How much employees actually pay for health care plans

Tyler Olson // Shutterstock

How much employees actually pay for health care plans

A nurse preparing a patient for a CT scan in a hospital room

American employer health care costs are expected to rise by 6.5% in 2023. More than half of employers have said they expect to be over budget and are switching their vendors, according to survey data from Willis Towers Watson. The survey also found that about a quarter of employers expect to pass costs on to employees via higher premiums.

Sana collected data from the Agency for Healthcare Research and Quality’s Medical Expenditure Panel Survey Insurance Component to understand how employee contributions to company-sponsored health plans have changed over the last 20 years. Data was collected in 2021 from a survey of private-sector employers to understand the types and costs of insurance benefits offered.

In the first year of COVID-19, the number of medical claims was artificially suppressed due to hospital policies and quarantines. Medical claims have rebounded since, mixing with inflation to increase employers’ cost pressures, which are only expected to grow in the coming year.

While the number of working adults with employment-based health insurance slumped during the first year of the pandemic, private coverage—not public—represented the largest share (66%) of coverage for working-age adults in 2021, according to Census data. That year, nearly 159 million people were covered by employer-sponsored insurance, representing approximately 48% of the country’s population.

In 2022, 13% of employees who had single-coverage health insurance had their premium payments fully paid by their company. For family coverage, 5% of employees were fully covered by their employers, according to the Kaiser Family Foundation.

Keep reading to discover how much employees actually pay for their health care plans.

![]()

Sana

Employee contributions for health insurance have more than tripled in 20 years

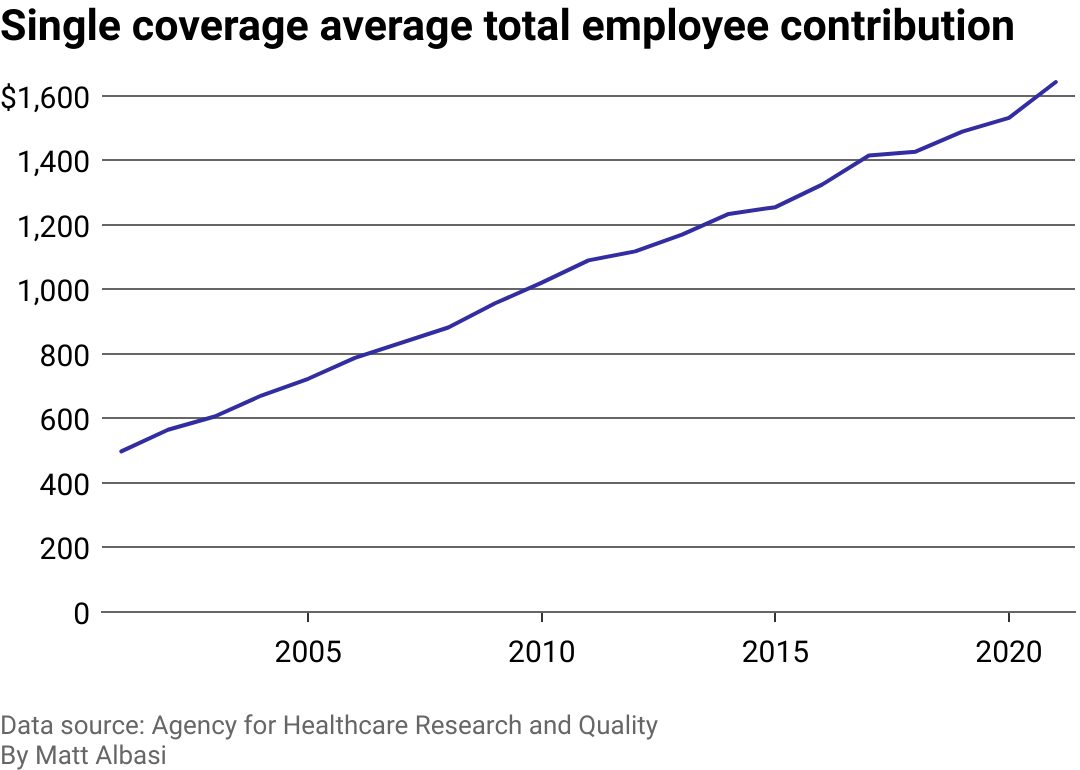

A line chart showing the average employee contribution for a single employee’s health care from 2001 until 2021. The line is increasing constantly.

Single coverage is a health insurance plan option covering the individual employee only. The average total employee contribution in the last 20 years nearly quadrupled to cover individual employees. Affordability is therefore a significant concern for employers and employees, as health insurance premiums have risen twice as fast than average income or wages since 2008. Meanwhile, deductibles have grown eight times faster than wages in the same period.

Experts project that in 2023, two key factors will influence employer premiums: market inflation and utilization rates. It’s important to note that payer-provider contracts often are signed for multiple years, so while rising inflation may not have an immediate impact on costs through the contract, it can be an important factor when companies evaluate renewals—or new providers.

Sana

Employee-plus-one plans increased by more than 290%

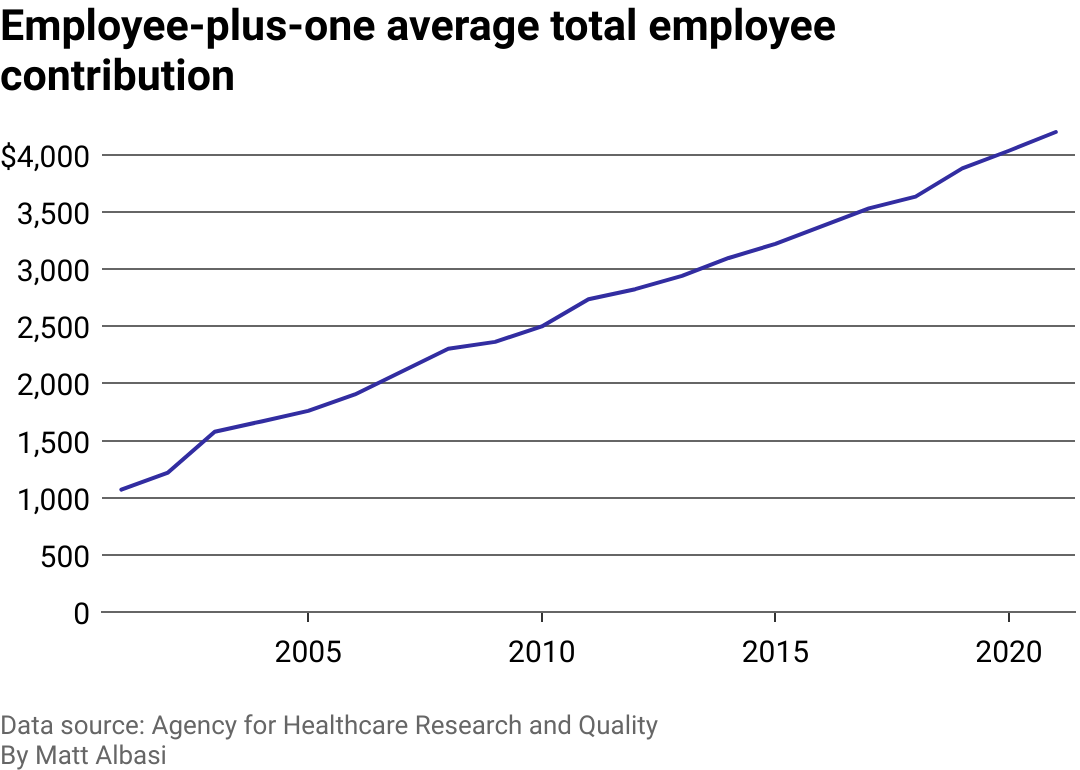

A line chart showing the employee contribution for an employee-plus-one to their health care from 2001 until 2021. The line is increasing constantly.

Employee-plus-one health insurance covers an employee and one additional family member at a lower cost than family coverage.

Like the employee-only plans, the cost for employee-plus-one plans is rising much faster than the increase in employees’ wages or inflation. Employee contributions averaged $4,984 for small firms, $5,526 for medium-sized businesses, and $3,986 for large employers.

Sana

Family coverage increased by more than 250%

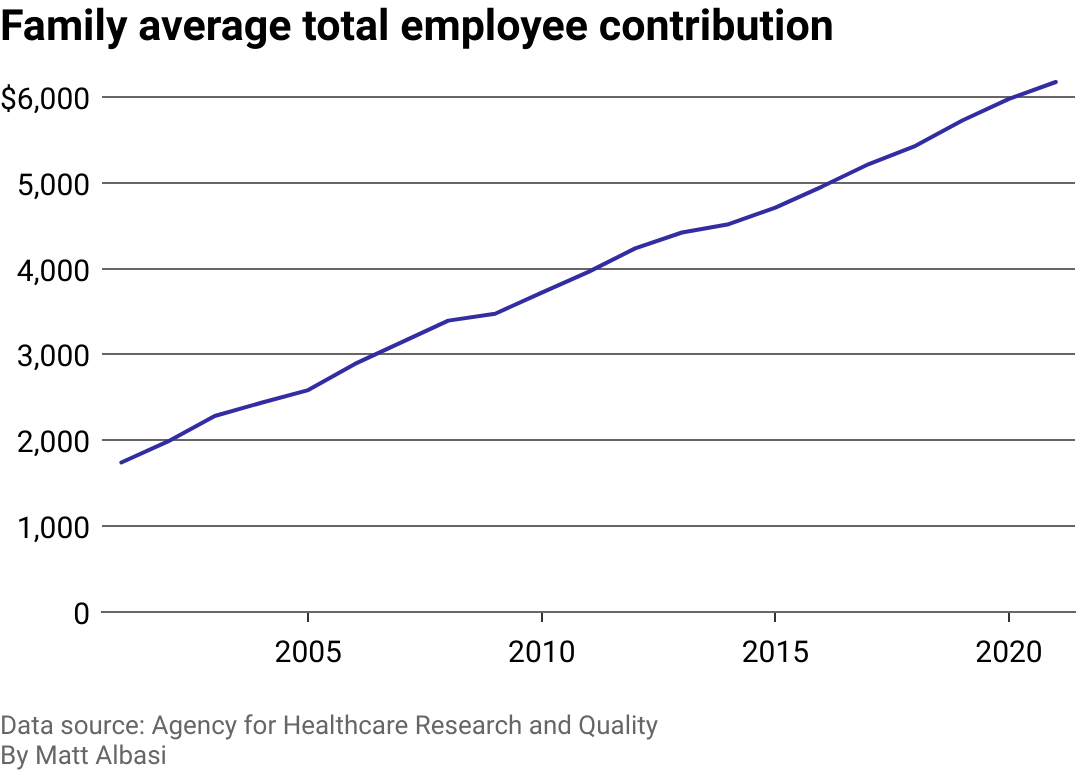

A line chart showing the employee contribution for a family to their health care from 2001 until 2021. The line is increasing constantly.

Family coverage refers to insurance that covers the employee and their family, which can include a spouse and children.

The growing cost of health care has become one of the biggest financial concerns for American families, according to KFF polls, and it influences decisions regarding insurance coverage and seeking medical attention. Over the past two decades, employee contributions to family coverage have significantly increased. However, the burden of health care costs is much more significant on employees in small firms (less than 200 employees). For these employees, their premium costs about $2,000 more than employees in large firms. The current economic climate is giving employers a sense that these costs will continue to increase.

The average annual employee contribution for family coverage was $6,106 in 2022, which reflects a 7% increase since 2017, according to KFF. A family plan price is significantly higher, which makes sense given it covers more individuals. Larger families, however, are not always associated with higher medical costs. Factors like age and geographical location are among other elements that insurers take into account when determining the premium.

This story originally appeared on Sana and was produced and

distributed in partnership with Stacker Studio.