NMSU default rate at 19.9%; tops list for large public schools with highest default rates

An alarming one out of every five New Mexico State University students fails to repay student loans, according to data released by the Department of Education.

NMSU has a default rate of 19.9%. According to an online report by the Quartz, an online news publication, that puts NMSU at the top of the list for large public schools with the highest default rates-almost five percent higher than the next closest school.

The number is the result of a three-year period, measured by the Department of Education in order to determine a school’s default rate. The loans indicated in the report were supposed to be repaid beginning in fiscal year 2011. Students failed to repay and went into default.

Several NMSU students agreed the number was alarming.

“It’s hard to pay them,” one student said.

“That’s not surprising,” another added.

?

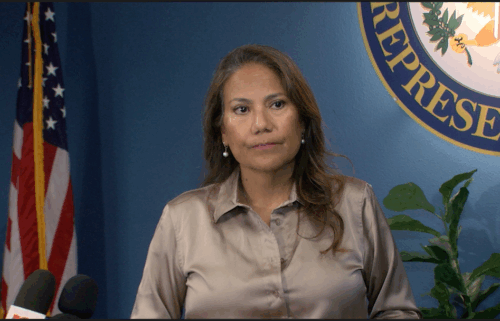

Bernadette Montoya, Vice President of Student Affairs and Enrollment Management at NMSU, cites a number of different reasons for such a high rate.

She says the rate that is determined by the federal government, also includes the rates of NMSU’s community colleges, which makes up a combined rate of 19.9% for all campuses, including NMSU’s main campus in Las Cruces.

She adds that 49% of students are from low-income families. According to Montoya, those students are more vulnerable to default on loans.

The least surprising reason-the rate includes a large percentage of freshmen who simply drop out and don’t repay their loans.

As a result, NMSU has cracked down on the availability of loans. NMSU now withholds first-time borrower loans for the first 30 days of the semester.

It’s a practice in place that was implemented in the fall semester of 2013. It’s similar to sanctions by the Dept. of Education. According to Montoya, schools with a default rate of 30% to 35% are penalized by the Department of Education. First-time borrower loans are withheld for the first 30 days of the semester.

Montoya says they are not required to enforce that practice, but did so anyway to help improve default rates. Montoya adds she expects the 30-day withholding practice, as well as financial counseling and workshops to lead to a lower rate next year, when the latest numbers are released.

“Efforts we’re putting in now, which have been a lot more measured, we will see those results in the next few years. Next year being the first,” Montoya said.