Cybercrime losses were highest in these states

Shutterstock // Max Acronym

Cybercrime losses were highest in these states

A man’s silhouette in a dark room sitting in front of a laptop and another computer screen.

With fast-evolving technologies, near-ubiquitous internet use, and increasingly realistic scams, cybercrime is on the rise—and Americans, in particular, are being swindled out of billions. Hundreds of thousands more cybercrimes were reported in the U.S. in 2023 than the other top 19 countries combined.

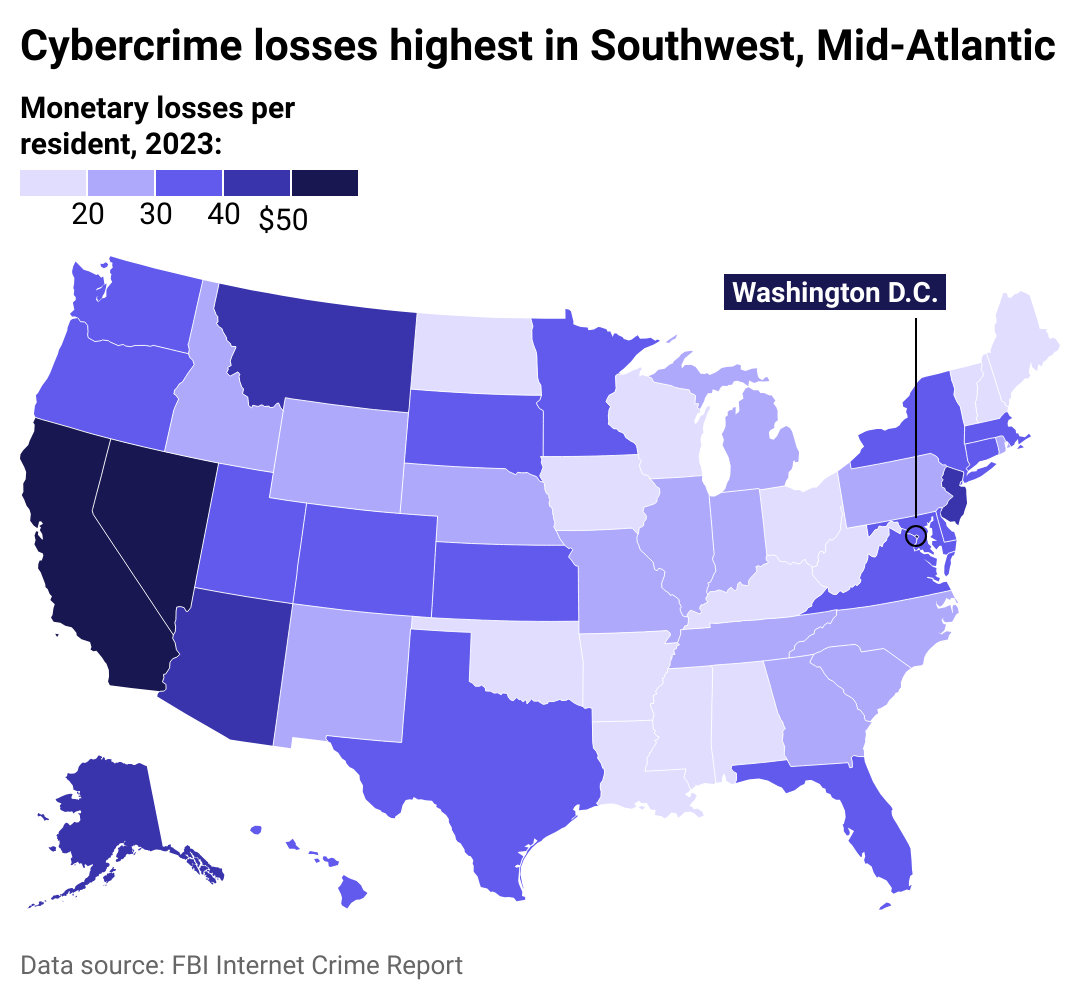

Drata identified states with the highest monetary losses from cybercrime per resident, according to data from the FBI‘s 2023 Internet Crime Report.

FBI data shows that cybercrime cost Americans $12.5 billion in 2023—a statistic that has grown annually for at least five years. The FBI’s Internet Crime Complaint Center, or IC3, received a record 880,000-plus complaints in 2023, with victims reporting losses of more than $14,000 on average. Importantly, cybercrimes are vastly underreported, making the FBI data—which only includes reported crimes—woefully incomplete.

Cybercrime affects people of all ages in all parts of the country. Nearly 1 in 3 Americans have been victims of online financial fraud or cybercrime, according to a 2023 Ipsos poll on behalf of Wells Fargo. Earlier this year, the Cybersecurity and Infrastructure Security Agency published draft rules for cyberattack reporting among critical infrastructure institutions, which would mandate reporting of substantial attacks and ransoms paid. In the future, these guidelines will allow for more comprehensive data collection, at least among major entities. Even so, current numbers make it clear that some Americans are more at risk of scams than others.

Americans older than 60 reported the highest number of complaints and volume of losses in 2023. They bore the brunt of an escalation in “phantom hacker scams,” where attackers impersonate IT, banking/investment personnel, and government officials to establish authority and trust with victims. About half of those who filed related complaints were 60 or older and experienced over $770 million in losses.

Still, increasingly sophisticated scams heighten the risks for younger and more tech-savvy populations. Of the $2.2 billion increase in cybercrime losses from 2022-2023, more than half was due to a surge in cryptocurrency scams. Crypto scams comprise most digital investment fraud, a category affecting age groups over 30 relatively evenly.

![]()

Drata

Losses high in technology and political centers

Heat map showing cybercrime losses are highest in the Southwest and Mid-Atlantic regions of the United States.

Within the U.S., centers of politics, technology, and gambling experienced particularly high losses. In the nation’s capital, cybercrime victims lost over $46 million in scams, nearly doubling the national loss per capita. California and Nevada residents also reported heavy losses.

As the nation’s capital, Washington D.C. is an obvious target for cybercriminals. Government facilities were among the largest critical infrastructure targets for ransomware attacks in 2023. D.C. experienced multiple high-profile data breaches, including leaks of voter records and senior national security officials’ personal information. Attacks were also launched against political action committees, threatening campaign financiers, lobbyists, and donors.

California’s high-tech culture makes it another clear target for cybercriminals. Californians from Silicon Valley to Los Angeles have been some of the first to be impacted by growing crypto fraud. That has included more advanced cons, in which scammers build relationships with people through dating apps, social media, networking sites, and other means, then convince them to invest in cryptocurrency through fake websites and apps.

The California state government has already taken some action, limiting withdrawals from bitcoin ATMs after a string of scams utilizing them. In May, the FBI San Francisco division released a memo warning of AI-enabled cybercrime, such as automated and highly targeted phishing campaigns and advanced voice and video impersonations of friends, family, and colleagues.

As cybercrimes become more advanced, they also wreak havoc on entire systems or disrupt businesses. Within neighboring Nevada, Las Vegas—a hub of flashy business and nonstop spending—also faced major attacks last year. Two of the city’s largest casino and hotel operators were targeted in attacks that forced one to shut down its casino, hotel, and key systems and the other to pay about $15 million to prevent its data from being leaked. This January, the Nevada Gaming Control Board was also hacked.

Though many people and institutions lost money to scams last year, timely reporting and enforcement prevented further losses. The FBI helped freeze victims’ funds in thousands of incidents and prevented about 71% of losses within those cases. Even in cases where victims’ funds were already stolen, reporting losses helps the FBI investigate and connect strings of crimes, identify and warn the public of emerging scams, and track cybercriminals.

Story editing by Alizah Salario. Additional editing by Kelly Glass. Copy editing by Paris Close. Photo selection by Ania Antecka.

This story originally appeared on Drata and was produced and

distributed in partnership with Stacker Studio.