What’s behind the boom in construction business applications?

Panumas Yanuthai // Shutterstock

What’s behind the boom in construction business applications?

Two construction workers with blueprints at a building site

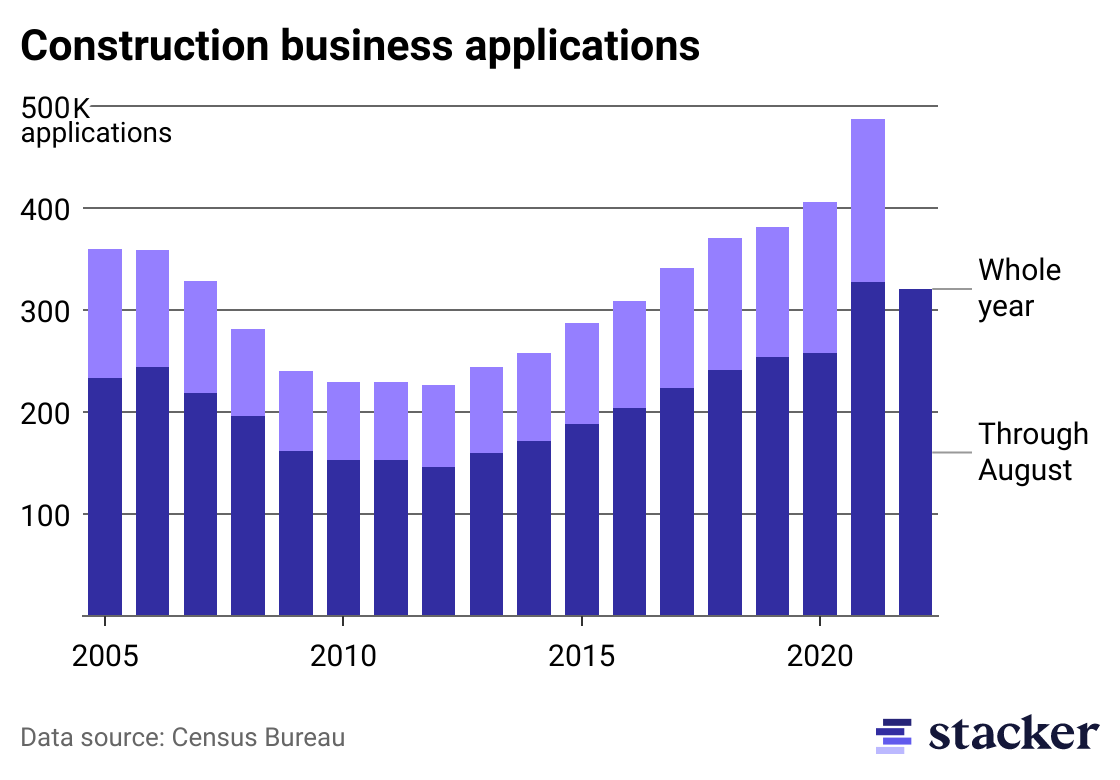

Applications to start construction companies have more than doubled over the past decade, reaching nearly 490,000 in 2021. It was a record-setting year for new businesses in general, with about 5.4 million applications nationwide. Among industries, construction saw the fourth-largest volume of applicants. Interest in starting construction businesses broke records, with the volume of applications hitting their peak since data reporting began in mid-2004.

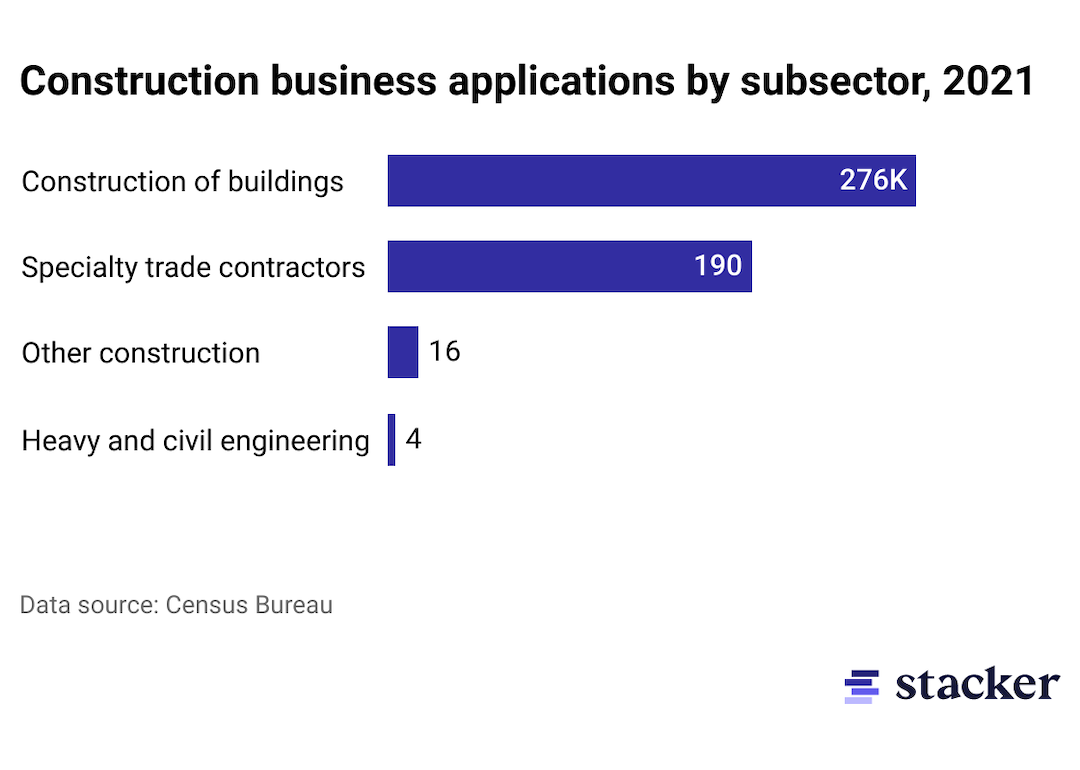

Within the industry, building construction companies have been the most prolific, launching in the largest numbers to work on residential and commercial properties. In the residential space, housing supply is low; a National Association of Realtors analysis found the U.S. is short 5.2 million homes, creating plenty of work for existing contractors and new ones coming online. Residential construction starts increased 12.2% from July to August, according to Census data. Meanwhile, Zonda predicts that the 16.2 million pro-level remodeling projects nationwide in 2021 will grow to 17.9 million by the end of 2022.

The Census Bureau measures business applications through IRS Employer Identification Number filings, which are generally required to start a business. Stacker analyzed data from the bureau’s Business Formation Statistics to reveal trends and explored potential causes for this unprecedented growth.

![]()

Stacker

Considered essential, the construction business exploded during COVID-19

A stacked bar chart showing the number of business applications in the construction industry through August and the rest of each year.

COVID-19 drew attention to the construction industry as a sector ripe for entrepreneurship, Brian Turmail, Vice President of Associated General Contractors, told Stacker.

“Construction was one of the relatively few sectors of the economy to be considered essential in much of the country,” Turmail said. “There were a lot of people in other lines of work that saw construction as a far more stable career opportunity or business path than other sectors that might be subjected to future government shutdowns.”

Construction businesses grew 20% last year—faster than any other year recorded. Applications through August are pacing slightly behind 2021, but are still higher than pre-2021 years.

Still, according to Census data, national construction spending increased about 8.5% from August 2021 to 2022, largely from growth in residential building construction. And business owners’ outlooks remain positive; a September survey of AGC members shows that about half of respondents expect to increase sales over the next six months.

Stacker

New companies are less likely to turn into employers

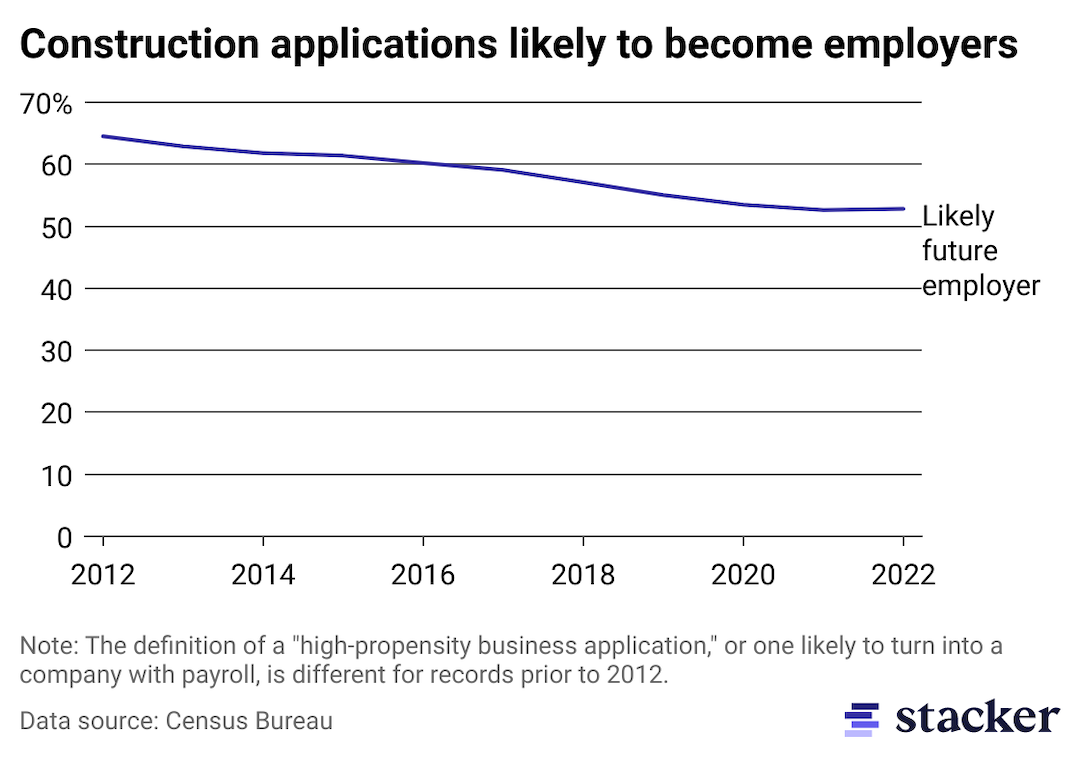

A line chart showing two lines: one with applications that have a high propensity to become businesses with payroll, and one with the percent of business applications that include planned wages.

The share of business applications that BFS data shows as likely to become employers has been decreasing. That’s not to say the volume of businesses likely to become employers is down; it’s also increasing, just at a slower rate than overall applications.

Likely future employers—or “high-propensity business applications,” as the Census deems them—are determined based on several parts of their EIN application. The evaluation includes whether they are hiring, whether they have a date scheduled to start paying wages, and if they have an NAICS code in certain sectors and subsectors. About 13% of applications have a first wages date planned so far in 2022, which has also been decreasing steadily since 2012.

Bureau of Labor Statistics employment data shows that about 7.4 million people worked in the American construction industry in 2021, and projects that employment in the sector will grow by a little less than 3% by 2031.

Construction startups are most often one-person shops, Turmail said, so it stands to reason that many wouldn’t have hiring or payroll plans. Larger startups do show up, too, he said, particularly when specialized teams break off from a larger firm, or when they’re backed by venture capital and operate more like a tech startup.

“There’s an enormous amount of opportunity in the industry,” Turmail said. “Because so much of the work is subcontracted out, it’s one of the few industries where there is no small group of dominant players—it is a large, vibrant, and very competitive sector of the economy.”

Stacker

The applications are largely in building construction, as well as specialty trades

A bar chart showing which subsectors of construction have the most new business applications.

Most businesses are popping up in construction of buildings, specifically. Building construction more often involves a large number of subcontractors completing work on behalf of a general contractor, Turmail said. With things like road construction, more of the work is often performed by the general contractor, so there are fewer gaps for small, enterprising companies to fill.

Technology and innovation companies continue to enter the construction scene as well, Turmail said, aiming to make the industry more modern, productive, and efficient. That covers everything from construction software to robotics to personnel management.

“Ultimately, it’s not like we’ve radically changed the way a building is built,” he said. “What differentiates one firm from another is their ability to do the same kind of work as efficiently and as cost-effectively as possible. The firms that are able to be innovative—not just in terms of the use of technology, but looking at more efficient ways to undertake specific tasks associated with construction—tend to do better.”