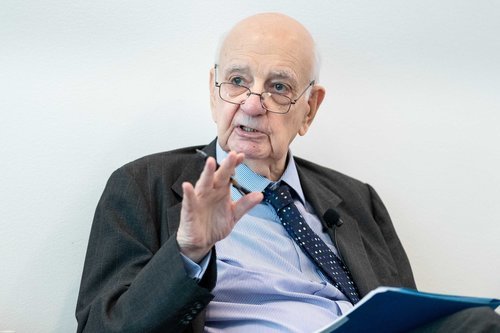

Paul Volcker, former Fed chairman who fought inflation, dies at 92

Paul Volcker, the former chairman of the Federal Reserve known for his battles against inflation in the late 1970s and early 1980s, has died. He was 92.

He passed away at his home in New York Sunday from complications related to his prostate cancer, said his daughter, Janice Zima.

Volcker served as Fed chairman from August 1979 through 1987. He returned to public service more than 20 years later in the wake of the financial crisis, serving as an economic adviser to President Barack Obama during the early days of his administration.

“Paul A. Volcker was a giant among American public servants. He was a man of great courage and integrity who committed most of his working life to the public good,” said Thomas Ross, president of the Volcker Alliance, a government advocacy group for which Volcker was the chairman.

Volcker became chairman of the Federal Reserve in August 1979, appointed by President Jimmy Carter, as the United States was in the grip of high inflation. Prices were up 11.8% from the prior year during his first month on the job.

To choke off demand for goods and put downward pressure on prices, the Fed under Volcker raised interest rates to unprecedented levels. By the high point in July 1981, the effective Fed funds rate had reached 22.36%.

But the high rates also plunged the nation into a series of recessions, one starting in January 1980, the next in July 1981. It helped lead to Carter’s loss of his 1980 reelection bid. Unemployment hit a high of 10.8% in late 1982, the highest rate since the Great Depression and a higher rate than the one that was reached during the Great Recession of 2007 through 2009.

But his battle against inflation was successful. The annual rate of price increases had fallen to 1.2% by late 1986, soon before he left office. And except for a brief period in 1990, overall inflation hasn’t topped 6% since he left office.

Volcker was reappointed to lead the Fed by President Ronald Reagan in 1983. But he clashed with the Reagan administration, according to a biography by Joseph Treaster. Although Reagan didn’t publicly criticize Volcker, he made it clear a third term was not in the cards. Volcker announced he was stepping down in 1987 and was replaced with Alan Greenspan.

During his time working with the Obama administration, he helped to draft what became known as the “Volcker Rule” which limited the trading that banks could do with their own proprietary accounts.

At a January 2010 press conference, Obama announced his support for the Volcker Rule, saying new reforms should ban proprietary trading. Volcker was reportedly surprised to discover Obama had given the ban his name.

The Volcker Rule passed as a part of the Dodd-Frank bill of Wall Street reforms, but remains one of the most contested measures by banks and Republicans. Volcker had vigorously defended it.

But the limits were loosened on smaller banks in 2018 under a bipartisan bill signed by President Donald Trump. There were further changes put in place by Federal regulators in August 2019.

He was praised Monday by several of his successors.

“He personified the idea of doing something politically unpopular but economically necessary,” said Ben Bernanke, who served as Fed chairman from 2006 through 2014.

“Paul Volcker was an inspiration to me and to everyone in the Federal Reserve,” said Janet Yellen, who was Fed chair from 2014 through 2018. “He embodied the values we hold most dear: devotion to public service, the courage to do the right thing, even when it’s immensely unpopular, a commitment to strong and effective regulation of the banking system and the highest ethical standards.”

Yellen said Americans have Volcker to thank for low inflation and economic stability

“His life exemplified the highest ideals — integrity, courage, and a commitment to do what was best for all Americans,” said Jerome Powell, the current Fed chairman. “His contributions to the nation left a lasting legacy. My colleagues and I at the Federal Reserve mourn this loss and send our condolences to his family.”

Volcker has been active in public affairs until recently. He was one of four former Fed chairmen, along with Greenspan, Bernanke and Yellen, who wrote in an op-ed column in the Wall Street Journal in August arguing that it was dangerous to even suggest Powell could be removed from office by President Trump, who has repeatedly criticized him and the Fed’s decisions. They argued that an erosion of the central bank’s independence would undermine financial markets and damage the economy.

“Even the perception that monetary-policy decisions are politically motivated, or influenced by threats that policy makers won’t be able to serve out their terms of office, can undermine public confidence that the central bank is acting in the best interest of the economy. That can lead to unstable financial markets and worse economic outcomes,” they wrote in the column.

Volcker was an imposing figure, who was six feet, seven inches tall. He loved fly-fishing and cigars. He is survived by his wife Anke Dening, his children Janice Zima and James Paul Volcker, and by his grandchildren. His first wife Barbara Bahnson Volcker died in 1998.