Inflation, wages and credit: Are younger consumers winning in 2024?

Drazen Zigic // Shutterstock

Inflation, wages and credit: Are younger consumers winning in 2024?

A young woman carefully selecting items to purchase in a grocery aisle.

Since 2022, the costs consumers bear have risen significantly. This is the case not only for consumer goods including food and shelter, but for interest payments on their debts as well. Nonetheless, consumer credit markets remain healthy, according to an Experian analysis of data from the second quarter (Q2) of 2024.

With unemployment still near a historic low, more consumers have the income to service their monthly credit card and auto payments, higher though they may be, in 2024. And although delinquencies on some types of credit have increased, Experian data shows they are not far off record-low levels. Both of these factors undergird the rise in the average consumer credit score, even though consumer confidence indicators suggest that some consumers have felt sour on the economy for some time.

![]()

Experian

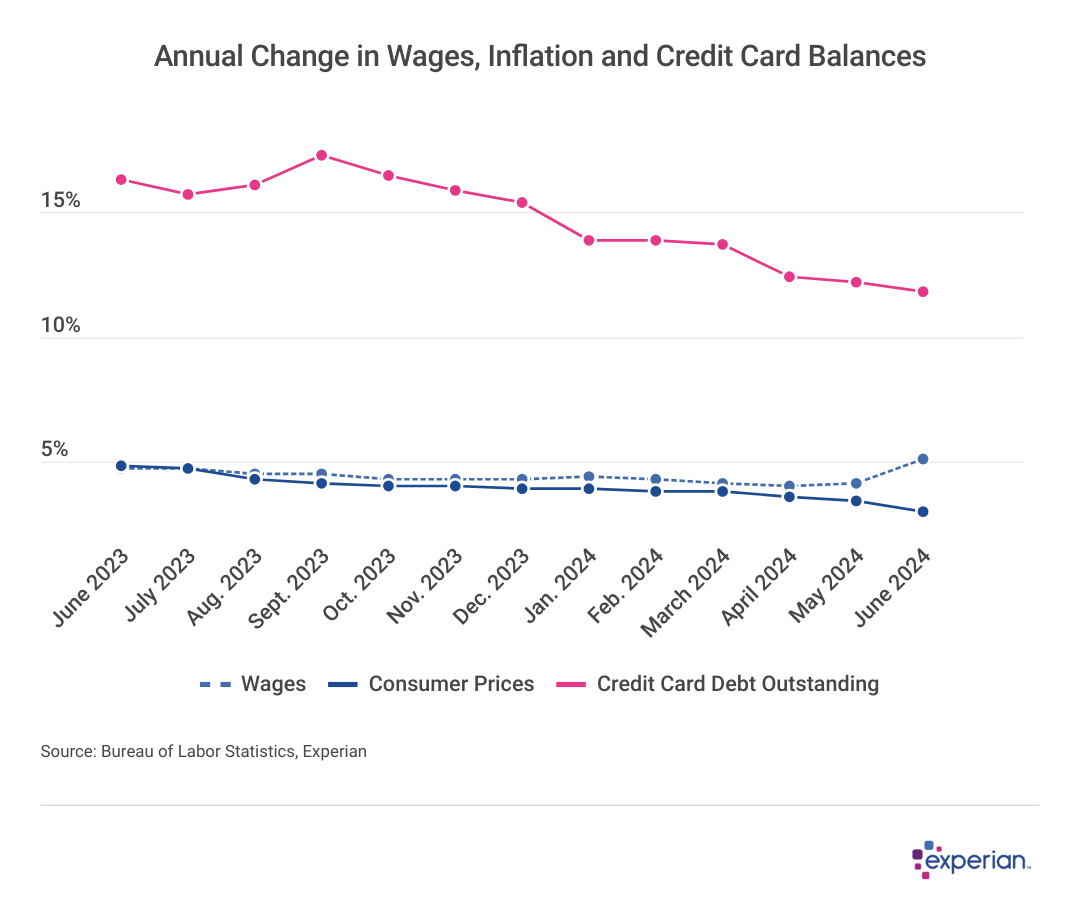

Interest and Card Balances Growing Faster Than Wages and Inflation

Line graph chart showing data on “Annual Change in Wages, Inflation and Credit Card Balances”.

With lower unemployment rates, workers are asking for and receiving increases in wages, reversing a trend that’s persisted over more than a decade. And, for the first time since the Great Recession, wages have been growing faster than inflation.

However, hovering over both inflation and wages are credit card balances, which have only recently begun to moderate from double-digit percentage increases over much of the past two years. As of June 2024, credit card balances were still increasing by a nearly 12% annual rate, dwarfing the increases in both wages and inflation.

Although some of that spending may be pent-up demand (vacations that were deferred during the pandemic, for instance), some increases in credit card spending could equally be due to higher costs. Price hikes for large, nondiscretionary components of the consumer basket of goods, such as rent and auto insurance, have left less cash available for consumer discretionary spending—so out comes the plastic.

Experian

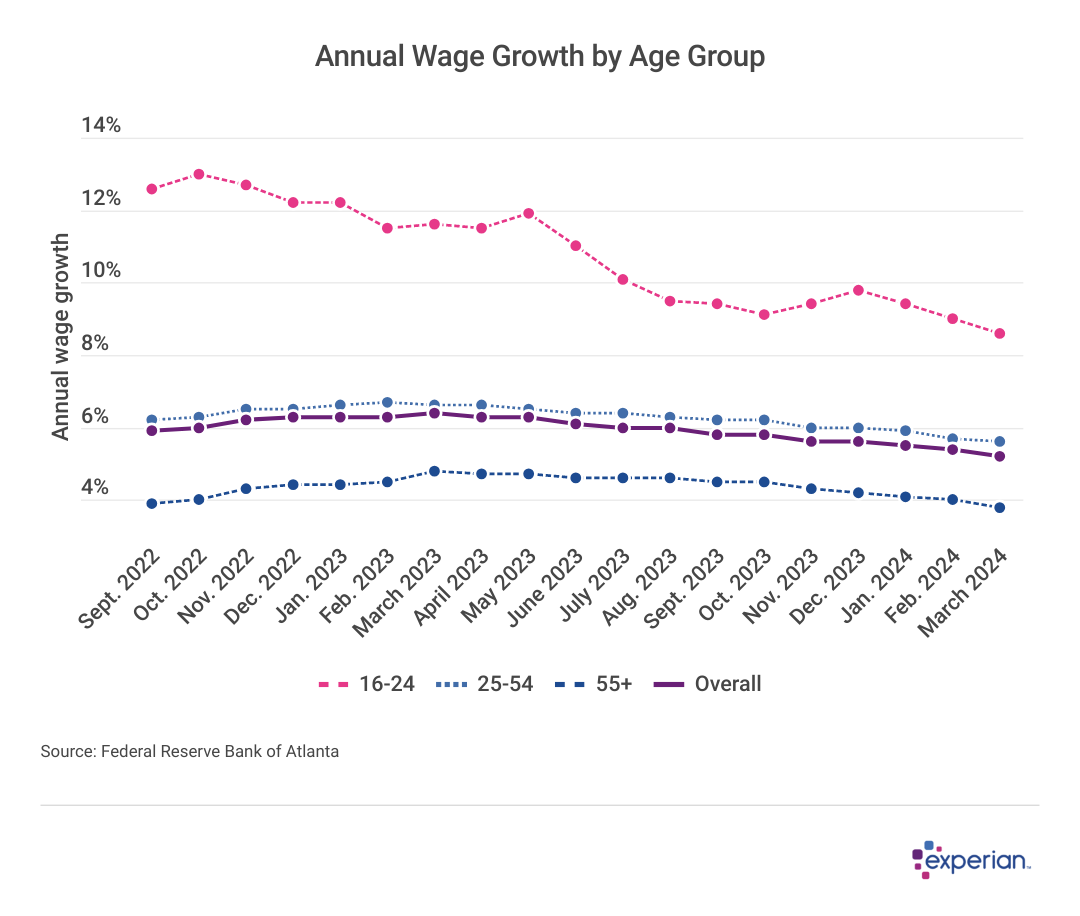

Younger Workers Getting More, Spending (Somewhat) Less

Line graph chart showing data on “Annual Wage Growth by Age Group”.

According to Federal Reserve Bank of Atlanta data, younger and lower-paid workers may be benefiting the most from recent wage gains. Workers 16 to 24 have been earning wage increases of more than 10% annually for much of the past two years, and still earned 9% more in 2024. Meanwhile, prices have only increased 3% over the past year (through June 2024).

Older workers over the same period also earned more than inflation over the same period, but only around about half the increase of younger workers.

Although not all younger workers are lower-paid, many are. And while on an individual level they may not feel their earnings power growing, the way these consumers are collectively spending suggests that those earnings gains are being spent. Compared to other generations, however, young consumers appear to be showing some restraint—when you compare their balances to their credit limits, at least. Meanwhile, their FICO Scores remain relatively constant.

Experian

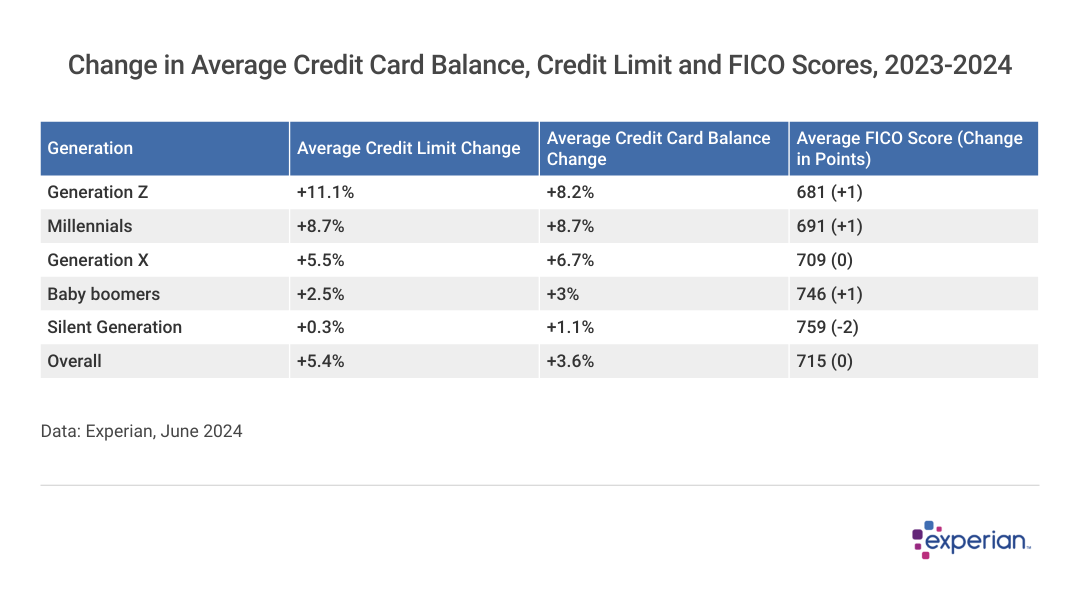

Gen Z Credit Utilization Rates Lower Than Other Generations

Table showing data on “Change in Average Credit Card Balance, Credit Limit and FICO® Scores, 2023-2024”.

Among the generations, Generation Z adults 18 to 27 in 2024, were the only ones to not grow their average balance more than their credit limits. In other words, while all other generations are using more of their credit and growing their credit utilization, Gen Zers are using less of their credit than they were a year ago, in percentage terms.

Nonetheless, even though Gen Zers are receiving a greater percentage of credit than they’re currently using, they still have far lower credit limits. The average credit limit for Gen Z consumers was $13,900 in Q2 2024, less than half of the $29,200 average credit limit of millennials. These lower limits also mean potentially less room for error: A $3,000 doom spending spree or car repair may cost the same in dollar terms for every consumer, but impacts those with lower credit limits more.

Experian

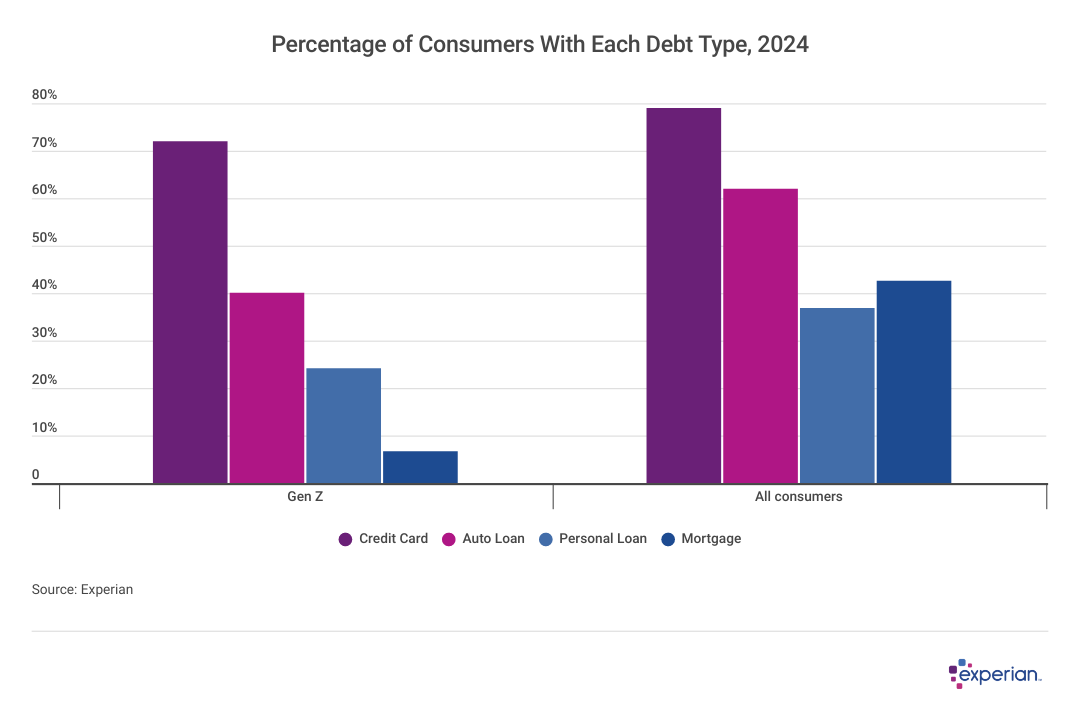

Slowly but Surely, Gen Z Is Gaining Experience With Credit

A graph showing data on “Percentage of Consumers With Each Debt Type by Year”.

As Gen Z ages, these consumers have been increasingly taking on more types of debt besides revolving credit card debt. The percentage of Gen Zers with personal loans, auto loans and even mortgages has grown substantially in 2024.

In other words, while younger workers may be receiving larger raises, there is likely new borrowing that will quickly absorb that extra income, if not in mortgages (or rent for that matter) but also other bigger-ticket items like auto loans, which, depending on where in the country you are, can be more difficult to avoid as adult responsibilities increase.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analyses. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.