Consumers are more likely to track health and fitness data than changes to their credit

![]()

Canva

Consumers are more likely to track health and fitness data than changes to their credit

illustration concept of credit tracking

By the middle of January, many of those who made a New Year’s resolution have already broken it. According to contemporary folklore, January 12th marks “Quitter’s Day,” the day when most people throw in the towel on their goal for the year. Somewhat more scientifically, research has shown that nearly half of us give up on resolutions within the first month of the year.

And every year, the goals of those broken resolutions are often financially based. By far the most common resolutions focus either on health (such as losing weight) or personal finances, the two-sided coin of spending less and saving more. But there’s some good news in these same studies: A fraction of people making resolutions reported they managed to keep them throughout the year, and sometimes for good. What’s their secret?

Experian surveyed 1,022 consumers about how or if they track everyday activities. Survey conducted November 2, 2023. The sample was collected using a third-party company and was not from Experian’s consumer credit database.

![]()

Experian

Nudge, nudge: tracking your credit score

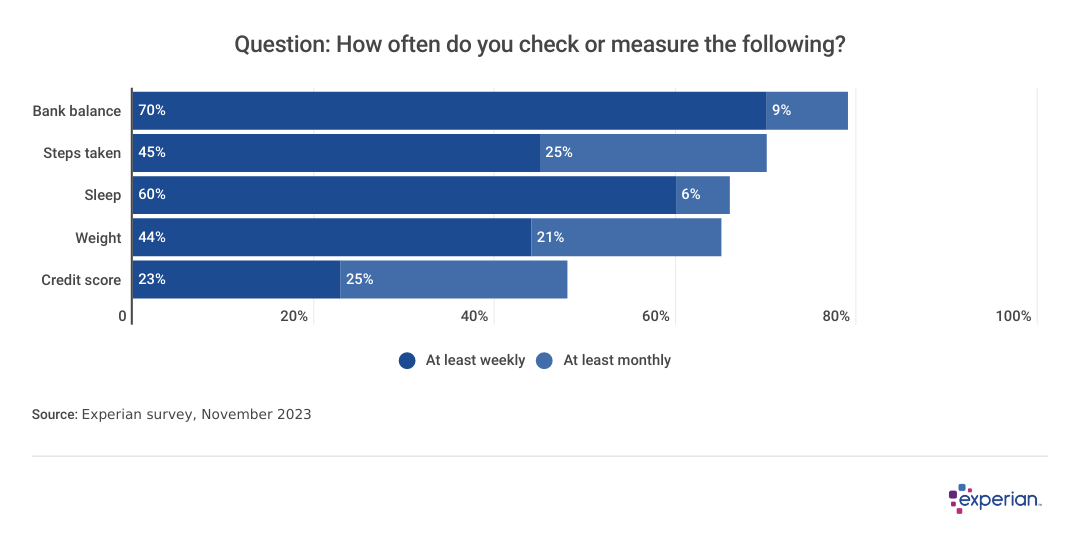

results of survey question: How often do you check or measure the following?

When it comes to monitoring their own data, consumers are more likely to keep tabs on health and fitness data, like weight, sleep, and step counts, than their credit, according to the survey.

About two-thirds of survey respondents said they track their physical activity like steps taken and how much sleep they’re getting on a monthly basis, or more frequently. But for financial matters, less than half (48%) check their credit score at least monthly. However, 61% of those under age 45 (largely millennials and Gen Z) check their credit score at least monthly, far more than the 41% of Generation X and baby boomers who keep monthly, or better, tabs on their credit score.

Experian

Tracking your progress is key to success

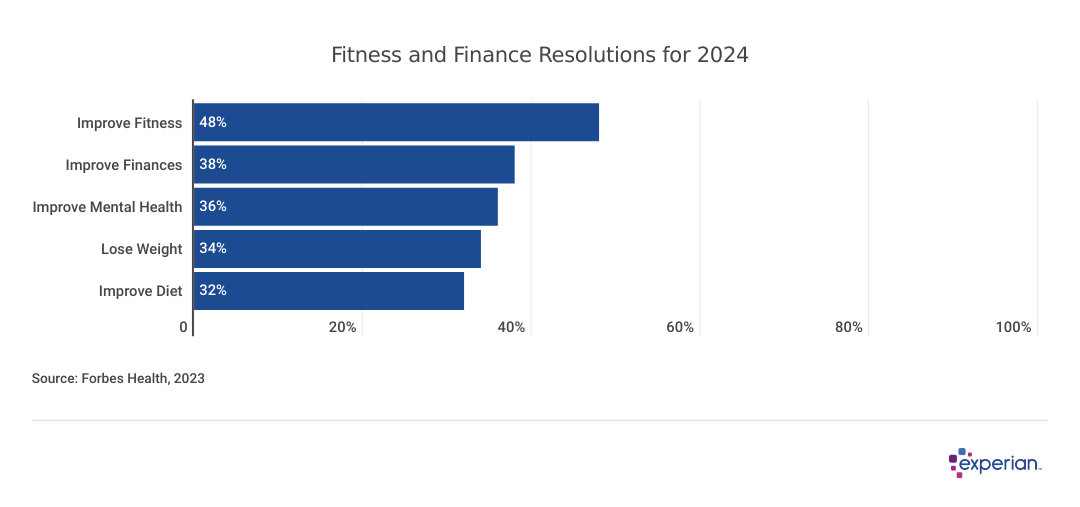

chart showing common “Fitness and Finance Resolutions for 2024”

Accountability is key to keeping resolutions on track. Studies indicate that those who write down their goals and set up a way to track progress are twice as likely to reach their goals. Big business has known this for a while now, putting into practice SMART goals, the famous acronym designed to help employees reach their specific, measurable, achievable, relevant and time-bound goals. Tracking SMART goals might be too much paperwork for the typical consumer, but finding a system for tracking your success in meeting your financial goals can pay off.

Fortunately, recent technological advances (chiefly access to smartphones) are giving individuals the power to measure many of their specific, achievable goals in 2024. Unfortunately for some resolution-makers, the effectiveness of tracking saving and spending with a financial smartphone app still lags behind fitness apps on those same devices. Steps and weigh-ins are more reliably trackable than spending from multiple accounts for your morning coffee and other ad-hoc purchases you might make throughout the day. And it’s at these micro-levels—counting steps, calories or pennies—that resolutions are often made or broken.

Regardless of their effectiveness, there’s clearly a lot of demand for some technological accountability in tracking fitness and finance goals. A November 2023 Forbes survey of consumers found that while improving finances tends to be a very popular resolution, the goal remains a runner-up to improving fitness in the new year.

The bottom line

Even though tracking your finances may not be as seamless as tracking mile splits with a smartwatch, financial planners and economists have been studying consumer savings behavior for years. In fact, behavioral economics may have already, imperceptibly, made a positive impact on how much most workers save for retirement today, by implementing automatic savings increases annually for many 401(k) and other workplace retirement savings plans.

And as far as credit is concerned, establishing a pattern of on-time payments is the best way to improve your scores.

The result that more people monitor their physical activity more frequently than their credit makes some sense: After all, most consumers’ credit scores won’t likely change as often as, say, their step count. Nor are all consumers in need of new credit in the short or intermediate term, which may cause them to check their credit score less often.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.