identifying cities with the highest proportions of total homeowners within each age group. MoneyGeek also compared the increase in householders from 2012 with the figures from 2022 to identify trends in homeownership by age group. Cities where the householders for any age group were below 1,000 in both 2022 and 2012 were excluded from the analysis. MoneyGeek used the term “young adults” throughout to refer to individuals under 25.

This story was produced by MoneyGeek and reviewed and distributed by Stacker Media.