Where people are using the most FHA loans

Trong Nguyen // Shutterstock

Where people are using the most FHA loans

A row of residential two-storey houses in suburban Atlanta, Georgia.

A Federal Housing Administration mortgage loan is designed for first-time homebuyers who may need less stringent requirements to qualify, and is often available with down payments as low as 3.5%. However, these loans usually require an additional property inspection and can be seen by sellers as less competitive when compared with conventional loans or cash offers. So higher frequencies of FHA loans may indicate there is less competition in a given market. And these homeowners may also be more likely to have fewer assets in the bank and lower starting equity.

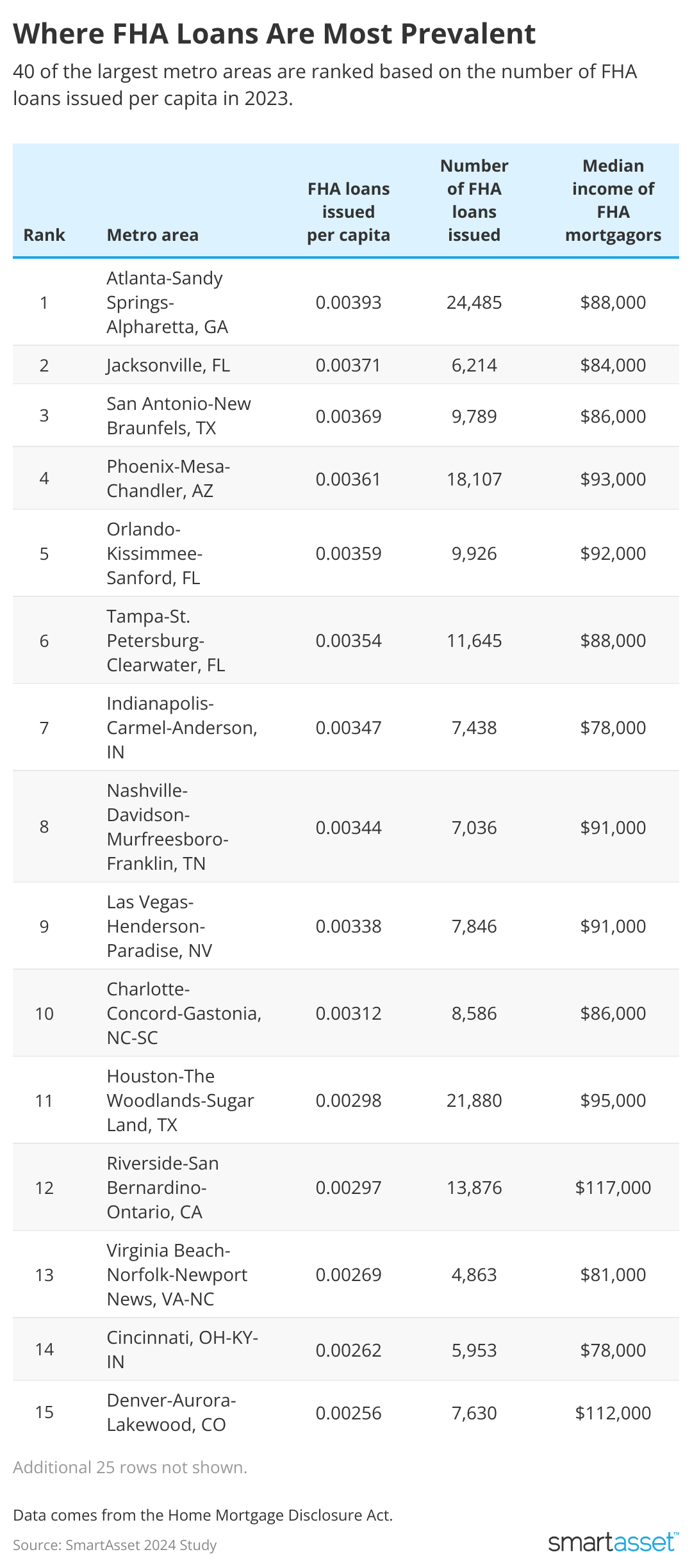

Keeping this in mind, SmartAsset ranked 40 of the largest U.S. metro areas by the number of FHA loans issued in 2023 relative to the local population. The interest rates, property value, and incomes of new homeowners were also taken into account.

Key Findings

- Most FHA loans are being issued in Atlanta, GA. The Atlanta-Sandy Springs-Alpharetta metro area has the highest rate of FHA loans being issued relative to the population, at 0.0039 per capita. Additionally, the highest raw number of FHA loans is being issued here: 24,485 in 2023 alone. The median home value for these new homeowners is $335,000—which happens to be the median across all new FHA homeowners studywide.

- People earning less than the median income are using FHA loans to buy homes in these areas. The median household income in the U.S. is hovering around $75,000. In five metro areas, people are using FHA loans to help compensate for their lower-than-average income. These include St. Louis ($75,000 annual income for new FHA homeowners); Pittsburgh ($73,000); Cleveland ($70,000); Philadelphia ($69,000); and Detroit ($64,000). These metro areas also have the lowest median home values for new FHA owners.

- FHA loans issued in Texas metros are getting the best interest rates. The San Antonio and Austin metros have the lowest median interest rate for new FHA homeowners studywide at 5.99%. The Houston and Dallas metros each have a median interest rate of 6.25% for the same. Across all 40 metro areas, the median interest rate is 6.5%, with the highest being 6.82% in the San Francisco metro.

![]()

SmartAsset

Top 10 Metro Areas With the Highest Rate of FHA Loans Being Issued

Table showing where FHA loans are most prevalent.

- Atlanta-Sandy Springs-Alpharetta, GA

- FHA loans issued per capita: 0.00393

- Number of FHA loans issued in 2023: 24,485

- Median interest rate: 6.38%

- Median property value: $335,000

- Median income: $88,000

- Population: 6,222,908

- Jacksonville, FL

- FHA loans issued per capita: 0.00371

- Number of FHA loans issued in 2023: 6,214

- Median interest rate: 6.25%

- Median property value: $315,000

- Median income: $84,000

- Population: 1,675,668

- San Antonio-New Braunfels, TX

- FHA loans issued per capita: 0.00369

- Number of FHA loans issued in 2023: 9,789

- Median interest rate: 5.99%

- Median property value: $275,000

- Median income: $86,000

- Population: 2,655,342

- Phoenix-Mesa-Chandler, AZ

- FHA loans issued per capita: 0.00361

- Number of FHA loans issued in 2023: 18,107

- Median interest rate: 6.25%

- Median property value: $385,000

- Median income: $93,000

- Population: 5,015,678

- Orlando-Kissimmee-Sanford, FL

- FHA loans issued per capita: 0.00359

- Number of FHA loans issued in 2023: 9,926

- Median interest rate: 6.25%

- Median property value: $365,000

- Median income: $92,000

- Population: 2,764,182

- Tampa-St. Petersburg-Clearwater, FL

- FHA loans issued per capita: 0.00354

- Number of FHA loans issued in 2023: 11,645

- Median interest rate: 6.37%

- Median property value: $335,000

- Median income: $88,000

- Population: 3,290,730

- Indianapolis-Carmel-Anderson, IN

- FHA loans issued per capita: 0.00347

- Number of FHA loans issued in 2023: 7,438

- Median interest rate: 6.63%

- Median property value: $255,000

- Median income: $78,000

- Population: 2,142,193

- Nashville-Davidson-Murfreesboro-Franklin, TN

- FHA loans issued per capita: 0.00344

- Number of FHA loans issued in 2023: 7,036

- Median interest rate: 6.25%

- Median property value: $365,000

- Median income: $91,000

- Population: 2,046,715

- Las Vegas-Henderson-Paradise, NV

- FHA loans issued per capita: 0.00338

- Number of FHA loans issued in 2023: 7,846

- Median interest rate: 6.25%

- Median property value: $385,000

- Median income: $91,000

- Population: 2,322,985

- Charlotte-Concord-Gastonia, NC-SC

- FHA loans issued per capita: 0.00312

- Number of FHA loans issued in 2023: 8,586

- Median interest rate: 6.25%

- Median property value: $335,000

- Median income: $86,000

- Population: 2,756,069

Data and Methodology

To find people who are using FHA loans to buy homes at the highest rates, SmartAsset reviewed Home Mortgage Disclosure Act data for 2023. Specifically, the number of originated FHA loans was considered, relative to the size of the local population in the same metro area, according to 2022 Census Bureau data. The median income of associated new homeowners, as well as subject property value and interest rates, were also considered.

This story was produced by SmartAsset and reviewed and distributed by Stacker Media.