How does deferring a loan affect my credit score?

Grusho Anna // Shutterstock

How does deferring a loan affect my credit score?

Person holding loan and utility bills while using a calculator.

An unexpected layoff or a job loss can make keeping up with debt payments more challenging. When your budget is stretched thin, having the option to pause payments on credit cards, car loans, or other debts may be appealing, SoFi explains.

Taking a break from financial obligations can offer some financial breathing room, but it’s important to understand how deferred payments may affect your credit score. (Please note: SoFi is not a credit repair company.)

Does Deferring a Payment Hurt Credit?

Here’s the good news: Deferring loan payments does not directly affect your credit scores. In fact, if you’re having trouble making payments, it can be a good idea to defer your loans until you get on solid financial footing. Lenders will report that they’ve paused payments to the credit bureaus, and this will appear on your credit report, but it will not hurt your score.

That said, deferring your loans can have other consequences for your finances. For example, depending on the type of loan, it may continue to accrue interest while it’s deferred. That means you’ll end up paying more money in the long run. However, if deferring your loans means avoiding defaulting, paying late fees, and hurting your credit score, the extra interest may still be worth it.

How Deferring Loan Payments Works

If you’re having trouble making payments on a loan, you can ask your lender if it’s possible to defer them. If they agree, you can temporarily stop making payments on your loan, avoiding late payment fees. Also, your lender will not report missed payments to the credit reporting bureaus.

You’ll need to apply for deferment directly with your loan provider. If you have federal student loans, you’ll apply with your loan servicer. Similarly, if you are interested in deferring your auto loan or mortgage, contact your lender directly. Auto lenders may refer to deferment as loan extension or postponement.

Forbearance vs. Deferring Loan Payments

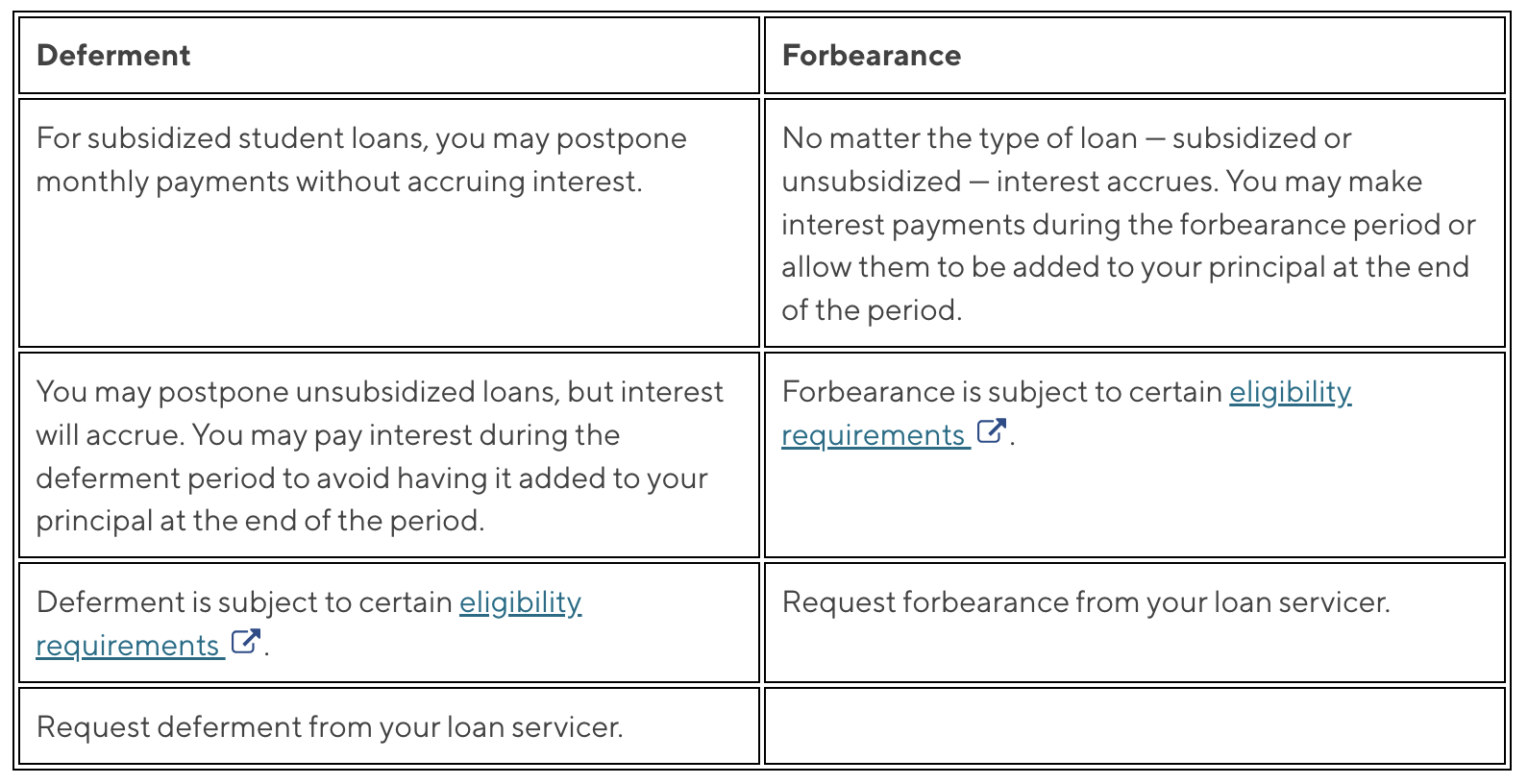

The difference between forbearance vs. deferment can be tricky to parse. For mortgages, forbearance is the pausing of a loan during which interest accrues, while deferment is the option to tack on paused payments to the end of the loan. The terms are also often used to describe options for pausing debt on student loans. Here’s a look at the differences between the two terms in this case.

![]()

SoFi

Which Loan Payments Can Be Deferred?

Table showing differences between forbearance and deferment.

A wide range of loans can be deferred, from federal student loans to home mortgage loans. Most government debt-relief measures introduced during COVID-19 have since expired. However, many lenders, credit card issuers, and utility service providers offer programs allowing customers to pause payments due to financial hardship.

Depending on each individual situation, U.S. residents may be able to get relief (at the state or local level) from paying these expenses temporarily:

- •Rent

- Mortgage

- Federal student loans

- Private student loans

- Credit cards

- Utility services, including water, electric, and gas

- Car loans

- Personal loans

Will I Be Charged Interest During Deferment?

You will likely be charged interest during loan deferment, with some exceptions. For example, if you defer a subsidized federal student loan, the government may make interest payments for you. Otherwise, with other loan programs, you’ll be on the hook for any interest that accrues during the deferment period.

How you pay interest will likely vary by lender. For example, some lenders may only apply interest rates to your principal, and won’t charge you interest on the interest you accrue. Interest payments may be tacked on to the end of your loan, or they may make your monthly payments larger. They may also be added to your principal amount once your payments restart. In all of these cases, you’ll end up paying more over the life of the loan.

Federal Programs That Allow Deferred Payments

For those who own or rent homes or have student loan debt, the federal government offered relief options in response to the COVID-19 pandemic.

COVID-19 Mortgage Forbearance

The Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, allowed eligible homeowners to pause making mortgage payments for up to 180 days. That measure expired in May 2023 when the National Emergency was declared over.

Deferred Payments for Federal Student Loans

The CARES Act also extended a forbearance period automatically for eligible federal student loan borrowers. Previously, qualified students could defer student loan payments through deferment or forbearance due to hardship or other factors, but there are some changes due to the CARES Act.

For now, those with an eligible federal student loan are not required to make student loan payments. The interest rate for federal student loans is set to 0% during this time, and any payments made would be applied only to loan principal.

Deferred payments still count toward required payments for Public Service Loan Forgiveness for those still employed full time, regardless of whether they pay anything toward their loans. Since payments are being suspended automatically, credit score won’t be affected.

Note that once the automatic forbearance ends (potentially this summer), payments will become due again. Borrowers will need to reach out to their lenders if they wish to continue forbearance or take a deferment instead.

As of this writing, Direct Loan borrowers or Federal Family Education Loan Program borrowers who stop paying their student loans altogether after the forbearance period is over could end up in default once payments are 270 days late. Borrowers in the Federal Perkins Loan Program are considered in default if their payment is not made by the scheduled due date.

Federal Relief for Renters

If a U.S. resident is renting a home versus owning one, they may be able to temporarily stop making rent payments without risking eviction.

Most of the federal protections for renters under the CARES Act have expired, but some states still have eviction protections in place, with varying expiration dates. There may also be state or local rent and utility assistance available for those who meet eligibility requirements.

Deferring Payments Outside of Federal Relief

Federal forbearance programs can help provide a break from certain payments, but they don’t offer blanket coverage to everyone. For those negotiating deferred payments outside of these programs, it’s important to keep one’s credit score in sight.

Pausing Mortgage and Rent Payments

If a mortgage or rental property isn’t covered by the CARES Act, borrowers can still reach out to their lender to discuss what options, if any, may be available for putting payments on hold.

Those options might include:

- Loan modification

- Forbearance

- Mortgage refinancing

Modifying a loan or requesting a forbearance can help protect a credit score if the borrower hasn’t fallen behind on the payments. But any late or missed mortgage payments will still be included on their credit report.

On the renting side, the CARES Act temporarily prohibited adverse credit reporting for rent in cases where the landlord has agreed to forbearance, as long as payments weren’t already delinquent.

But if a tenant and their landlord don’t have an agreement in place and the tenant wasn’t covered by federal forbearance, it’s possible that late or missed rent payments could be reported to the credit bureaus.

Deferring Payments on Private Student Loans

Private student loans aren’t covered by the CARES Act. It’s up to individual lenders to decide what options, if any, they’ll offer to allow borrowers to ease payment burdens during this time.

That might include:

- Deferment

- Forbearance

- Student loan refinancing

Similar to a traditional student loan forbearance for federal student loans, private student loan forbearance wouldn’t affect the borrower’s credit score. Not all private lenders offer forbearance on private student loans, so a borrower would need to check with their loan servicer.

If a private student loan lender doesn’t offer forbearance as an option, the borrower may want to look into refinancing their private student loans online. SoFi can work with private student loan borrowers to come up with possible options.

Student loan refinancing allows borrowers to pay off an existing loan with a new loan, ideally at a more competitive interest rate. Refinancing could also help lower monthly payments, making loans more manageable for a specific budget. (Note: You may pay more interest over the life of the loan if you refinance with an extended term.)

With the payment pause for federal student loans due to expire this year, it may be a good time to consider refinancing or forbearance.

Putting Utility Payments on Hold

If someone is unable to pay their electric, water, or other utility bills, they may be able to work with their service providers to defer those payments.

While many utility companies suspended disconnects during COVID-19 and were allowing customers to make those payments up at a later date, some utility moratoriums have ended.

Generally, utility service payments (or non-payments) aren’t reported to a person’s credit unless their account is sold to a debt collector after default.

If you are struggling to make utility payments, it might be a good idea to work out a payment plan with the utility company. Additionally, some states have relief programs for qualifying individuals and families who are struggling to make utility payments.

Deferring Credit Card Payments and Other Loans

For those with credit cards, car loans, or personal loans, making sure to stay on top of those payments can be critical to a credit score. Remember, payment history accounts for 35% of a FICO® Score.

Pausing Credit Card Payments

Worried about falling behind on credit card payments? Credit card companies may be able to help.

Many credit card issuers offer hardship programs for customers who are having trouble making payments. Depending on the terms of the card issuer’s program, cardholders may be able to:

- Reduce the card’s annual percentage rate (APR) temporarily.

- Reduce the minimum monthly payment due.

- Waive late fees and other penalties.

- Pause payments temporarily.

Cardholders could call their credit card company to find out what hardship options might be available. When negotiating deferred payments for credit cards or any other type of debt, they might want to be prepared to explain why they can’t pay and the nature of their hardship.

If the cardholder is able to enroll in a hardship program, understanding the terms of the program is important. If they’re expected to make a payment, for example, even if it’s a nominal one, it’s still important to pay on time to avoid a negative mark on their credit history.

Pausing Loan Payments

If a borrower owes money on a car loan or personal loan, they could reach out to their lenders to see whether a forbearance is possible.

For instance, an auto loan lender might offer a skip-a-payment program. Instead of making a regular payment, they might let a borrower skip it and have it added on to the end of their loan term.

Personal loan lenders may offer similar options or allow borrowers to reduce their monthly loan payments temporarily for those who qualify. Checking with the individual lender to inquire about options is recommended.

Loan Deferment Alternatives

There may be certain situations in which you don’t want to put your loan into deferment or you aren’t able to. For example, perhaps you’ve reached the maximum number of times you can defer a loan, or your request to do so is denied for some other reason. If this is the case, you may want to consider other options.

Your lender may be able to offer some alternatives. For example, they might be able to temporarily lower your interest rate or monthly payment. They might also be able to modify your loan agreement to lower your monthly payments—though you may pay more interest over the life of the loan if you’re extending your term.

Finally, you might consider refinancing your loan. When refinancing, you take out a new loan—ideally with a lower interest rate or better terms—and use it to pay off the old loan.

Staying on Top of Credit Scores During a Crisis

Credit scores are an important part of financial life, and preserving yours during a crisis like the COVID-19 outbreak may be a top priority. Using deferment and forbearance periods to pause payments could help protect a credit score.

However, bear in mind that while a credit score itself may not change, a forbearance can still appear on a credit report and could affect future lending decisions.

The three main credit reporting agencies, Equifax®, Experian®, and TransUnion® will continue providing weekly free credit reports through the end of 2023. This is an extension of the program, which was announced in April 2020, at the start of the COVID-19 pandemic.

The Takeaway

For people facing financial uncertainty, there are a number of programs designed to provide temporary relief. Current programs can help borrowers defer their federal student loan payments, and some borrowers may be eligible to pause mortgage payments. Those struggling to make payments can consider talking to their lender to see what types of plans are available.

This story was produced by SoFi and reviewed and distributed by Stacker Media.