College athletes aren't paid by their schools. Here's how brands fill that gap.

Jesse Grant // Getty Images

College athletes aren’t paid by their schools. Here’s how brands fill that gap.

Desi Okeke, Brayden Reynolds, and Julius Erving are seen at March Madness Fan Fest.

Throughout the history of college sports, money has always stoked controversy. Since the NCAA was formed, student-athletes have been prevented from earning anything apart from their scholarships. No jobs or sponsorships allowed. And yet, over and over, numerous pay-to-play scandals saturated the billion-dollar landscape. Within the last two decades alone, high-profile players from major institutions were caught selling memorabilia, taking thousands of dollars from marketing representatives, and accepting illegal gifts.

These recurring issues caused media firestorms and damaged school and player reputations, eventually spurring change, starting with class action lawsuits and unionizing efforts before a monumental U.S. Supreme Court decision in 2021. NCAA v. Alston affirmed a lower-court decision that the collegiate governing body was not exempt from antitrust regulations. The ruling led the NCAA to adopt a policy in which student-athletes could benefit financially from their name, image, and likeness, or NIL, without fear of repercussions.

Though there are many rules and regulations around NIL deals from state to state, the policy marked a huge step forward for student-athlete compensation. In a short time, brands have already taken advantage of this watershed ruling, and the market has provided ample opportunities for amateur athletes to profit. To date, more than 450,000 student-athletes across the United States have earned money from using their NIL to promote products and services.

As these nascent opportunities continue to become more widespread, Collabstr mapped how brands have already compensated college athletes using data from SponsorUnited and Opendorse.

![]()

Collabstr

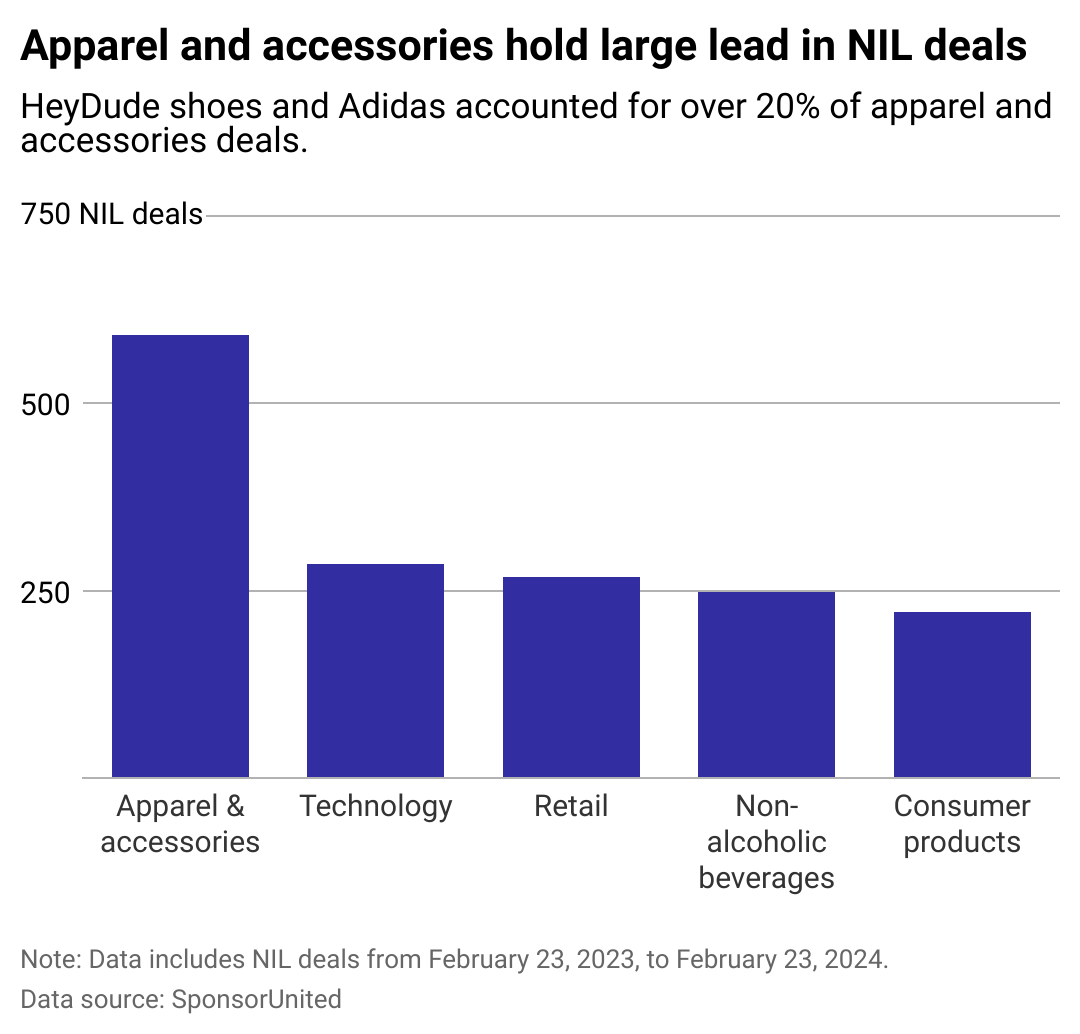

5 categories account for more than 1,500 NIL deals

A column chart showing NIL deals by brand category. Apparel and accesories lead, doubling the other categories.

What does it mean to profit from your own NIL? Most of the time, student-athletes sign sponsorships with corporate brands and organizations, create their own brand merchandise, and charge money for photos, personalized videos, and autographs. With many marketing opportunities at their disposal, specific kinds of companies have begun to aggressively sign high-profile college kids as their paid ambassadors.

Across the NIL landscape, apparel and accessories (a natural fit for athletes) is the most active category with 591 total deals. Within that grouping, HeyDude shoes boasts the highest volume of deals, with 78, most of which are tied to athletes who play baseball, women’s basketball, track and field, and gymnastics. Some other most active brands include EA Sports, Powerade, CVS Pharmacy, and Urban Outfitters, representing marketing deals in popular categories such as technology, retail, and nonalcoholic beverages.

There are a few reasons that 35% of brands invest exclusively in college sports, according to the Harvard Business Review. Working with college athletes can often be an entry for brands to reach younger, more engaged, and passionate audiences.

Dreamfield, an NIL-marketing platform, estimates that student-athletes can boast engagement rates up to 30%, while brands that team up with social media influencers only hover between 1% and 3%. An Instagram post by Louisiana State University basketball star Angel Reese, for example, might garner more than a million engagements, making her a great fit to partner with Mercedes-Benz, among other popular brands. And finally, budgets. Inking sponsorship deals with college athletes also comes at a lower cost than tapping professionals.

Much like Adidas, the apparel company Rhoback is a good example of how companies began blitzing collegiate football players with sponsorship deals in 2022. Rhoback was adamant about finding players from well-known, established programs in markets that fostered community, pumping their products out to some of the most loyal fan bases in the country (Alabama, Notre Dame, Texas, and Georgia). Though the legal limitations of NIL deals prevent players from wearing their school’s logos, most star players in these dedicated college football and basketball pockets are celebrities in their own right—fans know who they are even without their school affiliations, making it easier for brands to target customers geographically.

Collabstr

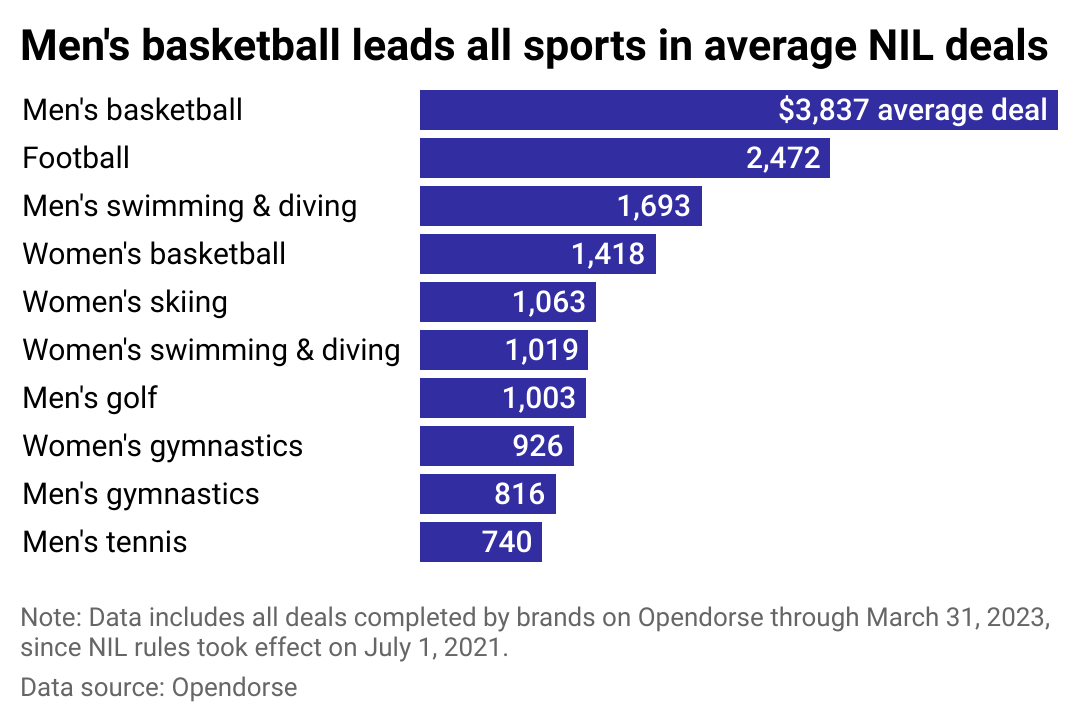

Women’s sports trail top men’s sports in average deal value

A bar chart showing the average NIL deal broken down by sport. Men’s basketball averages over $3,800 per deal. Football is the next highest at over $2,400 followed by men’s swimming and diving at nearly $1,700.

As much as brands have benefited from student-athletes, NIL deals are a symbiotic relationship. Players in high-visibility sports with multibillion-dollar television deals—primarily football and basketball—have the potential to earn millions of dollars in promotional deals. According to On3’s deal tracker, an index of an athlete’s NIL value, there are at least 25 athletes who have made over $1 million to this point, which includes Bryce James, Shedeur Sanders, Olivia Dunne, and Travis Hunter. These kinds of high-grossing opportunities have influenced some athletes who might have been eager to jump into professional sports to stay in school longer while still being able to earn money.

Not all deals are this lucrative, though. From a licensing standpoint, college athletic site Athletic Director U estimates the annual NIL value per student-athlete ranges from $1,000 to $10,000. However, as the chart above shows, lesser-known athletes in lesser-watched sports at smaller institutions and programs sit on the lower side of that range, not receiving the same chances to earn from NIL activities and collectives. Though it is illegal for coaches to broker NIL deals, more and more recruiters are luring athletes who might have excelled at smaller schools to larger programs with the promise of better deals in bigger markets.

There is also a discrepancy between women and men athletes. Despite some of the recent headliners, such as Caitlin Clark and Angel Reese, earning major endorsement deals, according to NIL marketplace Opendorse, male athletes have taken home nearly 70% of total NIL earnings. Note that Opendorse’s data was based on the sports categories, which continue to rely on a binary understanding of sex and gender. Another key difference between the men and women is the type of NIL deal offered. According to SponsorUnited, men athletes have a greater share of deals in the sports drink, car dealership, nonathletic apparel, and video game space than women, whose deals primarily center around cosmetics and skincare, jewelry, and consumer financial services. “I think there is a clear gap in who the performance industry is interested in,” Chamblee Russell, a Georgia Southern University volleyball player, told Grady Newsource.

This kind of disparity extends to the professional ranks, where women athletes have less earning potential regarding their salaries. A study of 2022 data by Wasserman and The Collective, which advocates for women in sports, found that men earn 21 times more in salary compared to their women counterparts. As a result, they depend on sponsorships twice as much as men, with 82% of their incomes coming from endorsements compared to only 37% for men. In many ways, NIL deals, especially for women athletes, both highlight the economic gaps between genders and offer a first step to becoming profitable brands in their own right.

Due to more representation from women’s volleyball, softball, and basketball players, SponsorUnited notes an increase in the number of women athletes included in the top 100 most endorsed list—52 women, up from 38 women in the prior year. Brands have also discovered the benefits of working with women’s teams.

In July 2022, Texas Tech University’s women’s basketball team made history when it inked an arrangement with marketing agency Level 13, which agreed to provide every Lady Raider $25,000 a year. It was the largest deal for a women’s basketball program at the time. Thanks to deals like these names like Southern Methodist University volleyball player Alex Glover, University of Illinois Urbana-Champaign softball player Yazzy Avila, and Rutgers University volleyball player Isabella Choice are becoming more familiar to households around the country, perhaps paving the way for more awareness and value for women in sports.

Story editing by Carren Jao. Additional editing by Kelly Glass. Copy editing by Paris Close. Photo selection by Clarese Moller.

This story originally appeared on Collabstr and was produced and

distributed in partnership with Stacker Studio.