10 states where residents write off the most in taxes

Ground Picture // Shutterstock

10 states where residents write off the most in taxes

business owners going through receipts and finances

With strategic planning, Americans can reduce their tax liability via tax deductions and credits. Common deductions include qualified mortgage interest payments, student loan interest, property taxes and other expenses. Taxpayers have the option to itemize deductions above and beyond the standard tax deduction. For the 2023 tax year, the standard deduction is $13,850 for individuals and $27,700 for joint filers.

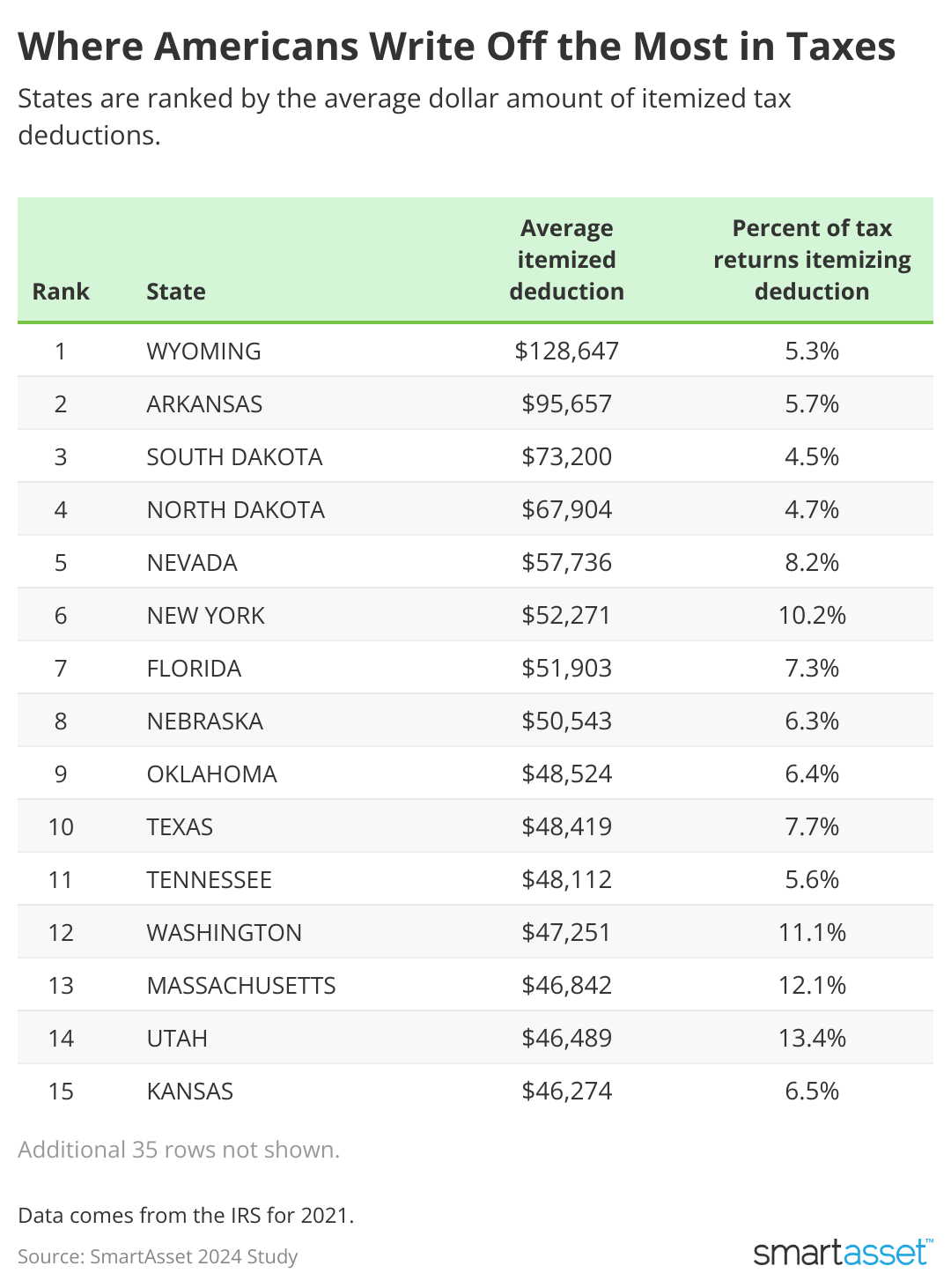

SmartAsset used the latest IRS data available to evaluate where Americans write off the most in taxes by measuring the average itemized deduction amount and the percentage of returns opting to itemize.

Key findings

- Wyoming has the highest deduction amount by a wide margin at $128,647. Wyoming also has recently seen the biggest influx of high-income households across the nation. Still, Wyoming has one of the lowest rates of tax returns using the itemized deduction election. Arkansas has the second-highest itemized deduction at $95,657.

- Itemizing is most normalized in Maryland. Just over one-fifth of taxpayers in Maryland itemize their deductions, more than any other state. Despite this, Maryland averages the second-smallest itemized deduction at $33,772. Rhode Island has the smallest average itemized return at $32,580.

- In California, 15% of filers itemize their returns. This is second only to Maryland and Washington, D.C. The average itemized deduction in California is $44,722. In total, the state has itemized deductions 2.5 times of that of the second-most state (New York) with $1.26 billion. Residents still end up paying the fourth-highest tax liability at 18.1% of aggregate adjusted gross income (AGI).

- Connecticut, New York and Massachusetts have the highest tax liabilities. After accounting for deductions and credits, Connecticut residents face the highest final tax liability at 18.9% of adjusted gross income. New York places second with 18.7% and Massachusetts residents pay an average of 18.4%.

![]()

SmartAsset

Top 10 States with the highest average itemized deduction

chart showing top 15 states where residents write off most in taxes

- Wyoming

Wyoming residents claim average itemized deductions totaling $128,647, with 5.3% of tax returns itemizing. The total collective income tax liability for households was $5.5 billion, which accounted for 16.9% of AGI.

- Arkansas

In Arkansas, the average itemized deduction reached $95,657, with 5.7% of taxpayers opting for itemization. The total tax liability for state residents was $13.7 billion, or 13.7% of AGI.

- South Dakota

Itemized deductions in South Dakota averaged $73,200, spread across 4.5% of filers. After paying taxes on 14.5% AGI, the total yield in tax liability was $5.5 billion.

- North Dakota

North Dakota taxpayers averaged $67,904 in itemized deductions, with a 4.7% itemization rate. The total tax liability was $4.9 billion, which represented 14.6% of AGI.

- Nevada

Nevada taxpayers reported an average itemized deduction of $57,736, with 8.2% of returns opting to itemize. The total tax liability of $24.8 billion accounts added up to 16.8% of AGI.

- New York

The average itemized deduction was $52,271 in New York, with 10.2% of returns itemizing. Aggregate taxes collected included $199.8 billion, which represented 18.7% of AGI.

- Florida

In Florida, the average itemized deduction is $51,903. With 7.3% of taxpayers itemizing, the effective tax rate in the state was 17.1% of AGI. Total income tax liability for residents reached $177.7 billion.

- Nebraska

Nebraska’s average itemized deduction is $50,543, with 6.3% of returns participating. The total tax liability of $11.0 billion accounted for 14.1% of AGI.

- Oklahoma

Oklahoma reports an average itemized deduction of $48,524. With 6.4% of filers itemizing, this adds up to a total tax liability of $15.9 billion, which represents 13.3% of AGI.

- Texas

Texas has an average itemized deduction of $48,419, with 7.7% of taxpayers itemizing. The aggregate tax liability totaled $190.6 billion, or 16.1% of AGI.

Data and Methodology

Using the most recently available IRS tax data from 2021, states were ranked by the size of itemized deductions averaged across taxpayers. Total tax liability paid was also compared with the total adjusted gross income for the state, as well as the percentage of returns electing to itemize their deductions.

This story was produced by SmartAsset and reviewed and distributed by Stacker Media.