Types of retirement plans and which to consider

PeopleImages.com – Yuri A // Shutterstock

Types of retirement plans and which to consider

Older mother and her adult daughter looking up finance and retirement information using a laptop.

Retirement will likely be the most significant expense of your lifetime, which means saving for retirement is a big job. This is especially true if you envision a retirement that is rich with experiences such as traveling through Europe or spending time with your grown children and grandkids. A retirement savings plan can help you achieve these financial goals and stay on track.

There are all types of retirement plans to help you build your wealth, from 401(k) to Individual Retirement Accounts, or IRAs, to annuities. SoFi explains the nuances of these different retirement plans, like their tax benefits and various drawbacks, to help you choose the right mix of plans to achieve your financial goals.

Key points:

- There are various types of retirement plans, including traditional and non-traditional options, such as 401(k), IRA, Roth IRA, SEP IRA, and Cash-Balance Plan.

- Employers offer defined contribution plans (e.g., 401(k)) where employees contribute and have access to the funds, and defined benefit plans (e.g., Pension Plans) where employers invest for employees’ retirement.

- Different retirement plans have varying tax benefits, contribution limits, and employer matches, which should be considered when choosing a plan.

- Individual retirement plans like Traditional IRA and Roth IRA provide tax advantages, but have contribution restrictions and penalties for early withdrawals.

- It’s possible to have multiple retirement plans, including different types and accounts of the same type, but there are limitations on tax benefits based on the IRS regulations.

Types of Retirement Accounts

There are several different types of retirement plans, including some traditional plan types as well as non-traditional options.

Traditional retirement plans can be IRAs or 401(k)s. These tax-deferred retirement plans allow you to contribute pre-tax dollars to an account. With a traditional IRA or 401(k), you only pay taxes on your investments when you withdraw from the account.

Non-traditional retirement accounts can include Roth 401(k)s and IRAs, for which you pay taxes on funds before contributing them to the account.

Here’s information about some of the most common retirement plan types.

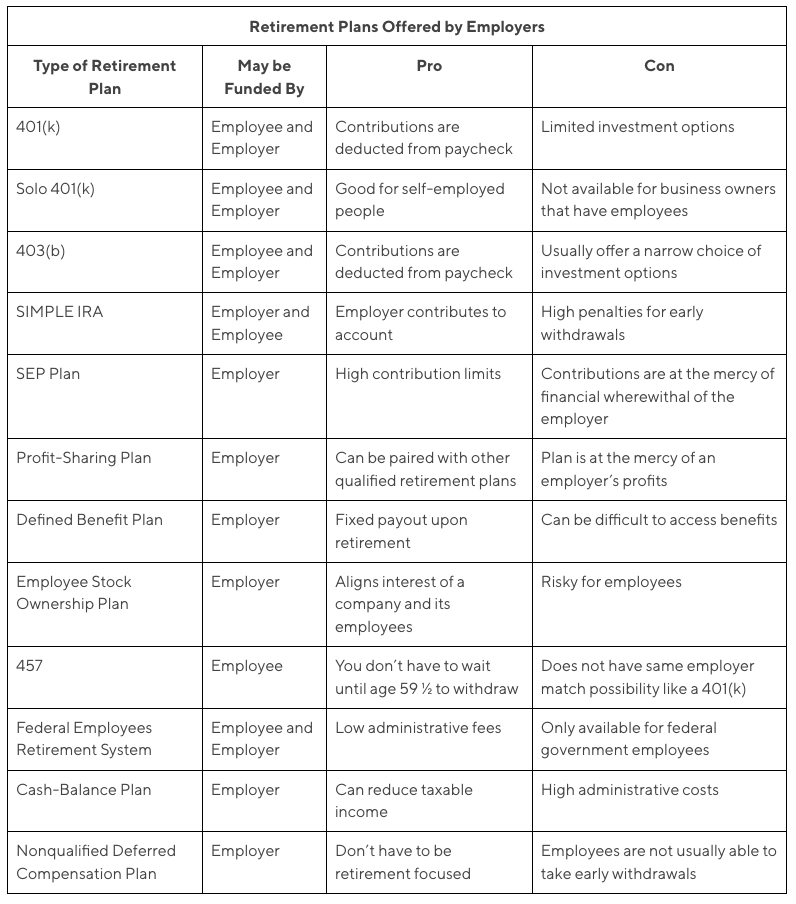

![]()

SoFi

Retirement Plans Offered by Employers

List of types of retirement plans.

There are typically two types of retirement plans offered by employers:

- Defined contribution plans (more common): The employee invests a portion of their paycheck into a retirement account. Sometimes, the employer will match up to a certain amount (e.g. up to 5%). In retirement, the employee has access to the funds they’ve invested. 401(k)s and Roth 401(k)s are examples of defined contribution plans.

- Defined benefit plans (less common): The employer invests money for retirement on behalf of the employee. Upon retirement, the employee receives a regular payment, which is typically calculated based on factors like the employee’s final or average salary, age, and length of service. As long as they meet the plan’s eligibility requirements, they will receive this fixed benefit (e.g. $100 per month). Pension plans and cash balance accounts are common examples of defined benefit plans.

Here are the specific types of plans employers usually offer.

401(k) Plans

A 401(k) plan is a type of work retirement plan offered to the employees of a company. Traditional 401(k)s allow employees to contribute pre-tax dollars, where Roth 401(k)s allow after-tax contributions.

- Income taxes: If you choose to make a pre-tax contribution, your contributions may reduce your taxable income. Additionally, the money will grow tax-deferred and you will pay taxes on the withdrawals in retirement. Some employers allow you to make after-tax or Roth contributions to a 401(k). You should check with your employer to see if those are options.

- Contribution limit: $22,500 in 2023 and $23,000 in 2024 for the employee; people 50 and older can contribute an additional $7,500.

- Pros: Money is deducted from your paycheck, automating the process of saving. Some companies offer a company match. There is a significantly higher limit than with Traditional IRA and Roth IRA accounts.

- Cons: With a 401(k) plan, you are largely at the mercy of your employer—there’s no guarantee they will pick plans that you feel are right for you or are cost-effective for what they offer. Also, the value of a 401(k) comes from two things: the pre-tax contributions and the employer match. If your employer doesn’t match, a 401(k) may not be as valuable to an investor. There are also penalties for early withdrawals before age 59 ½, although there are some exceptions, including for certain public employees.

- Usually best for: Someone who works for a company that offers one, especially if the employer provides a matching contribution. A 401(k) retirement plan can also be especially useful for people who want to put retirement savings on autopilot.

- To consider: Sometimes 401(k) plans have account maintenance or other fees. Because a 401(k) plan is set up by your employer, investors only get to choose from the investment options they provide.

403(b) Plans

A 403(b) retirement plan is like a 401(k) for certain individuals employed by public schools, churches, and other tax-exempt organizations. Like a 401(k), there are both traditional and Roth 403(b) plans. However, not all employees may be able to access a Roth 403(b).

- Income taxes: With a traditional 403(b) plan, you contribute pre-tax money into the account; the money will grow tax-deferred and you will pay taxes on the withdrawals in retirement. Additionally, some employers allow you to make after-tax or Roth contributions to a 403(b); the money will grow tax-deferred and you will not have to pay taxes on withdrawals in retirement. You should check with your employer to see if those are options.

- Contribution limit: $22,500 in 2023 and $23,000 in 2024 for the employee; people 50 and older can contribute an additional $7,500 in both of those years. The maximum combined amount both the employer and the employee can contribute annually to the plan is generally the lesser of $66,000 in 2023 and $69,000 in 2024, or the employee’s most recent annual salary.

- Pros: Money is deducted from your paycheck, automating the process of saving. Some companies offer a company match. Also, these plans often come with lower administrative costs because they aren’t subject to Employee Retirement Income Security Act, or ERISA, oversight.

- Cons: A 403(b) account generally lacks the same protection from creditors as plans with ERISA compliance.

- To consider: 403(b) plans offer a narrow choice of investments compared to other retirement savings plans. The IRS states these plans can only offer annuities provided through an insurance company and a custodial account invested in mutual funds.

Solo 401(k) Plans

A Solo 401(k) plan is essentially a 1-person 401(k) plan for self-employed individuals or business owners with no employees, in which you are the employer and the employee. Solo 401(k) plans may also be called a Solo-k, Uni-k, or One-participant k.

- Income taxes: The contributions made to the plan are tax-deductible.

- Contribution limit: $22,500 in 2023 and $23,000 in 2024, or 100% of your earned income, whichever is lower, plus “employer” contributions of up to 25% of your compensation from the business. The 2023 total cannot exceed $66,000, and the 2024 total cannot exceed $69,000. (On top of that, people 50 and older are allowed to contribute an additional $7,500 in 2023 and 2024.)

- Pros: A solo 401(k) retirement plan allows for large amounts of money to be invested with pre-tax dollars. It provides some of the benefits of a traditional 401(k) for those who don’t have access to a traditional employer-sponsored 401(k) retirement account.

- Cons: You can’t open a solo 401(k) if you have any employees (though you can hire your spouse so they can also contribute to the plan as an employee—and you can match their contributions as the employer).

- Usually best for: Self-employed people with enough income and a large enough business to fully use the plan.

SIMPLE IRA Plans (Savings Incentive Match Plans for Employees)

A SIMPLE IRA plan is set up by an employer, who is required to contribute on employees’ behalf, although employees are not required to contribute.

- Income taxes: Employee contributions are made with pre-tax dollars. Additionally, the money will grow tax-deferred and employees will pay taxes on the withdrawals in retirement.

- Contribution limit: $15,500 in 2023 and $16,000 in 2024. Employees aged 50 and over can contribute an extra $3,500 in 2023 and in 2024, bringing their total to $19,000 in 2023 and $19,500 in 2024.

- Pros: Employers contribute to eligible employees’ retirement accounts at 2% their salaries, whether or not the employees contribute themselves. For employees who do contribute, the company will match up to 3%.

- Cons: The contribution limits for employees are lower than in a 401(k) and the penalties for early withdrawals—up to 25% for withdrawals within two years of your first contribution to the plan—before age 59 ½ may be higher.

- To consider: Only employers with less than 100 employees are allowed to participate.

SEP Plans (Simplified Employee Pension)

This is a retirement account established by a small business owner or self-employed person for themselves (and if applicable, any employees).

- Income taxes: Your contributions will reduce your taxable income. Additionally, the money will grow tax-deferred and you will pay taxes on withdrawals in retirement.

- Contribution limit: For 2023, whichever is lower: $66,000 or 25% of earned income; for 2024, $69,000 or 25% of earned income, whichever is lower.

- Pros: Higher contribution limit than IRA and Roth IRAs, and contributions are tax-deductible for the business owner.

- Cons: These plans are employer contribution only and greatly rely on the financial wherewithal and available cash of the business itself.

- Usually best for: Self-employed people and small business owners who wish to contribute to an IRA for themselves and/or their employees.

- To consider: Because you’re setting up a retirement plan for a business, there’s more paperwork and unique rules. When opening an employer-sponsored retirement plan, it generally helps to consult a tax advisor.

Profit-Sharing Plans (PSPs)

A profit-sharing plan is a retirement plan funded by discretionary employer contributions that gives employees a share in the profits of a company.

- Income taxes: Deferred; assessed on distributions from the account in retirement.

- Contribution limit: The lesser of 25% of the employee’s compensation or $66,000 in 2023. (On top of that, people 50 and older are allowed to contribute an additional $7,500 in 2023.) In 2024, the contribution limit is $69,000 or 25% of the employee’s compensation, whichever is less. Those 50 and up can contribute an extra $7,500 in 2024.

- Pros: An employee receives a percentage of a company’s profits based on its earnings. Companies can set these up in addition to other qualified retirement plans, and make contributions on a completely voluntary basis.

- Cons: These plans put employees at the mercy of their employers’ profits, unlike retirement plans that allow employees to invest in securities issued by other companies.

- Usually best for: Companies who want the flexibility to contribute to a PSP on an ad hoc basis.

- To consider: Early withdrawal from the plan is subject to penalty.

Defined Benefit Plans (Pension Plans)

These plans, more commonly known as pension plans, are retirement plans provided by the employer where an employee’s retirement benefits are calculated using a formula that factors in age, salary, and length of employment.

- Income taxes: Deferred; assessed on distributions from the plan in retirement.

- Contribution limit: Determined by an enrolled actuary and the employer.

- Pros: Provides tax benefits to both the employer and employee and provides a fixed payout upon retirement that many retirees find desirable.

- Cons: These plans are increasingly rare, but for those who do have them, issues can include difficulty realizing or accessing benefits if you don’t work at a company for long enough.

- Usually best for: Companies that want to provide their employees with a “defined” or pre-determined benefit in their retirement years.

- To consider: These plans are becoming less popular because they cost an employer significantly more in upkeep than a defined contribution plan such as a 401(k) program.

Employee Stock Ownership Plans (ESOPs)

An employee stock ownership plan is a qualified defined contribution plan that invests in the stock of the sponsoring employer.

- Income taxes: Deferred. When an employee leaves a company or retires, they receive the fair market value for the stock they own. They can either take a taxable distribution or roll the money into an IRA.

- Contribution limit: Allocations are made by the employer, usually on the basis of relative pay. There is typically a vesting schedule where employees gain access to shares in one to six years.

- Pros: Could provide tax advantages to the employee. ESOP plans also align the interests of a company and its employees.

- Cons: These plans concentrate risk for employees: An employee already risks losing their job if an employer is doing poorly financially. By making some of their compensation employee stock, that risk is magnified. In contrast, other retirement plans allow an employee to invest in stocks in other securities that are not tied to the financial performance of their employer.

457(b) Plans

A 457(b) retirement plan is an employer-sponsored deferred compensation plan for employees of state and local government agencies and some tax-exempt organizations.

- Income taxes: If you choose to make a pre-tax contribution, your contributions will reduce your taxable income. Additionally, the money will grow tax-deferred and you will pay taxes on the withdrawals in retirement. Some employers also allow you to make after-tax or Roth contributions to a 401(k).

- Contribution limit: The lesser of 100% of employee’s compensation or $22,500 in 2023 and $23,000 in 2024; some plans allow for “catch-up” contributions.

- Pros: Plan participants can withdraw as soon as they are retired at any age, they do not have to wait until age 59 ½ as with 401(k) and 403(b) plans.

- Cons: 457 plans do not have the same kind of employer match as a 401(k) plan. While employers can contribute to the plan, it’s only up to the combined limit for individual contributions.

- Usually best for: Employees of governmental agencies.

Federal Employees Retirement System (FERS)

The Federal Employees Retirement System, or FERS, consists of three government-sponsored retirement plans: Social Security, the Basic Benefit Plan, and the Thrift Savings Plan.

The Basic Benefit Plan is an employer-provided pension plan, while the Thrift Savings Plan is most comparable to what private-sector employees can receive.

- Income taxes: Contributions to the Thrift Savings Plan are made before taxes and grow tax-free until withdrawal in retirement.

- Contribution limit: The contribution limit for employees is $22,500 in 2023, and the combined limit for all contributions, including from the employer agency, is $66,000. In 2024, the employee contribution limit is $23,000, and the combined limit for all contributions, including those from the employer, is $69,000. Also, those 50 and over are eligible to make an additional $7,500 in “catch-up” contributions in both 2023 and 2024.

- Pros: These government-sponsored plans are renowned for their low administrative fees and employer matches.

- Cons: Only available for federal government employees.

- Usually best for: Federal government employees who will work at their agencies for a long period; it is comparable to 401(k) plans in the private sector.

Cash-Balance Plans

This is another type of pension plan that combines features of defined benefit and defined contribution plans. They are sometimes offered by employers that previously had defined benefit plans. The plans provide an employee an “employer contribution equal to a percent of each year’s earnings and a rate of return on that contribution.”

- Income taxes: Contributions come out of pre-tax income, similar to 401(k).

- Contribution limit: The plans combine a “pay credit” based on an employee’s salary and an “interest credit” that’s a certain percentage rate; the employee then gets an account balance worth of benefits upon retirement that can be paid out as an annuity (payments for life) or a lump sum. Limits depend on age, but for those over 60, they can be more than $250,000.

- Pros: Can reduce taxable income.

- Cons: Cash-balance plans have high administrative costs.

- Usually best for: High earners and business owners with consistent income.

Nonqualified Deferred Compensation Plans (NQDC)

These are plans typically designed for executives at companies who have maxed out other retirement plans. The plans defer payments—and the taxes—you would otherwise receive as salary to a later date.

- Income taxes: Income taxes are deferred until you receive the payments at the agreed-upon date.

- Contribution limit: None

- Pros: The plans don’t have to be entirely geared around retirement. While you can set dates with some flexibility, they are fixed.

- Cons: Employees are not usually able to take early withdrawals.

- Usually best for: Highly-paid employees for whom typical retirement plans would not provide enough savings compared to their income.

Multiple Employer Plans

A multiple employer plan, or MEP, is a retirement savings plan offered to employees by two or more unrelated employers. It is designed to encourage smaller businesses to share the administrative burden of offering a tax-advantaged retirement savings plan to their employees.

These employers pool their resources together to offer a defined benefit or defined contribution plan for their employees.

Administrative and fiduciary responsibilities of the MEP are performed by a third party (known as the MEP Sponsor), which may be a trade group or an organization that specializes in human resources management.

Compare Types of Retirement Accounts Offered by Employers

To recap retirement plans offered by employers:

SoFi

Retirement Plans Not Offered by Employers

A table comparing different retirement plans offered by employers.

Traditional Individual Retirement Accounts (IRAs)

Traditional individual retirement accounts (IRAs) are managed by the individual policyholder.

With an IRA, you open and fund the IRA yourself. As the name suggests, it is a retirement plan for individuals. This is not a plan you join through an employer.

- Income taxes: You may receive an income tax deduction on contributions (depending on your income and access to another retirement plan through work). The balance in the IRA will always grow tax-deferred, and withdrawals will be taxed (the amount will vary depending on whether contributions were deductible or non-deductible).

- Contribution limit: $6,500 in 2023, or $7,500 for people age 50 or over. In 2024, the contribution limit is $7,000, or $8,000 for people 50 and older.

- Pros: You might be able to lower your tax bill if you’re eligible to make deductible contributions. Additionally, the money will grow tax-deferred, which can make a difference over a long period of time. Finally, there are no income limits for contributing to a traditional IRA.

- Cons: Traditional IRAs come with a number of restrictions, including how much can be contributed and when you can start withdrawals without penalty. Traditional IRAs are also essentially a bet on the tax rate you will be paying when you begin withdrawals after age 59 ½, as the accounts grow tax-deferred but are taxed upon withdrawal. Also, traditional IRAs generally mandate withdrawals starting at age 73.

- Usually best for: People who can make deductible contributions and want to lower their tax bill, or individuals who earn too much money to contribute directly to a Roth IRA. Higher-income earners might not get to deduct contributions from their taxes now, but they can take advantage of tax-deferred growth between now and retirement. An IRA can also be used for consolidating and rolling over 401(k) accounts from previous jobs.

- To consider: You may be subject to a 10% penalty for withdrawing funds before age 59 ½. As a single filer, you cannot deduct IRA contributions if you’re already covered by a retirement account through your work and earn more (according to your modified gross adjusted income) than $83,000 in 2023 (with a phase-out beginning at $73,000 in 2023) and more than $87,000 in 2024, with a phase-out starting at $77,000.

Roth IRAs

A Roth IRA is another retirement plan for individuals that is managed by the account holder, not an employer.

- Income taxes: Roth IRA contributions are made with after-tax money, which means you won’t receive an income tax deduction for contributions. But your balance will grow tax-free and you’ll be able to withdraw the money tax-free in retirement.

- Contribution limit: $6,500 in 2023, or $7,500 for people age 50 or over. In 2024, the contribution limit is $7,000, or $8,000 for those 50 and up.

- Pros: While contributing to a Roth IRA won’t lower your tax bill now, having the money grow tax-free and being able to withdraw the money tax-free down the road provides value in the future.

- Cons: Like a traditional IRA, a Roth IRA has tight contribution restrictions. Unlike a traditional IRA, it does not offer tax deductions for contributions. As with a traditional IRA, there’s a penalty for taking some kinds of distributions before age 59 ½.

- Usually best for: Someone who wants to take advantage of the flexibility to withdraw from an account during retirement without paying taxes. Additionally, it can be especially beneficial for people who are currently in a low income-tax bracket and expect to be in a higher income tax bracket in the future.

- To consider: To contribute to a Roth IRA, you must have an earned income. Your ability to contribute begins to phase out when your income as a single filer (specifically, your modified adjusted gross income) reaches $138,000 in 2023 and $146,000 in 2024. As a joint filer, your ability to contribute to a Roth IRA phases out at $218,000 in 2023 and at $230,000 in 2024.

Payroll Deduction IRAs

This is either a traditional or Roth IRA that is funded through payroll deductions.

- Income taxes: For a Traditional IRA, you may receive an income tax deduction on contributions (depending on income and access to a retirement plan through work); the balance in the IRA will always grow tax-deferred, and withdrawals will be taxed (how much is taxed depends on if you made deductible or non-deductible contributions). For a Roth IRA, contributions are made with after-tax money, your balance will grow tax-free and you’ll be able to withdraw the money tax-free in retirement.

- Contribution limit: $6,500 in 2023, or $7,500 for people age 50 or over. In 2024, the limit is $7,000, or $8,000 for those 50 and older.

- Pros: Automatically deposits money from your paycheck into a retirement account.

- Cons: The employee must do the work of setting up a plan, and employers can not contribute to it as with a 401(k). Participants cannot borrow against the retirement plan or use it as collateral for loans.

- Usually best for: People who do not have access to another retirement plan through their employer.

- To consider: These have the same rules as a Traditional IRA, such as a 10% penalty for withdrawing funds before age 59 ½. Only employees can contribute to a Payroll Deduction IRA.

Guaranteed Income Annuities (GIAs)

Guaranteed income annuities are products sold by insurance companies. They are similar to the increasingly rare defined benefit pensions in that they have a fixed payout that will last until the end of life. These products are generally available to people who are already eligible to receive payouts from their retirement plans.

- Income taxes: If the annuity is funded by 401(k) benefits, then it is taxed like income. Annuities purchased with Roth IRAs, however, have a different tax structure. For “non-qualified annuities,” i.e. annuities purchased with after-tax income, a formula is used to determine the taxes so that the earnings and principal can be separated out.

- Contribution limit: Annuities do not have contribution limits.

- Pros: These allow for payouts until the end of life and are fixed, meaning they’re not dependent on market performance.

- Cons: Annuities are expensive; to buy an annuity, you’ll likely pay a high commission to a financial advisor or insurance salesperson.

- Usually best for: People who have high levels of savings and can afford to make expensive initial payments on annuities.

Cash-Value Life Insurance Plan

Cash-value life insurance covers the policyholder’s entire life and has tax-deferred savings, making it comparable to other retirement plans. Some of the premium paid every month goes to this investment product, which grows over time.

- Income taxes: Taxes are deferred until the policy is withdrawn from, at which point withdrawals are taxed at the policyholder’s current income tax rate.

- Contribution limit: The plan is drawn up with an insurance company with set premiums.

- Pros: These plans have a tax-deferring feature and can be borrowed from.

- Cons: While you may be able to withdraw money from the plan, this will reduce your death benefit.

- Usually best for: High earners who have maxed out other retirement plans.

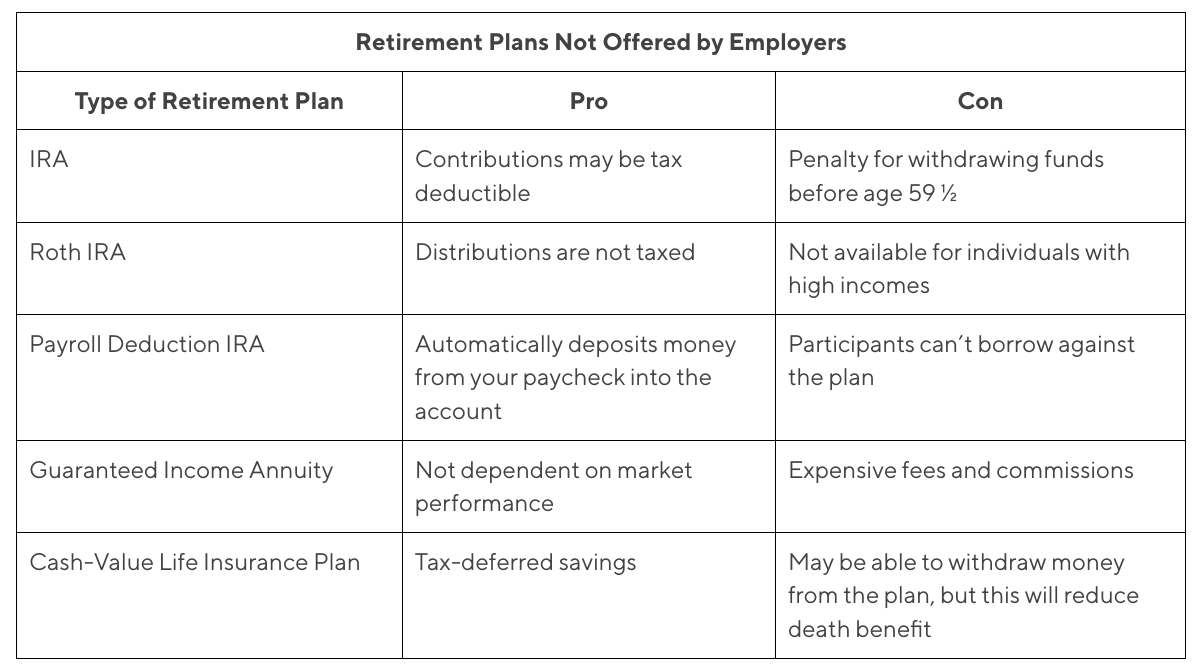

Compare Types of Retirement Accounts Not Offered by Employers

To recap retirement plans not offered by employers:

SoFi

Specific Benefits to Consider

A table comparing different retirement plans not offered by employers.

As you’re considering the different types of retirement plans, it’s important to look at some key benefits of each plan. These include:

- The tax advantage

- Contribution limits

- Whether an employer will add funds to the account

- Any fees associated with the account

Determining Which Type of Retirement Plan Is Best for You

Depending on your employment circumstances, there are many possible retirement plans in which you can invest money for retirement. Some are offered by employers, while other retirement plans can be set up by an individual.

Likewise, the benefits for each of the available retirement plans differ. Here are some specific benefits and disadvantages of a few different plans to consider.

With employer-offered plans like a 401(k) and 403(b), you have the ability to:

Take them with you. If you leave your job, you can roll these plans over into a plan with a new employer or an IRA.

Possibly earn a higher return. With these plans, you typically have more investment choices, including stock funds.

With retirement plans not offered by employers, like a SEP IRA, you may get:

A wider variety of investment options. You could have even more options to choose from with these plans, including those that may offer higher returns.

You may be able to contribute more. The contribution limits for some of these plans tend to be higher.

Despite their differences, the many different types of retirement accounts all share one positive attribute: utilizing and investing in them is an important step in saving for retirement.

Because there are so many retirement plans to choose from, it may be wise to talk to a financial professional to help you decide your financial plan.

Can You Have Multiple Types of Retirement Plans?

You can have multiple retirement savings plans, whether employer-provided plans like a 401(k), IRAs, or annuities. Having various plans can let you take advantage of the specific benefits that different retirement savings plans offer, thus potentially increasing your total retirement savings.

Additionally, you can have multiple retirement accounts of the same type; you may have a 401(k) at your current job while also maintaining a 401(k) from your previous employer.

Nonetheless, there are limitations on the tax benefits you may be allowed to receive from these multiple retirement plans. For example, the IRS does not allow individuals to take a tax deduction for traditional IRA contributions if they also have an employer-sponsored 401(k).

FAQ

Why is it important to understand the different types of retirement plans?

Understanding the different types of retirement plans is important because of the nuances of taxation in these accounts. The various rules imposed by the Internal Revenue Service, or IRS, can affect your contributions, earnings, and withdrawals. And not only does the IRS have rules around taxation, but also about contribution limits and when you can withdraw money without penalties.

Additionally, the various types of retirement plans differ regarding who establishes and uses each account and the other plan rules. Ultimately, understanding these differences will help you determine which combination of retirement plans is best for you.

How can you determine which type of retirement plan is best for you?

The best type of retirement plan for you is the one that best meets your needs. Many types of retirement plans are available, and each has its own benefits and drawbacks. When choosing a retirement plan, some factors to consider include your age, investing time horizon, financial goals, risk tolerance, and the fees associated with a retirement plan.

This story was produced by SoFi and reviewed and distributed by Stacker.