Charge card vs. credit card: What's the difference?

Yuliia_Yershova // Shutterstock

Charge card vs. credit card: What’s the difference?

Photo of two hands holding a credit card with each photographed with a teal background.

Charge cards and credit cards are both forms of cashless payments, but the way you pay them off is quite different. While credit cards allow you to carry a balance, charge cards must be paid in full every month.

Aside from how payment works, there are a few other differences to be aware of. In this article, Ramp explains how charge cards and credit cards work so that you can choose the right card for your business needs.

How does a charge card work?

A charge card is similar to a business credit card, except that it needs to be paid in full every month. There’s no option to make a minimum payment and carry your balance to the next month with interest.

In addition, charge cards come with expense management software and custom controls to help manage employee spending. You can add rules like merchant restrictions and preset spending limits to enforce your company’s expense policy.

![]()

Ramp

Advantages and disadvantages of charge cards vs. credit cards

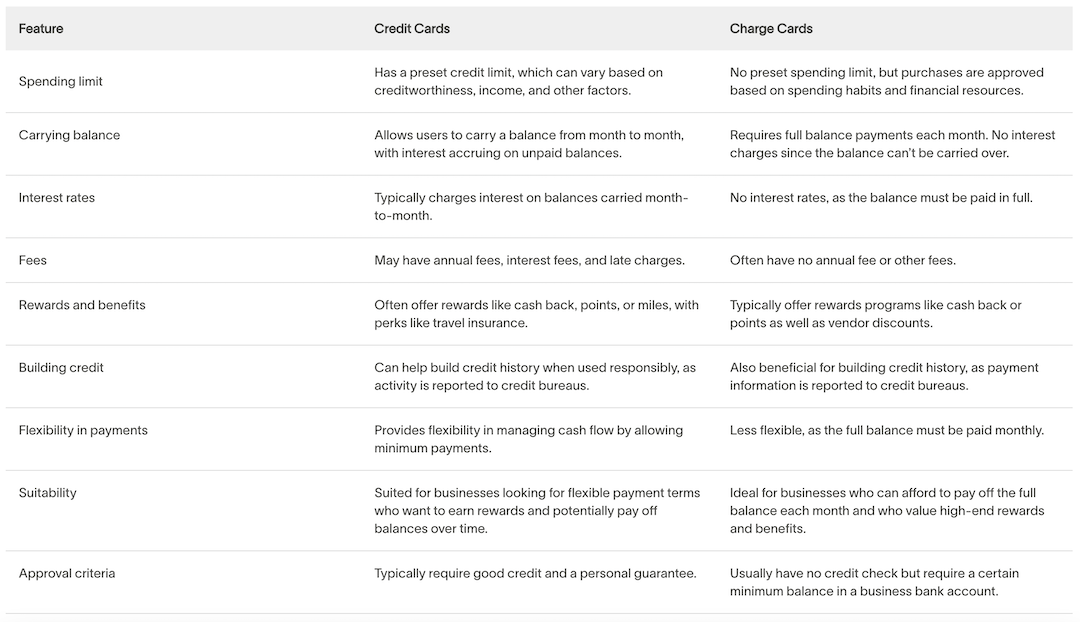

Table showing feature differences between credit cards and charge cards.

Here’s a quick glance at the unique advantages and disadvantages of these two types of cards:

The key differences between charge cards and credit cards

Now, let’s take a closer look at the key differences between charge cards and credit cards that you should keep in mind.

Payment terms

Although charge cards offer more flexible spending limits, credit cards have more flexible payment terms.

No matter how much you spend with your credit card during a given billing cycle, you’re only required to make the minimum monthly payment by the due date. This amount may represent a mere fraction of the outstanding balance for each billing cycle. Any unpaid balance that’s rolled over to the next month is charged according to your interest rate.

Be warned, though: The option to pay over time makes it deceptively easy to rack up debt on your account. If this cycle is perpetuated over a long period, your business can accrue exorbitant interest on your balance, damaging your credit score in the process.

In contrast, a charge card balance must be paid in full every month. As a result, this means you won’t pay interest or late fees. Businesses with consistent cash flow that can shoulder the full expense may find this option to be a highly effective way to manage their budgets.

Card limits

Credit cards put a cap on the amount of credit available to cardholders each month. Once you reach your limit, you’re automatically restricted from making any new purchases on the account. Once you pay down some of that debt, then your credit increases again.

When you’re approved for a card, the issuer determines your credit limit based on your credit score and payment history. If you’d like to raise your limit, you’ll have to demonstrate a history of responsible and frequent card use.

Meanwhile, charge cards don’t have preset card limits. Their spending limit fluctuates (sometimes even monthly) based on factors like:

- Credit history

- Monthly spending

- Liquid assets

- Historical sales

- Repayment habits

These flexible limits make charge cards useful for making large purchases or many purchases in a short timeframe.

Eligibility requirements

Credit card issuers determine your eligibility based on your credit history. If you have a bad credit score, you’ll still qualify for some cards, but they’ll usually come with higher interest rates. Having a good to excellent credit score allows you to access the best credit cards.

Credit card issuers determine your eligibility based on your credit history. You can still apply for business credit cards if you have a bad credit score, but they’ll usually come with higher interest rates. Having a good to excellent credit score allows you to access the best credit cards.

Charge cards, on the other hand, evaluate your application based on your company’s financial situation. Most providers consider your annual revenue and amount of capital in the bank. So, if you don’t have an established business credit history, you can still qualify—as long as your business is bringing in enough profit.

Impact on credit score

Credit utilization refers to how much of your available credit is used at any given time, and is expressed as a percentage. This factor accounts for a weighty 30% of your FICO credit score.

Since credit cards come with a preset limit, how much of that credit you use compared to your total available credit will impact your profile. Keeping your credit utilization down can help improve your credit score. It signals to creditors and credit bureaus that you can use your card, and pay it off, in a responsible manner. Conversely, a higher credit utilization ratio will impact your credit report.

Charge cards generally don’t come with preset limits, so credit agencies don’t factor credit utilization rates into their scoring models. Because of this, making larger purchases with a charge card instead of a credit card can help improve your credit score instead of harming it.

What’s the difference between a charge card and a debit card?

A charge card, often used by businesses for purchasing flexibility, requires the full balance to be paid off each month. This allows for potentially large, short-term spending without interest. In contrast, a debit card withdraws funds directly from a business’s bank account, providing a straightforward way to manage business expenses by spending only what is available.

Should I get a charge card or credit card?

If your business makes steady money every month, a charge card could work well since it requires paying off the full balance monthly. This can help keep spending in check. On the other hand, if money comes in more unevenly, a credit card might be better since you can carry a balance from month to month, providing some financial flexibility during tighter times.

Expense management is another factor to consider. Charge cards often come with tools that help track and control spending, making it easier to manage business expenses. Credit cards may also have expense management features, but they might not be as comprehensive. The right card can provide valuable insights into your spending, helping to streamline budgeting and financial planning for a small business.

Lastly, consider the costs and rewards of each card type. Credit cards often have rewards programs, but they also come with annual fees and interest rates. Charge cards can also offer rewards—Ramp, for example, provides 1.5% cash back on purchases with no fees or interest.

This story was produced by Ramp and reviewed and distributed by Stacker Media.