Web3 and crypto disasters of the last 3 years visualized

Hasbi Sahin // Shutterstock

Web3 and crypto disasters of the last 3 years visualized

Smartphone with cyrptocurrency app screen in a man’s hand.

Since the mysterious Satoshi Nakamoto (the anonymous inventor’s presumed pseudonym) created the first bitcoin in 2009, the digital currency has soared to astronomical values, making—and breaking—fortunes for those who have bet on it.

As cryptocurrency gained attention in the wake of a sweeping global recession, it ultimately was embraced by traditional Wall Street investment firms.

The technology was initially presented as a way to revolutionize trade and replace established currencies for daily spending. It would offer a decentralized financial system independent of governments or banks.

The technology underlying bitcoin, known as blockchain, has evolved with time; there are now thousands of different cryptocurrencies and other blockchain-based technologies, like non-fungible tokens, commonly called NFTs. Collectively, they fall under an umbrella of assets generally referred to as Web3—a concept for a new type of internet that allows exclusive ownership of digital assets and handles automatic or manual sales or trades of those assets.

So-called Web3 products saw a boom in popularity as the pandemic set in, and Americans, bolstered by government bailout money, invested more in the stock market as well as in crypto and NFT assets. Even ailing video game retailer GameStop was getting in on the excitement with an NFT marketplace. But by the end of 2022, crypto investments weren’t looking so sunny, underscoring the risk in investing in unregulated financial instruments.

Dragged down by hacks, fraud, and uncertainty, crypto assets took a significant haircut. AskGamblers.com analyzed data collected by the Web3 Is Going Just Great project and news reports to illustrate estimates of investor losses in cryptocurrency schemes.

The total losses recorded in the database from 2021 to the present day equate to more than $68 billion over almost three years. That’s after accounting for the $8.9 billion that was recoverable for investors.

The database covers more than 500 events from 2021 to the present, and loss estimates recorded in the database span from a relatively small $800 to an utterly enormous $40 billion, depending on the event. Where loss estimates were represented by a range, this analysis used the most conservative end of the estimated range. In the case of crypto exchange bankruptcies, losses represent the amount of liabilities owed to creditors.

![]()

Dom DiFurio // AskGamblers

85% of losses last year were the result of just 3 events

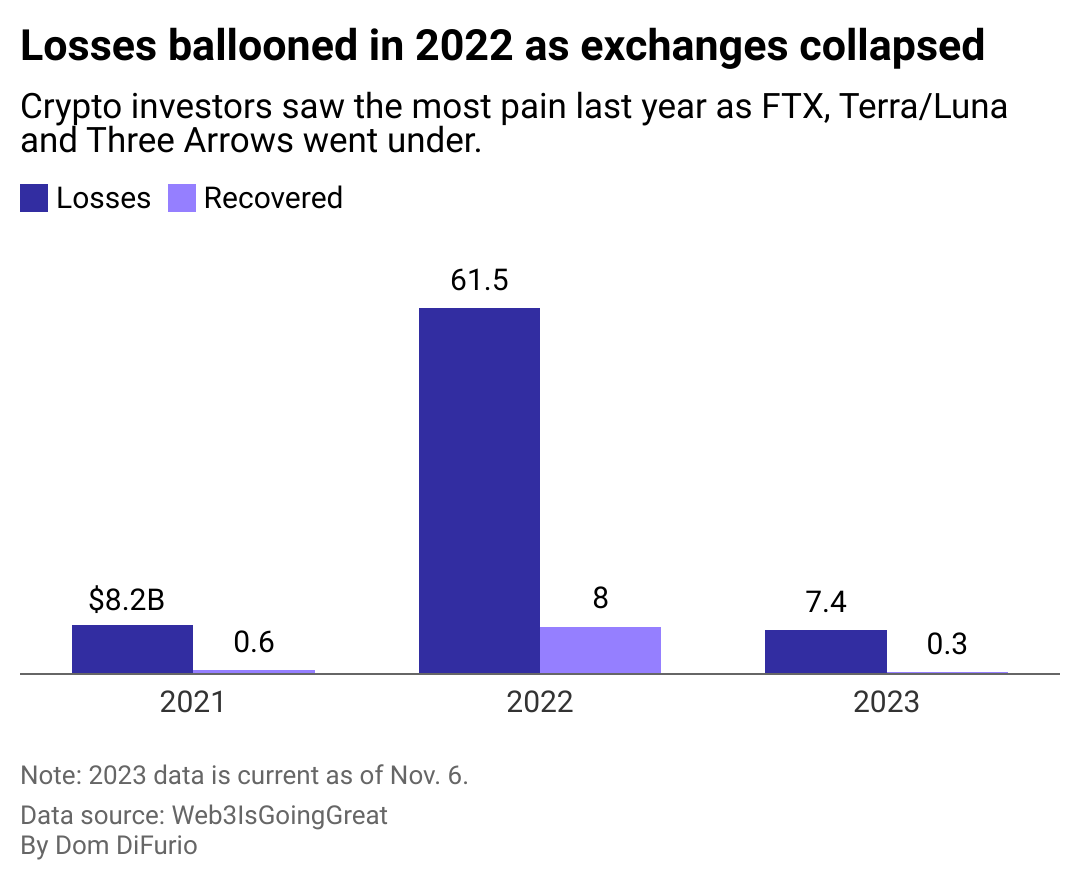

A double bar chart showing losses each year from crypto schemes that fell apart for investors in billions of dollars beside the amount recovered. Losses grew almost eight times from 2021-2022 as the year saw several major exchanges collapse under mismanagement.

A few specific events were the culprits behind a significant portion of the losses investors took in 2022.

The biggest was the collapse of FTX (an exchange or online platform), where investors traded dollars and other assets for cryptocurrency—or one cryptocurrency for another. In November 2022, reports surfaced that the company didn’t have enough money on hand to cover all of its investors’ holdings.

Investors moved to withdraw funds, while CEO Sam Bankman-Fried tried and failed to come up with the money to pay them. The cryptocurrency investors held at FTX became worthless almost overnight, erasing $8.7 billion of wealth, according to Web3 Is Going Just Great. Though $7 billion was later recovered, Bankman-Fried was convicted of fraud for stealing investors’ money to fund his extravagant lifestyle.

Also in 2022, a pair of cryptocurrencies known as Terra and Luna had been highly valued by banks and investors—up to a total of $40 billion—but in May 2022, fell prey to concerns about the degree to which the overall market would agree with those valuations. In the face of that doubt, people became unwilling to purchase Terra or Luna. With no buyers, Terra and Luna had no value at all.

The Terra-Luna collapse hit crypto hedge fund Three Arrows Capital hard. A month after the Terra-Luna failure, a British Virgin Islands bankruptcy court ordered the Singapore-based Three Arrows into liquidation, wiping out $3.3 billion in value. Cryptocurrencies were far from the only investment that performed poorly in 2022, a historically bad year for investments. But the pain was a new lesson for investors in how widespread fraud, poor security, and mismanagement were in the cryptocurrency market.

Dom DiFurio // AskGamblers

More than a dozen exchanges have collapsed since 2021, hitting investors hard

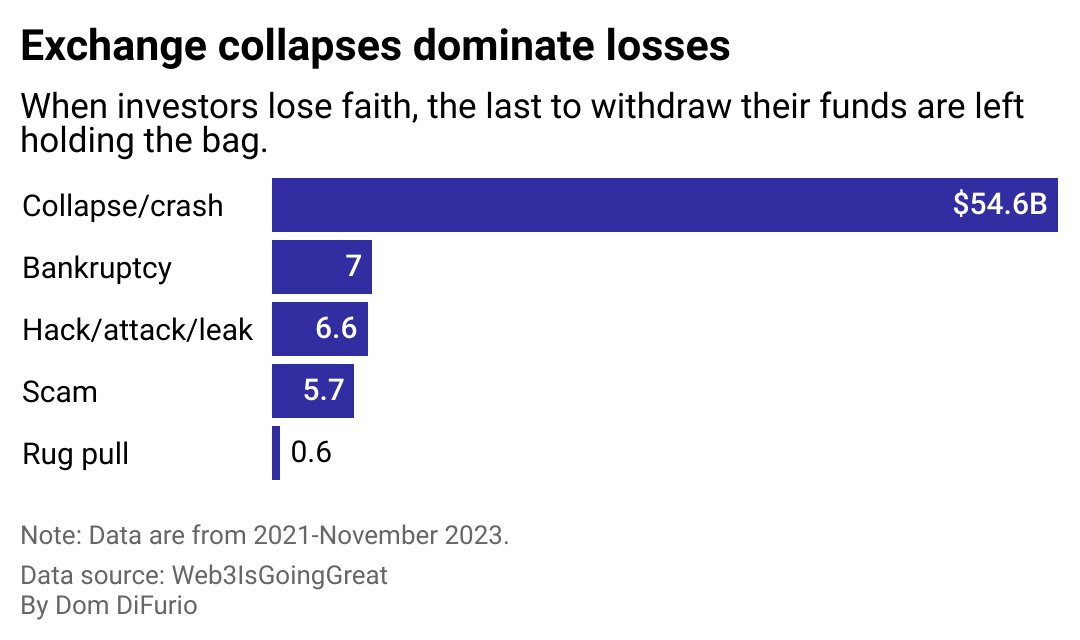

A stacked bar chart showing losses from crypto and Web3 investment by the type of event that led to the loss. Collapse of exchanges is the number one by dollar amount. Bankruptcy, hacks, scams, and rug pulls accounted for the next largest losses respectively.

With the collapse of certain cryptocurrencies has come the revelation that some aren’t as decentralized as the original promise of bitcoin and its proponents would suggest. The fall of FTX was due to a mismanagement of funds in a centralized exchange by Bankman-Fried and others, several of whom have faced federal charges for duping investors.

“Many of these intermediaries are simply new (and often unregulated) equivalents of what already exists in traditional finance,” Hilary J. Allen, a financial regulation researcher and professor at American University Washington College of Law, wrote in an International Monetary Fund publication last year.

Not all exchanges have suffered similar destruction, though. And fraud and mismanagement of exchanges aren’t the only risks involved in investing in Web3 in recent years.

Bankruptcies of exchanges, hacks, and other scams—including what’s known as “rug pulls”—can also cost investors dearly. A rug pull happens when people lure others into investing in a new asset, only to disappear with the money afterward.

Dom DiFurio // AskGamblers

Attacks on crypto exchanges were more common than collapses

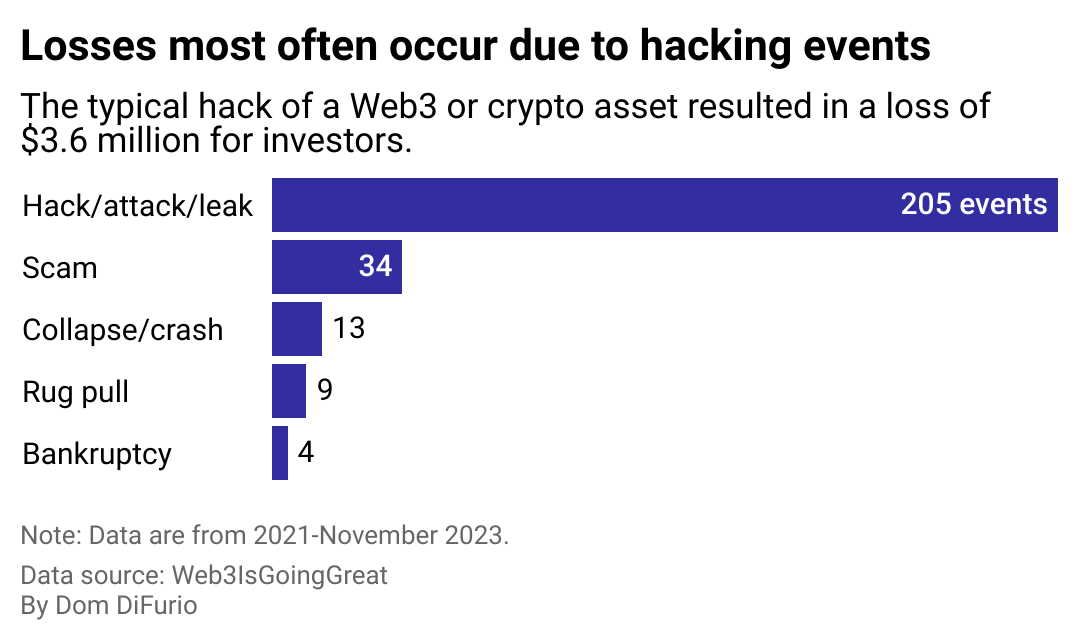

A stacked bar chart showing the frequency with which each type of event that led to losses over the last three years. Collapse of exchanges is the number one by dollar amount, but hacks lead in frequency.

While collapses at the exchange level can have massive financial consequences, hacking of exchanges and cryptocurrencies has happened with higher frequency since 2021, according to the database kept by Web3 Is Going Great.

The publishers of a popular Web3 game that incorporated the ability to earn cryptocurrency were hacked in early 2022, and $625 million in crypto assets were stolen. It was one of many hacks of crypto assets last year. Bressler, Amery and Ross, a corporate law firm representing Fortune 100 companies, called 2022 a “record-breaking year for crypto hackers.”

Story editing by Jeff Inglis. Copy editing by Kristen Wegrzyn.

This story originally appeared on AskGamblers.com and was produced and

distributed in partnership with Stacker Studio.