How personal loans are being used in states across the country

fizkes // Shutterstock

How personal loans are being used in states across the country

An elderly lady is sitting in her kitchen while happily reading a piece of paper.

There aren’t many things in life that are free – but there are many things in life that are quite costly. From cars and homes to business startups and medical treatments – there’s no short supply of things we need that we may not have the money for immediately. While there are loans for specific purposes – like a mortgage to buy a home or student loans to pay for tuition – other expenses may need financing as well. That’s where a personal loan comes in and Rocket Loans explains how it can help you.

How Do Personal Loans Work?

A personal loan is a lump sum of money you borrow from a lender with the agreement to pay it back in a certain amount of time, with interest, through monthly payments. Your loan may be secured with collateral or unsecured (not backed by collateral). When it comes to major expenses, these can be preferable to credit cards, which often come with some of the highest interest rates of any kind of debt.

You’ll need to apply for the loan and meet certain qualification requirements, like having a good credit score, good credit history and a low debt-to-income ratio (DTI). These factors will also help the lender determine your interest rate, repayment terms and other loan terms. Once you qualify for the loan and receive your funds, you can use the loan for almost anything.

What Are Personal Loans Used For?

Some of the most common uses for a personal loan are:

- Debt consolidation

- Home improvement

- Auto

- Medical Expenses

- Business

- Other (financing unexpected expenses, travel, wedding expenses or a large purchase)

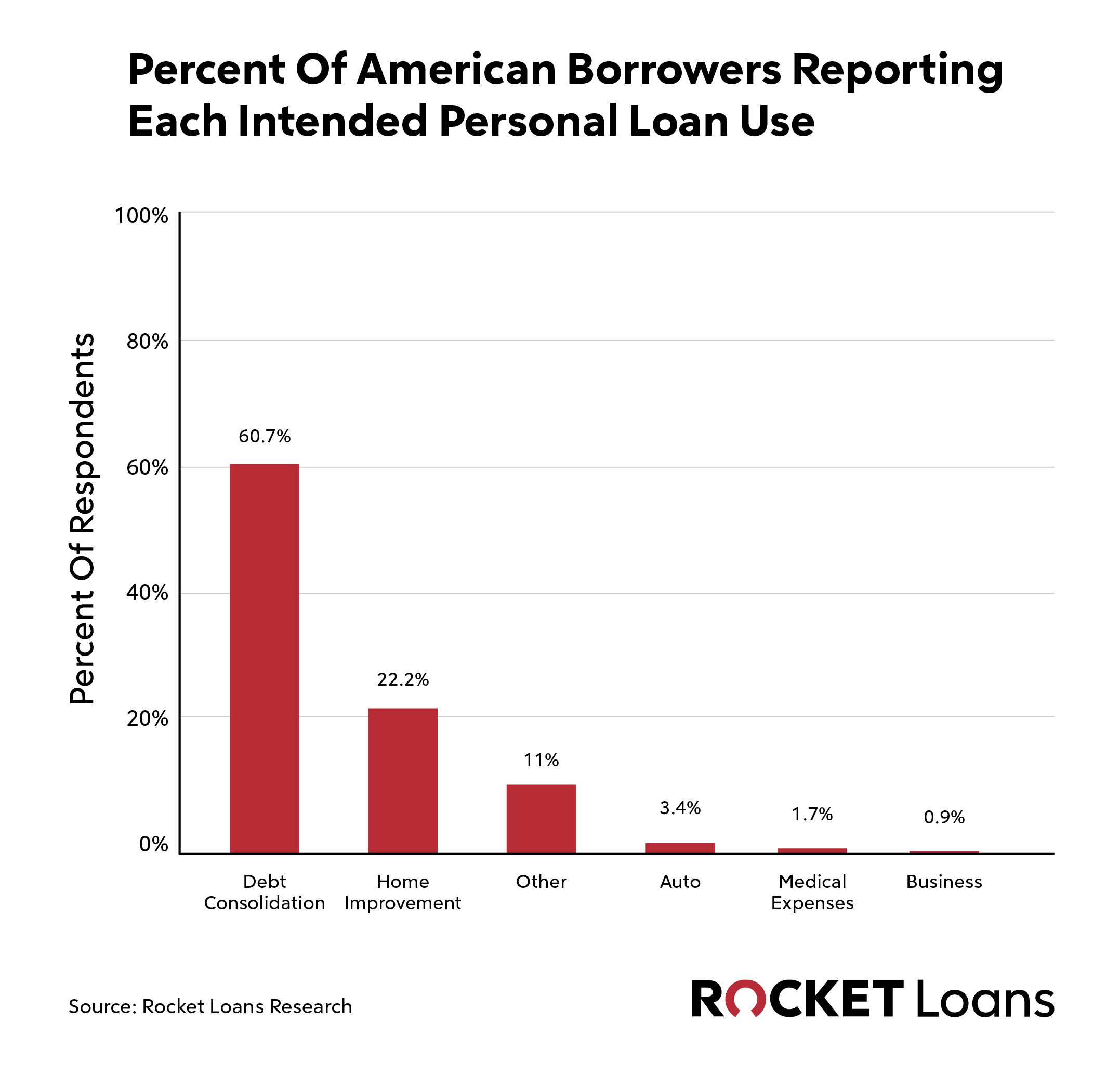

So how are Americans planning on using their personal loan? To find out, Rocket Loans took a randomized sample from thousands of closed clients over the past year, who self-reported their intended use. We looked at the nation as a whole, then drilled down further to see what personal loan purpose was most popular among the states.

![]()

Rocket Loans

Intended Personal Loan Use Across The Country

Graph results of “Percent of American Borrowers Reporting Each Intendend Personal Loan Use”.

The most popular intended personal loan purpose among all borrowing Americans in the study was debt consolidation, followed by home improvement. Financing business expenses was the least common intended use. Auto expenses were also less common. This could be because there are small business loans (SMBs) and auto loans available, too.

Rocket Loans

What States Are Taking Out The Most Personal Loans?

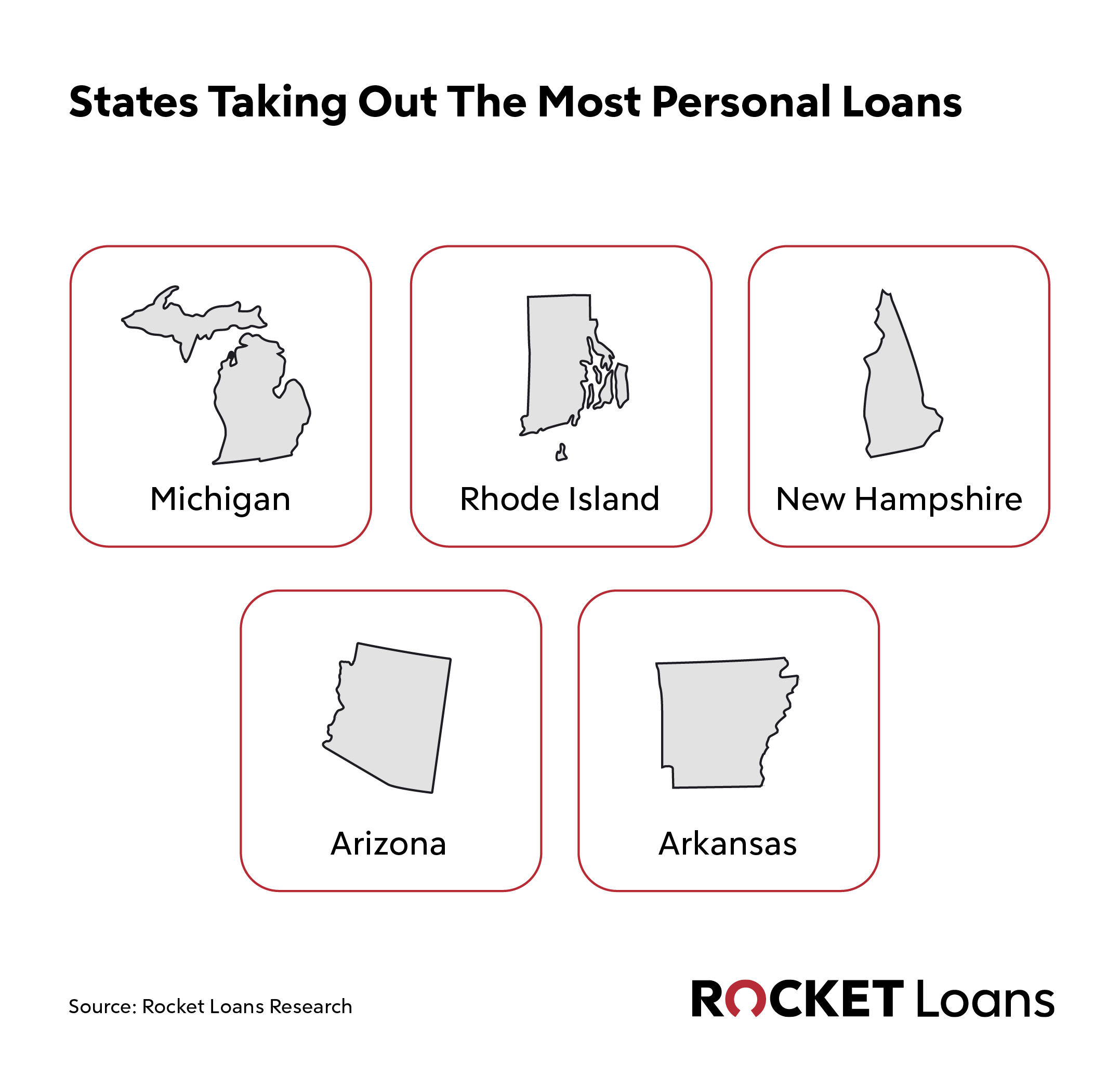

Infographic of the six “States Taking Out the Most Personal Loans”.

While each person is different, there are certain factors that allow the data to tell a story. Location is one of them. To learn more about personal loan use, we looked at the state level to find where people are using these loans the most and where they’re using them the most for each specific purpose.

It may be interesting to note that, of the top five states taking out the most personal loans, two – Rhode Island and New Hampshire – are listed among the top 10 states with the highest cost of living, according to U.S. News & World Report.

Top States For Each Loan Use

The states varied on what residents were using a personal loan for exactly. Below are lists of states where residents are most commonly using a personal loan for debt consolidation, home improvement, auto, medical expenses or business purposes.

Top 5 States For Debt Consolidation Personal Loan Use

Using a personal loan for debt consolidation means combining all your various debts into one debt – your personal loan. This can make your debt more manageable by requiring only one monthly payment, with a fixed interest rate for the life of the loan once you close. Debt consolidation can include credit card debt and medical bills.

The states where residents are taking advantage of this loan purpose the most include:

- Michigan

- Rhode Island

- New Hampshire

- Arizona

- New Jersey

Top 5 States For Home Improvement Personal Loan Use

Home improvements are not cheap. In fact, many cost thousands of dollars. But there are benefits to doing them, like increasing your space’s livability and adding value to your home. While some homeowners use a home equity loan for large projects, a personal loan can be a great option for smaller ones. Depending on the loan amount, you could use your funds to purchase new appliances or HVAC systems, pay for home repairs and services – like waterproofing your basement – or finance home renovations.

The states where residents are taking advantage of this loan purpose the most include:

- Michigan

- Rhode Island

- Delaware

- Wyoming

- New Hampshire

Top 5 States For Auto Related Personal Loan Use

People using a personal loan for auto-related purposes may be doing so to purchase a new or used car or pay for multiple expensive repairs needed at once. Auto-related personal loans can be helpful when a repair isn’t covered by insurance or warranty – or when you don’t wish to use your new vehicle as collateral.

The states where residents are taking advantage of this loan purpose the most include:

- Montana

- Alaska

- Arkansas

- Rhode Island

- Michigan

Top 5 States For Medical Expense Related Personal Loan Use

According to an analysis by the Peterson-KFF Health System Tracker, the total medical debt among Americans is at least $220 billion dollars. Medical bills are not something you want to deal with while you or a loved one are recovering. A personal loan may help you consolidate multiple bills.

The states where residents are taking advantage of using a loan for medical expenses the most include:

- Wyoming

- South Dakota

- Illinois

- Idaho

- Louisiana

According to the Peterson-KFF analysis, South Dakota – number two on our list – has the highest share of people with medical debt (17%).

Top 5 States For Business Related Personal Loan Use

There are many facets of running a budding business and expenses can build up quickly. From marketing campaigns and payroll to permits, utilities and office supplies, there are many one-time and ongoing costs to consider. A personal loan may help set owners up for success.

The states where residents are taking advantage of this loan purpose the most include:

- South Dakota

- Arkansas

- Missouri

- Georgia

- Arizona

Can I Use A Personal Loan For Anything?

You can use a personal loan for almost anything. But it will depend on your lender and the terms of your loan. It’s important to keep in mind that most lenders won’t allow you to use a personal loan to pay college tuition (as a student loan) or any illegal activities – and some lenders may not allow you to use it to pay for your business startup. In those cases, student loans or SMBs may be a better option. However, you can likely use a personal loan to pay for the education and business expenses that accompany those goals – like books and supplies. It’s best to speak with your lender about your intended use and financial goals to ensure the loan is the right fit for you. Keep in mind that you’ll pay origination fees and interest on this loan, so make sure to consider those costs when choosing from your loan options.

Bottom Line: There Are Many Uses For Personal Loans No Matter Where You Live

Because there are many ways one can use a personal loan, the name stands true: Personal loans are personal. You can use a personal loan for almost anything and the purpose you use it for is customized to you and your individual goals. While there are many ways to use it, there can be some limitations. It’s best to speak to your lender to see how the loan can help you.

Methodology

To understand personal loan usage around the United States, Rocket Loans analyzed a randomized sample of 40,000 anonymous closed loan clients from the past year. All the aggregated data was pulled March 14, 2024. To create a more accurate representation of the rankings, population size weighting was used to compensate for disproportionately higher numbers in states with larger populations. Note: As Rocket Loans is a Michigan-based company, higher market share in Michigan is an uncontrolled variable that could affect rankings.

This story was produced by Rocket Loans and reviewed and distributed by Stacker Media.