Trump’s tariffs are driving a wedge through the US economy, further separating the haves from the have-nots

By Alicia Wallace, CNN

(CNN) — Americans ramped up their spending in August; however, their costs of living were on the rise as food and other goods became even more expensive last month and services prices remained stubbornly high.

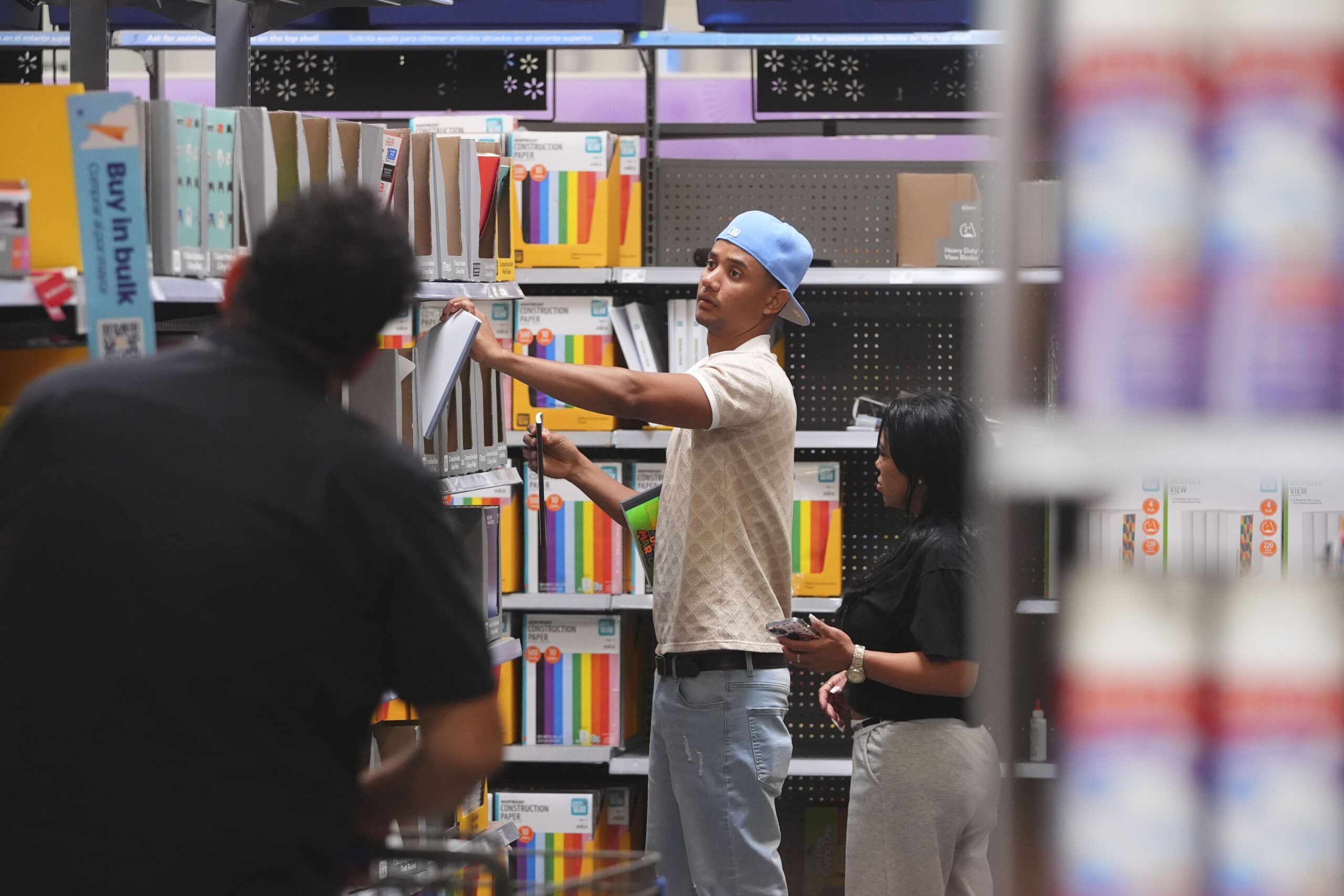

New economic data released Friday showed that consumer spending rose 0.6% in the key back-to-school shopping month of August, and 0.4% when adjusting for inflation. That’s further indication that a critical driver of the US economy continues to chug along despite broader uncertainty and a slowdown in the labor market.

However, that spending is increasingly being focused on essential purchases, such as health care, at a time when income gains aren’t keeping up.

At the same time, some prices — including those exposed to steep tariffs imposed by President Donald Trump — are rising faster than they have in months, according to Commerce Department data released Friday.

“Not all households are weathering the tariff storm equally,” EY-Parthenon economist Greg Daco wrote in a note to investors on Friday, adding that aggregate consumer spending “gives the appearance of broad-based consumer resilience, but a silent majority is increasingly feeling the strain of higher grocery, furniture, auto, and services prices.”

The Personal Consumption Expenditures price index — the inflation gauge the Federal Reserve uses for its 2% target rate — rose 0.3% on a monthly basis (versus a 0.2% increase in July), which lifted the annual rate to 2.7% from 2.6%, and hitting a six-month high.

Energy and gas prices rose in August, and that was a big driver of the monthly increase; however, food prices shot higher as well. Those were up 0.5%, the highest monthly gain since March, and are now up 2.2% from last year.

When excluding food and energy, categories that can be quite volatile, a closely watched gauge of underlying inflation held steady in August. The core PCE price index rose 0.2% in August, the same pace as July, and was unchanged at 2.9%.

Friday’s data showed that inflation remains well above the Fed’s 2% target.

“Inflation dynamics inside the August PCE report illustrated stubborn service sector inflation that increased from 3.5% to 3.6%, while one can clearly observe rising good prices inside the index with a year ago increase of 13.9% in beef and veal costs along with a 7% increase in household utility costs as well as a 6.2% increase in the cost of electricity all on a year ago basis,” Joe Brusuelas, chief economist at RSM US, wrote in a note Friday.

Economists were expecting inflation to rise 0.3% from July and to increase to 2.7% annually.

Stocks moved higher on the news. The Dow rose by 200 points, or 0.44%. The S&P 500 gained 0.2% and the Nasdaq Composite rose 0.03%.

A ‘K-shaped economy’ at play

For the August spending spree, Americans appeared to dip into their savings. Friday’s report showed that the saving rate dropped to 4.6% from 4.8% in July.

Part of that was because spending gains outpaced income growth for the month. Personal income was up 0.4% and just 0.1%, when accounting for inflation.

On an annual basis, inflation-adjusted (or “real”) after-tax personal income is growing 1.9% while real spending is up 2.7%, Commerce Department data shows. Pre-Covid, in September 2019, real disposable income was growing at a 3% tick, Commerce Department data shows.

Still, although the spending trajectory appears strong on the aggregate, the US economy is being increasingly powered by the few: Through the second quarter of this year, the top 20% of earners accounted for roughly half of all spending, Moody’s Analytics data has shown.

“While we are encouraged by the 0.4% increase in income growth, the fact that Americans had to draw down savings to support the current pace of spending is a not-so-friendly remainder that the pace of spending is likely driven by upper-end households while lower-income cohorts remain stressed,” Brusuelas wrote.

The latest sentiment data from the University of Michigan, also released Friday, showed that Americans’ feelings about the economy remain near a record low.

“You have to go back to the Great Recession to see economic vibes this bad,” Elizabeth Renter, senior economist at NerdWallet, wrote Friday. “Notable this month, the decline in sentiment was felt across demographics — people of most backgrounds are feeling more sour on the current and future economy.”

One exception: people with large stock holdings.

“Wealth provides some insulation from perceived economic volatility, and investors have been largely doing OK,” she added.

This “K-shaped” environment, economists warn, makes the US economy increasingly vulnerable to shocks.

Discretionary spending is shrinking

Another potential red flag for the economy is an ongoing shift in the composition of consumer spending.

Recent months’ data and company earnings reports show that Americans are putting an increasing share of their dollars toward essential areas — particularly health care, housing and insurance — as they pull back on other spending, said Adam Josephson, a longtime paper and packaging analyst who publishes a newsletter on consumer spending and other economic trends.

As of August, spending on health care accounted for nearly 23% of all consumer spending, Josephson told CNN. And almost half of health care spending is coming from the Medicare and Medicaid side, he added.

“As more of people’s wallets go toward mandatory items, the less money they have to spend on discretionary items,” he said in an interview.

And when discretionary spending falters, that could spell trouble for the broader economy.

“You’ve been seeing it for the past year among all manner of consumer companies, whether it’s [consumer packaged goods] companies, retailers, restaurants, airlines, hotels, you name it, any company that sells something that could reasonably be considered discretionary seems to be having a problem,” he said. “If these companies that sell to the consumer economy are experiencing growing difficulties, what are they likely to do? They’re likely to contract, cut costs, which means lay people off, shut facilities.”

Josephson pointed to Starbucks as a prime example.

The nation’s largest coffee chain announced plans Thursday to close 400 underperforming shops nationwide. Although the closures account for barely 1% of Starbucks’ footprint, the cost-cutting includes the layoffs of roughly 900 employees.

The-CNN-Wire

™ & © 2025 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.