Restaurant owners aren't feeling fully prepared for weather-related damages: Here are their top stressors—and what they can do about it

Mike Hardiman // Shutterstock

Restaurant owners aren’t feeling fully prepared for weather-related damages: Here are their top stressors—and what they can do about it

debris from flash flood piled in front of restaurant in Montepelier, Vermont

In a survey conducted in January 2024 and February 2024, Next Insurance gathered insights from 1,000 restaurant owners across the United States. The survey sought to understand their perspectives on insurance for weather-related damages and the top stressors they face as small-business owners.

The results reveal the multifaceted challenges restaurant owners face in protecting their businesses. Here are the key findings.

![]()

Next Insurance

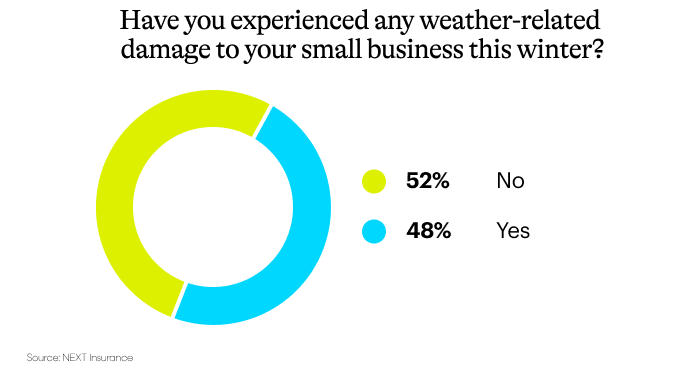

48% of small restaurant owners experienced weather-related damages last winter

Chart showing answers to question: Have you experienced any weather-related damage?

Forty-eight percent of restaurant owners reported experiencing weather-related damage to their small businesses during the winter months, from November 2023 to the first week of February 2024.

This data underscores the real impact weather events can have on the operations and financial stability of restaurants.

While this may seem like a high percentage in a short time frame, it aligns with recent national weather trends. The U.S. continues to experience an unprecedented number of weather and climate disasters — tallying $92.9 billion in 2023 — that have affected people’s livelihoods.

Next Insurance

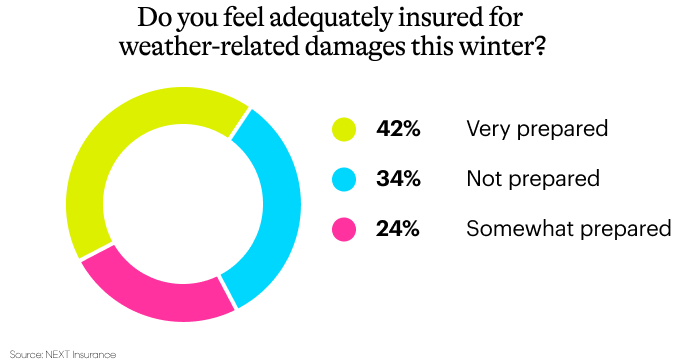

58% of restaurant owners question their preparedness for weather-related damages

Chart showing answers to question: Do you feel adequately insured…?

When asked if they felt adequately insured for weather-related damages such as snow damage, water damage, fallen trees, flooding and more, 42% of respondents said that they felt very prepared for severe weather compared to 34% that did not feel prepared and 24% that felt somewhat prepared

Next Insurance

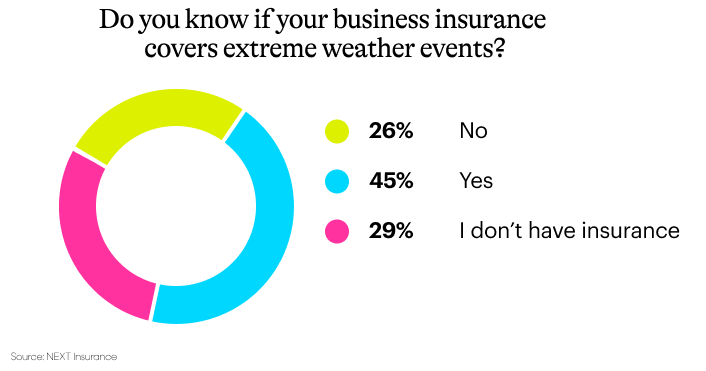

Awareness of extreme weather insurance coverage

chart showing answers to question do you know if your business insurance covers….?

A significant number of respondents were uncertain about whether their business insurance covered extreme weather events at all (26%). This lack of awareness suggests a potential gap in understanding the specific coverage and limitations of their insurance policies.

Additionally, 29% of respondents say they do not have business insurance. Without business insurance to help cover costs, restaurant owners would have to swallow out-of-pocket weather-related damages themselves.

The lack of confidence in insurance coverage and insurance knowledge is a continuing issue for small-business owners. In a previous survey, Next Insurance uncovered that 90% of small-business owners — across industries — aren’t confident that they are adequately insured for their business risks.

Next Insurance

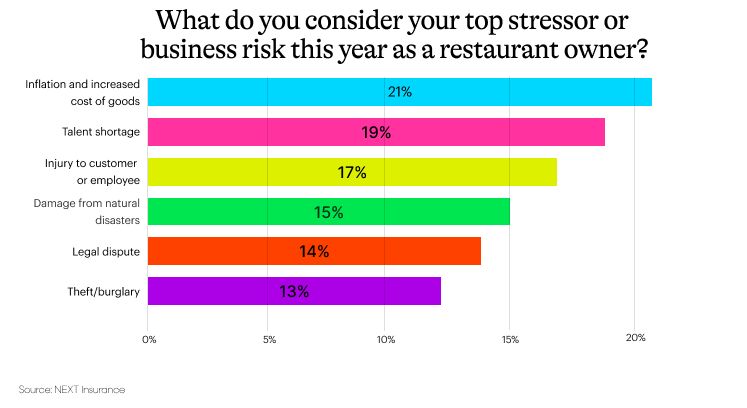

Inflation and talent shortages continue to stress restaurant owners in 2024

chart showing top stressors for restaurant owners

When asked about their top stressors or business risks, restaurant owners continued citing issues that have affected operations since 2020: inflation and talent shortages (21% and 19%, respectively). Injuries to customers or employees (17%) rounded out the top three challenges.

What restaurant owners can do to reduce winter-related risks

Moving forward, it’s crucial for restaurant owners to:

Prepare for winter weather before it hits. Investing in preventive measures goes a long way toward bracing for winter and reducing weather-related damages.

Review their insurance policies. Regular coverage review helps protect their changing needs and circumstances. It helps identify any gaps in coverage and allows owners to make adjustments to avoid being underinsured or paying for unnecessary coverage.

Seek clarification on coverages. Carefully read a policy’s terms and conditions, specifically looking for sections that mention coverage for weather events. If unsure, contact your insurance agent or company directly to understand coverage.

Explore additional measures to mitigate risks. This could take many forms, including adding endorsements to your insurance, implementing risk management strategies and conducting regular risk assessments. Restaurant owners can also shift risk by signing indemnification agreements with vendors or outsourcing high-risk tasks to specialized organizations.

Learn more about preparing for winter and reducing your risks. By staying informed and adequately protected, restaurant owners can navigate the uncertainties of weather-related damages and focus on running successful and resilient businesses.

This story was produced by Next Insurance and reviewed and distributed by Stacker Media.