Restarting student loan repayments is causing stress for most borrowers, according to survey

Canva

Restarting student loan repayments is causing stress for most borrowers, according to survey

A Black woman sits in front of a laptop in a stressed posture, her hands covering part of her face

Student loan payments have resumed on nearly $1.5 trillion in federal student loan balances. Despite significant changes made to loan repayment plans over the past year, the resumption of monthly payments―and interest charges―after more than three years is causing significant anxiety among many borrowers, according to a survey fielded in October 2023.

Experian surveyed 1,024 student loan borrowers about their views on repaying student loans now that the federal loan repayment pause has ended. The survey was conducted October 19, 2023, and results were collected using a third-party company not from Experian’s consumer credit database.

![]()

Experian

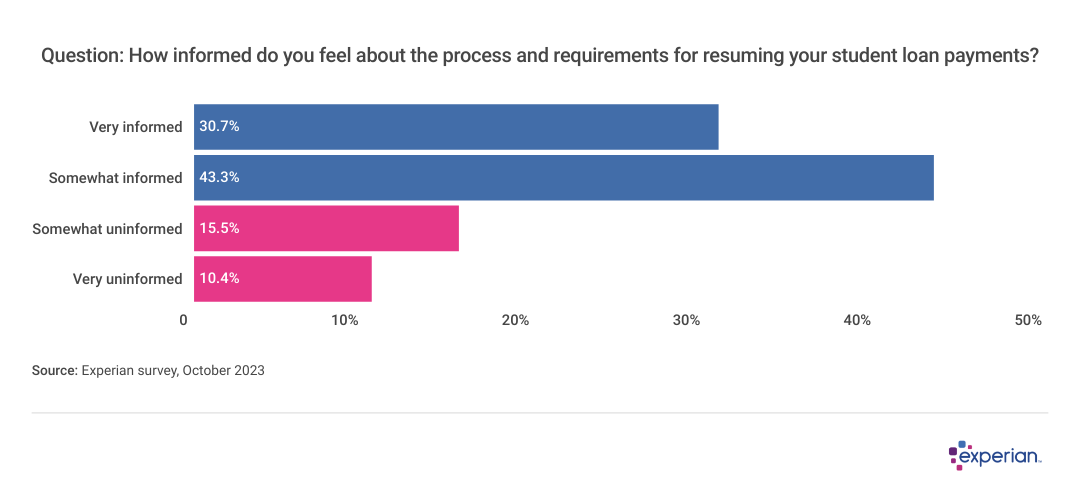

Most borrowers are informed about restarting payments

A bar chart: Question: How informed do you feel about the process and requirements for resuming your student loan payments?

First, some relatively positive news. As of October 2023, most student loan borrower respondents (74%) said they were well-informed about restarting their student loan payments. This suggests that these borrowers are aware of their repayment options, how much their monthly payments are, and where to send those payments.

That leaves about one-quarter of respondents who say they still don’t have all the information they need about their repayments.

“Not all loans are consolidated, so there are multiple agencies/companies I have to reach out to,” one survey respondent told us. “Everyone gives me different answers, so I don’t know who to trust.”

Another borrower said they thought they only owed private lenders and weren’t aware they had a federal loan until a $300 bill hit.

Experian

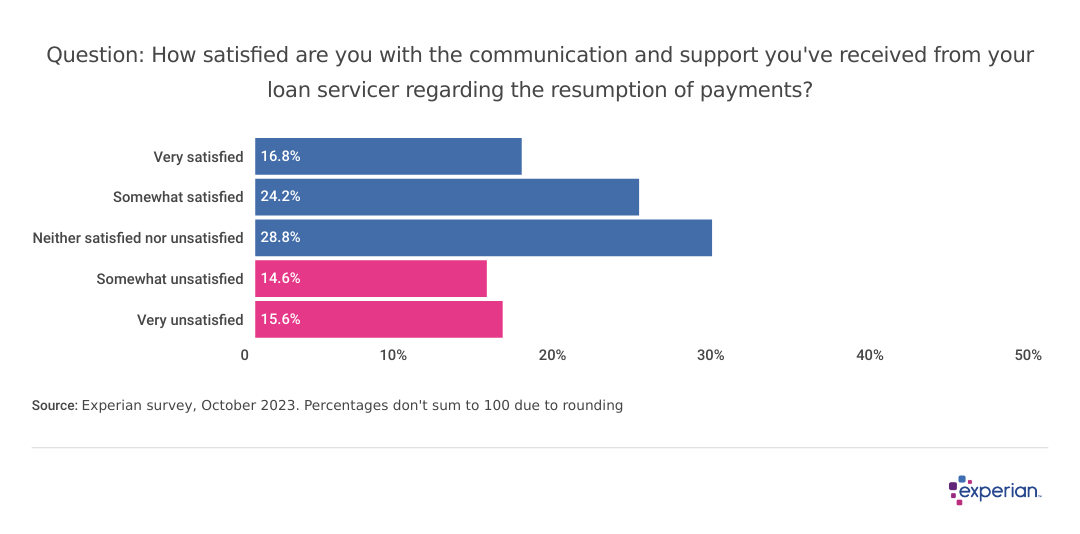

More than 30% of borrowers unsatisfied with their loan servicer’s communication

A bar chart: question: How satisfied are you with the communication and support you’ve received from your loan servicer regarding the resumption of payments?

Though borrowers indicate they are generally well-informed, that may not be due to communication from their loan servicer—the third party that collects the loan on behalf of the federal government. Nearly 1 in 3 respondents said they were either unsatisfied or very unsatisfied with the communication and customer support of their loan servicer.

Some borrowers said they were confused about which servicer or servicers currently own their debt. “It keeps getting sold to someone else even if payments were made,” one survey respondent wrote.

Another otherwise well-informed borrower complained that their loan servicer did not meet expectations for when a billing statement would be received. Department of Education guidance says borrowers should receive a bill at least 21 days before a payment is due.

Experian

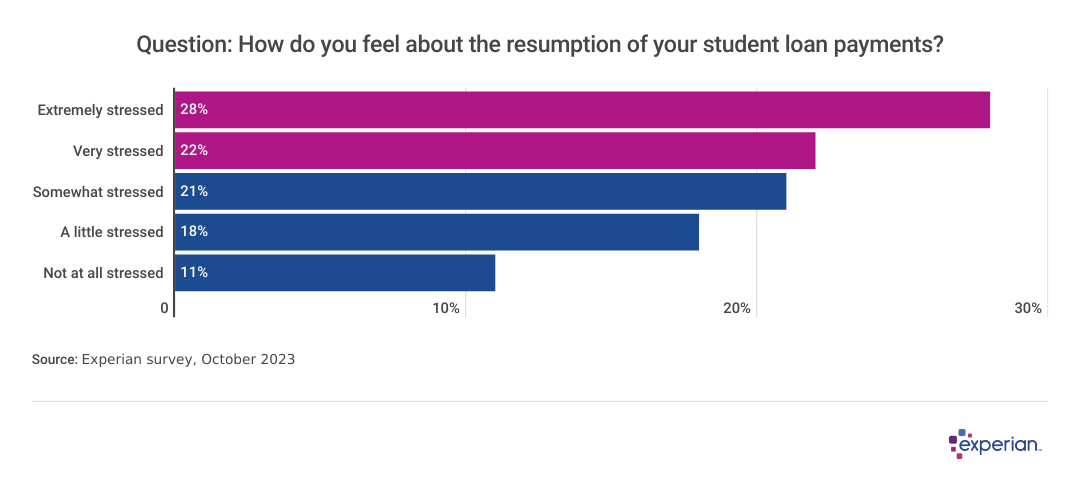

Most borrowers say they’re stressed over resuming student loan payments

A bar chart: how do you feel about the resumption of your student loan payments?

Knowledge may be power, but in the case of student loan repayments, it’s not especially relaxing. Exactly half of student loan borrower respondents (50%) reported feeling very stressed or extremely stressed about the resumption of loan repayments. Only 29% reported that repayments were currently causing them little or no stress.

Many borrowers were quite candid about their emotions surrounding loan payment resumption, which in many cases will add to other financial challenges they’re facing. More than a few respondents stated that even with income-driven repayment plans, like the most recent SAVE program designed to reduce or eliminate loan payments, their payments are still too much.

“I don’t know how I’ll be able to pay my student loan payments,” said one respondent, noting they can hardly afford to pay their regular non-student-loan bills.

It’s understandable. While economists quibble about how much student loan payments will cut into consumer spending, they nearly all agree that the new bill will have an impact on discretionary spending. The Federal Reserve Bank of New York, for instance, expects that borrowers will spend $56 less per month, on average, now that payments have resumed. That’s on top of other higher costs borrowers already may be managing, like higher auto insurance premiums and interest charges on revolving credit card debt.

Experian

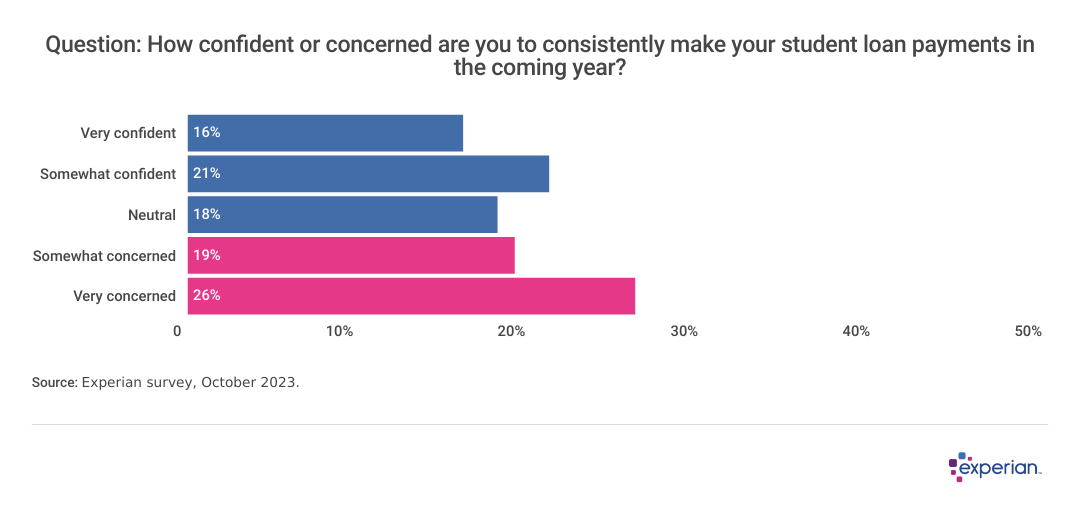

Close to half of student loan borrowers somewhat or very concerned about making payments over the next year

A bar chart: Question: Given your current financial situation, how confident are you in being able to consistently make your student loan payments in the coming year?

Nearly half of student loan borrowers (45%) indicated they were somewhat concerned or very concerned about repaying their student loans over the next 12 months, according to Experian’s survey.

This mirrors the overall uncertainty that’s plagued all consumers, not just student loan borrowers, since the pandemic began in March 2020. Consultancy firm McKinsey recently dubbed the phenomenon The Great Uncertainty, citing consumer pessimism in the face of uncertainties like rising prices and job security that are much more prominent today than they were prior to 2020.

Impact of loan resumption yet to shake out

Both the federal government and loan servicers—and probably many student loan borrowers themselves—likely expected some turbulence when payments resumed.

According to the most recent comments from the Department of Education, a 12-month on-ramp period, ending September 30, 2024, will prevent “the worst consequences of missed, late or partial payments, including negative credit reporting for delinquent payments for twelve months.” However, interest will accrue now that the pause has ended. In addition, the on-ramp period only applies to loans that were eligible for the pause.

And while some borrowers may be eligible for new repayment plans that can reduce or even eliminate the monthly payment based on their income, some aren’t. Broadly speaking, the addition of a student loan bill that is expected to average $203 per month is likely to cause at least some borrowers to tighten their belts. Beyond that, the impact of student loan payments resuming remains to be seen.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.