America's wealthiest are more likely to invest in these alternative assets than their international counterparts

Shutterstock // Daniel Jedzura

America’s wealthiest are more likely to invest in these alternative assets than their international counterparts

A closeup of man’s hands touching a watch on a black stand.

With interest rates at record highs and inflation eating away at investment returns, alternative investments have taken on a new luster for the richest of the rich.

Alternative investments are any investment outside traditional holdings like stocks, bonds, and cash. They can include real estate, hedge funds, and private credit, along with more exotic assets like rare whiskey, lustrous diamonds, classic race cars, luxury handbags, and one-of-a-kind trading cards.

In a difficult economic environment where a traditional investment strategy like asset diversification—buying different types of investments to spread out one’s risk—isn’t as effective, investments outside the traditional asset classes can help bolster the portfolios of ultra-high-net-worth individuals, defined as those with $30 million or more in assets.

Wealth Enhancement Group analyzed survey data from consulting firm Knight Frank to illustrate how wealth advisors are putting their clients’ money to work in alternative investments.

Art, classic cars, wine, and rare whiskey lead the list of “investments of passion” that are becoming more popular among the clients of wealth advisors, according to the survey. The alternative asset class has grown more popular in recent years, hitting a high of 15.5% in 2022 but falling last year to 14.9%, according to J.P. Morgan.

Alternative investments can also include cryptocurrency, which may come under pressure for its high electricity demands to power the computers for crypto mining operations. Some 65% of UHNWIs say they’re trying to reduce their own carbon footprint, and 24% are screening their investments for ESG (environmental, social, governance) compliance.

![]()

Wealth Enhancement Group

Hot rods and big rocks

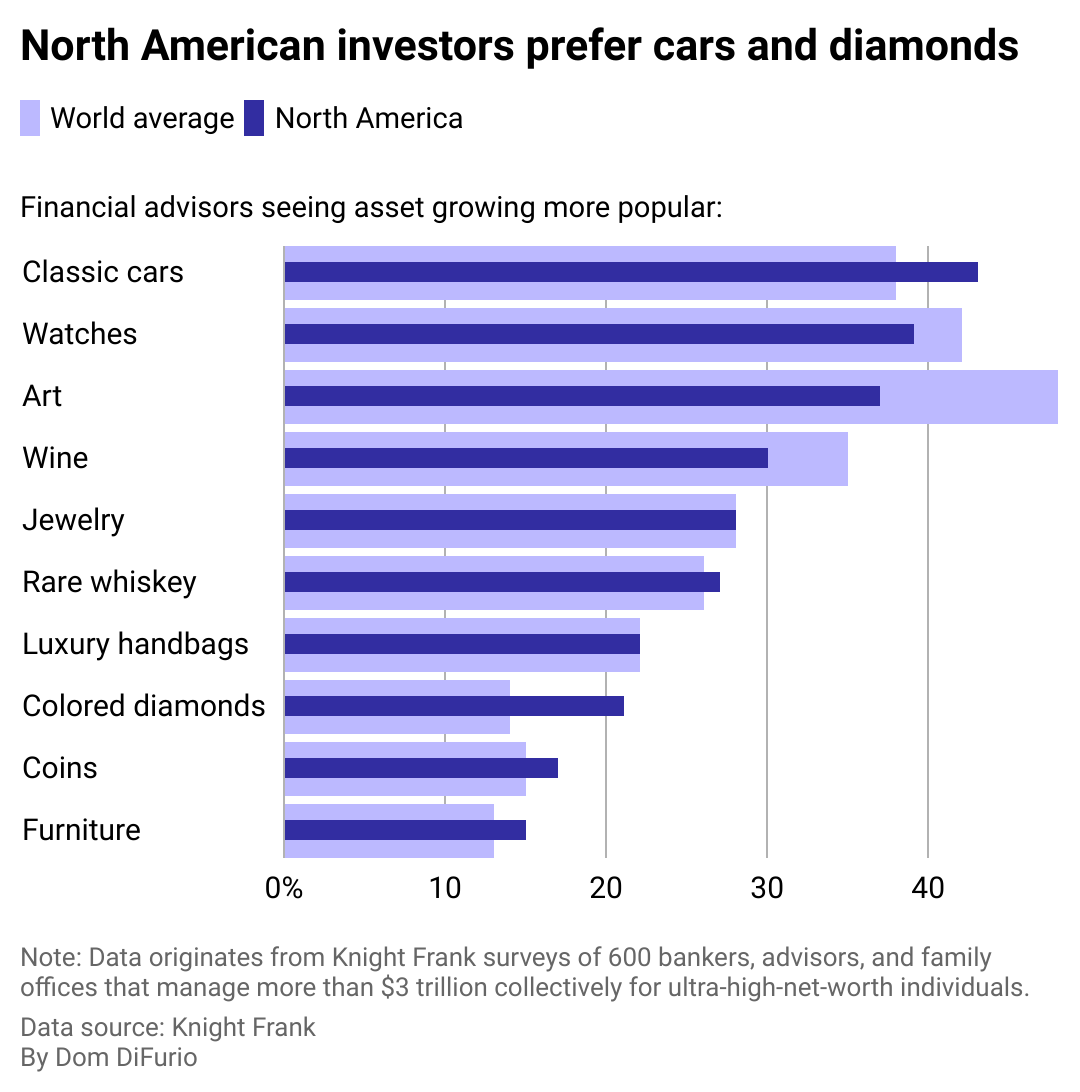

A bar chart showing the alternative investments becoming more popular based on a survey from consulting firm Knight Frank. Compared to the world average, North American investors are 7 percentage points more likely to invest in colored diamonds, 5 percentage points more likely to invest in classic cars, 2 percentage points more likely to invest in coins and furniture, and 1 percentage point more likely to invest in rare whiskey.

North American investors who put money into alternative investments outpace their global peers when it comes to classic cars and diamonds. And 21% of advisors said colored diamonds were becoming more popular on the continent, versus 14% worldwide.

In the past, accredited, high-net-worth individuals and institutional investors have been the ones to put money into alternative investments to hedge against risk and achieve additional gains over benchmark averages. Retail investors are now able to get some exposure to these asset classes through alternative funds that specialize in alternative investments, giving everyday investors access to assets like real estate, collectibles, and crypto.

However, the percentage of the portfolio they comprise is very different. On average, just 5% is allocated to alternative investments for retail investors, compared to 50% for UHNWIs. By 2024, the greatest shift in portfolio allocation toward alternative investments is expected to be among the “mass affluent”—those with $250,000 to $1 million in liquid assets—with an expected rise in portfolio allocation from 14% to 32%, according to a survey by accounting firm EY.

Wealth Enhancement Group

Alternative investments can prove lucrative

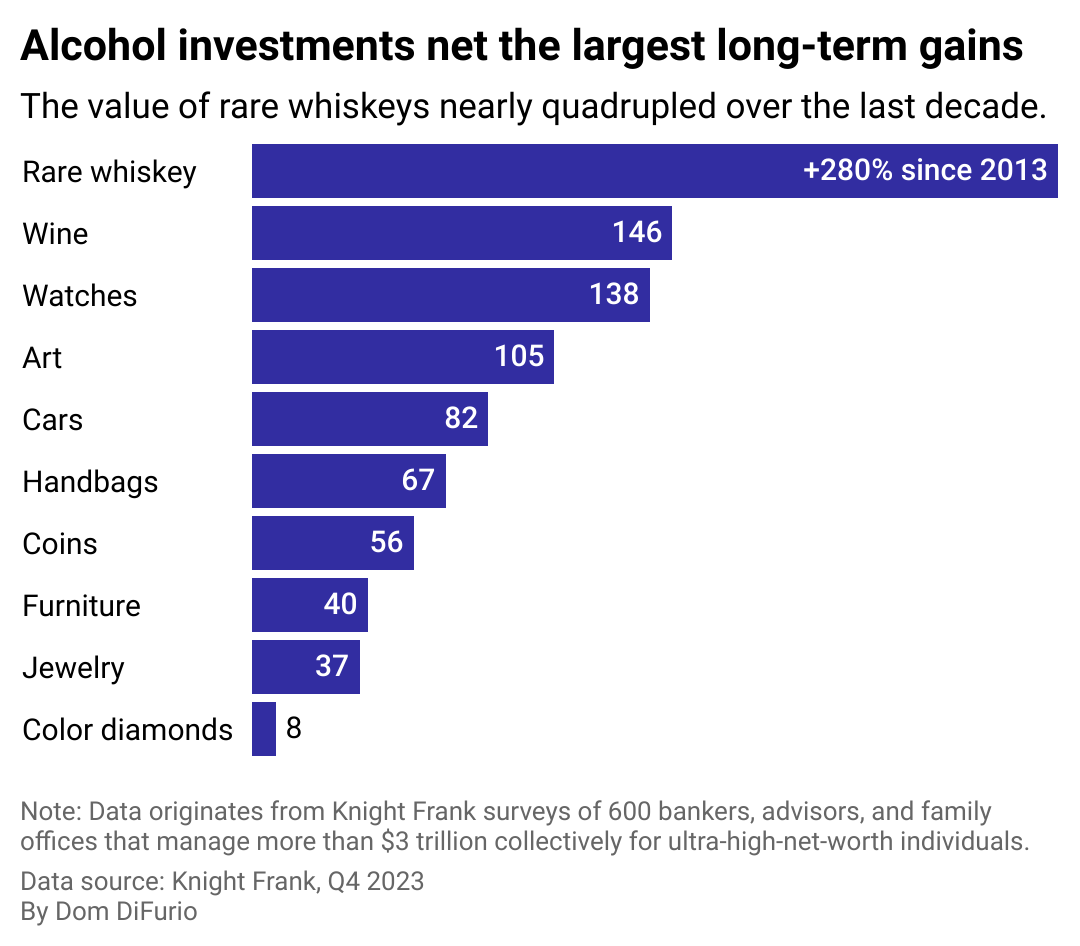

A stacked bar chart showing the 10-year change in the value of certain alternative investments tracked by consulting firm Knight Frank. Rare whiskey is up 280% over the decade, wine is up 150%, watches 140%, art 105%, cars 80%, handbags 67%, furniture 40%, jewelry 37%, and colored diamonds 8%.

Not all alternative investments perform equally, with some substantially outperforming others over the past decade. Rare whiskeys have gone up 280% since 2013, while wine has increased 146% and watches as much as 138%. At the bottom of the list, furniture has gone up just 40%, jewelry 37%, and color diamonds only 8%. For comparison, the average annualized return of the S&P 500 during the same time was 10.3%. With the exception of color diamonds, all of the alternative investments tracked in the survey outperformed the stock market benchmark during the span.

Some of the shine is coming off of alternative investments, with asset appreciation ranging from just 9% to 11% in 2023. Volatility and price-taking may continue in 2024, and certain specialized categories within assets that appeal to younger collectors may weather the waves better than others, according to the survey.

But the main reason investors pick up alternative investments isn’t wealth generation—it’s only the second. The number one reason is the “joy of ownership,” according to the report. In other words, price depreciation alone isn’t likely to cause a big sell-off in a given asset class as long as passion is fueling many alternative investment purchases.

Story editing by Alizah Salario. Additional editing by Kelly Glass. Copy editing by Tim Bruns.

This story originally appeared on Wealth Enhancement and was produced and

distributed in partnership with Stacker Studio.