Hispanic American women find the most financial prosperity in these two coastal states

Canva

Hispanic American women find the most financial prosperity in these two coastal states

A smiling Latina woman sitting at a desk, near a laptop

Hispanic American women represented the second-largest group of female workers in the U.S. (12.8 million) in 2022, about 17% of the women’s labor force. And yet, they still make at least $20,000 less than white women and men, according to national averages.

MoneyGeek analyzed 133 cities to find where Hispanic American women are prospering financially using data from the U.S. Census Bureau’s American Community Survey (ACS) and Annual Business Survey (ABS), as well as MIT’s Living Wage Calculator. Variables analyzed included income, cost of living, education, entrepreneurship, and home and business ownership.

Key findings

- Two cities on either side of the country rank best for Hispanic American women: Doral, Florida, and Downey, California. Almost all top 10 cities are in California and Florida, joined by Albuquerque, New Mexico.

- Texas falls behind. Despite its large Hispanic American population, none of the 15 Texas cities analyzed in this study made it into the top 25.

- Between 2019 and 2021, median earnings for Hispanic American women increased 24% for cities in the top 10, compared to just 3% for the 10 bottom-ranked cities.

- Only three cities with a population over 500,000 — San Francisco, Washington D.C., and Albuquerque, New Mexico — rank in the top 15.

Best cities for Hispanic American women veer West and Southeast

Doral, Florida, and Downey, California, are the top U.S. cities for Hispanic American women pursuing financial growth. Doral stands out for being a city where 51% have at least a bachelor’s degree and 8% are business owners, ranking No. 1 for both metrics. The No. 2 city, Downey, ranked in the top 30 across three metrics: 14th-lowest poverty level, 15th-highest number of homeowners, and 26th-highest median earnings for this demographic.

Two other California cities — Chula Vista and Santa Clarita — favorably stand out for Hispanic American women. Chula Vista has the 20th-highest population of Hispanic American women and the 13th-highest percentage of business owners in this demographic. Roughly three hours by car is Santa Clarita, with the fifth-lowest poverty rate and 13th-highest median earnings.

Breaking down financial growth indicators by category gives a more nuanced picture of the U.S. cities where Hispanic American women are economically thriving. Florida cities and the nation’s capital excel in education and income growth. Hispanic American women homeowners concentrate in the Northeast, while entrepreneurs find fertile ground in the South and West.

![]()

MoneyGeek

Educational attainment

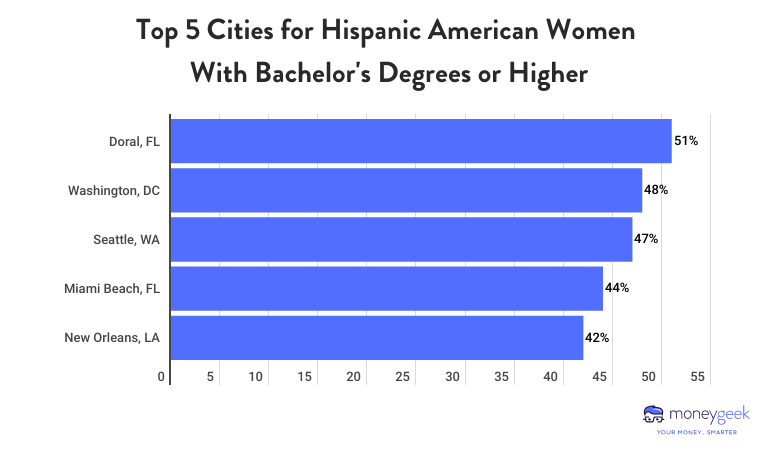

bar chart showing Top 5 Cities for Hispanic American Women With Bachelor’s Degrees or Higher

Regarding education, Doral, Florida, ranks first, with nearly 51% of Hispanic American women holding a bachelor’s or more advanced degree. Washington D.C., ranks second in educational attainment, where 48% of Hispanic American women are four-year degree graduates.

MoneyGeek

Median earnings and growth

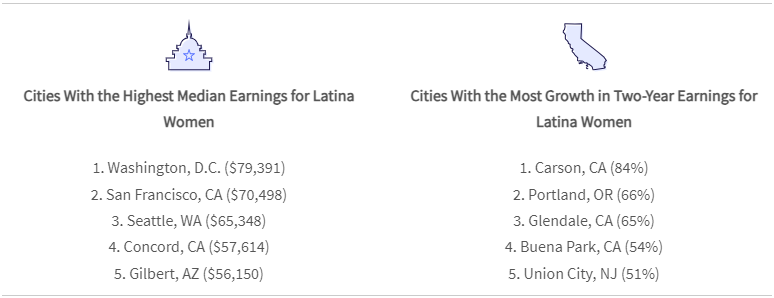

graphic showing Cities With the Highest Median Earnings for Latina Women and Cities With the Most Growth in Two-Year Earnings for Latina Women

The nation’s capital also leads in median earnings for Hispanic American women ($79,391), followed closely by San Francisco ($70,498). Both cities are hubs for specialized, high-paying industries such as government in Washington D.C., and tech in San Francisco. But if you’re seeking dynamic growth in earnings, look to Carson, California, and Portland, Oregon. Carson leads with an 84% growth rate over two years, and Portland isn’t far behind at 66%.

MoneyGeek

Homeownership and poverty rates

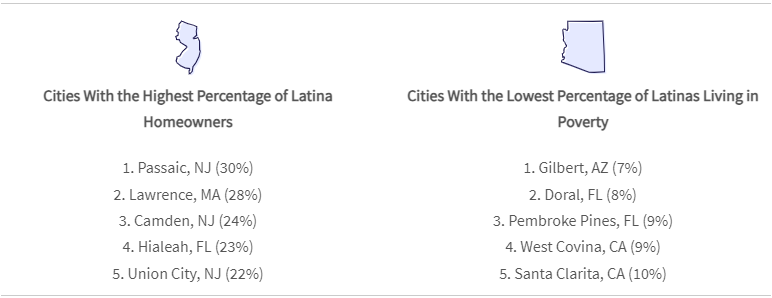

a graphic showing Cities With the Highest Percentage of Latina Homeowners and Cities With the Lowest Percentage of Latinas Living in Poverty

Two New Jersey cities (Passaic and Camden) and Lawrence, Massachusetts, stand out for homeownership. Passaic has the highest percentage of Hispanic American women homeowners (30%), followed by Lawrence (28%). The other Garden State city, Camden, takes the third spot, with 24% of homeowners who are Hispanic American women.

We also considered poverty rates to measure economic stability. The lowest percentages of Hispanic American women living at or below the poverty line are in Gilbert, Arizona (7%), and two Florida cities — Doral (8%) and Pembroke Pines (9%).

MoneyGeek

Business ownership

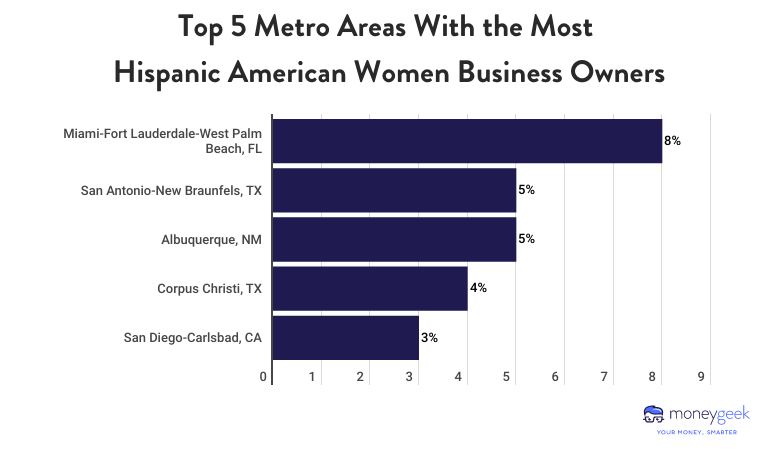

A bar chart showing Top 5 Metro Areas With the Most Hispanic American Women Business Owners

Entrepreneurs may find their niche in the Miami metro area, where approximately 8% of business owners are Hispanic American women. Three Florida cities included here (Doral, Pembroke Pines, and Hollywood) ranked in the top 10 overall, top 10 for educational attainment, and in the top half of all considered cities for median earnings for this demographic.

Financially advocating for yourself

The nation’s financial landscape offers both challenges and opportunities for Hispanic American women. These strategies can help optimize one’s financial position:

Prioritize skill development: Take advantage of upskilling opportunities in your industry to make yourself a more valuable asset. Better skills often translate to better pay.

Diversify income streams: Consider creating multiple income streams, such as a side gig or investment income, to supplement your primary earnings. Diversification often provides a financial safety net.

Become mortgage-savvy: Understanding how best to leverage mortgages and credit can put you in a solid position to own a home. Homeownership is not just a milestone but an appreciating asset.

Strategize for business ownership: If entrepreneurship interests you, start by doing market research and crafting a solid business plan. Owning a business can offer financial freedom and opportunities for wealth generation.

Invest in assets that create generational wealth: Spend your money wisely. Avoiding going into too much debt and planning for retirement are the first steps toward a better financial future for yourself and building generational wealth for your loved ones.

Methodology

MoneyGeek evaluated 133 cities to spotlight where Hispanic American women are economically thriving. We excluded cities that lacked specific data for this demographic. We considered the following points:

- Population of Hispanic American women.

- Median earnings for Hispanic American women.

- Two-year change in Hispanic women’s earnings. We used data between 2019 and 2021.

- Cost of living as a percentage of earnings. This is the post-tax cost of living divided by the median earnings for Hispanic American women.

- Hispanic American women’s homeownership rate. This is the number of Hispanic owner-occupied housing units divided by the number of total households.

- Poverty rate for Hispanic American women.

- Percentage of Hispanic American women with a bachelor’s degree. This is for the population 18 years and older.

- Percentage of business owners who are Hispanic American women. This is the number of Hispanic-owned businesses divided by the total number of businesses.

All data except cost of living came from the Census Bureau’s 2021 and 2019 1-Year American Community Survey and 2020 Annual Business Survey (at the metro level). Post-tax cost of living figures were pulled from the MIT Living Wage Calculator. We equally weighted each city and ranked them in every metric to create a weighted average that determined the final ranking. The city with the highest score emerged as the top place for Hispanic American women to prosper financially.

This story was produced by MoneyGeek and reviewed and distributed by Stacker Media.