The Great Wealth Transfer: How to protect your legacy

PeopleImages.com – Yuri A // Shutterstock

The Great Wealth Transfer: How to protect your legacy

Big family with grandparents play and laught at the beach.

Over the next few decades, U.S. wealth is set to undergo a radical transformation, with enormous collective fortunes transferring from one generation to the next. Without proper financial education and planning, however, much of this money stands to vanish before it ever passes to a third generation. So, with that in mind, LegalZoom explains how the richest generations in American history can go about protecting their legacies.

What is the Great Wealth Transfer (and does it really exist)?

In early 2022, a widely respected market research firm, Cerulli Associates, released a groundbreaking report detailing what it called the “Great Wealth Transfer.” In its report, the firm projected that an enormous $84.4 trillion worth of assets would be transferred to younger generations by 2045. Of this $84.4 trillion, more than half ($53 trillion) would come from baby boomers, with an additional $15.8 trillion shifting from the Silent Generation (those born between 1928 and 1945) to future generations.

Since the Cerulli report went public, other research firms and agencies have been quick to release their own findings, many of which either agree with the $84.4 trillion figure or offer slightly more conservative estimates. Regardless of which data you choose to trust, the implications are clear: The largest generational transfer of wealth is set to happen within the next two decades.

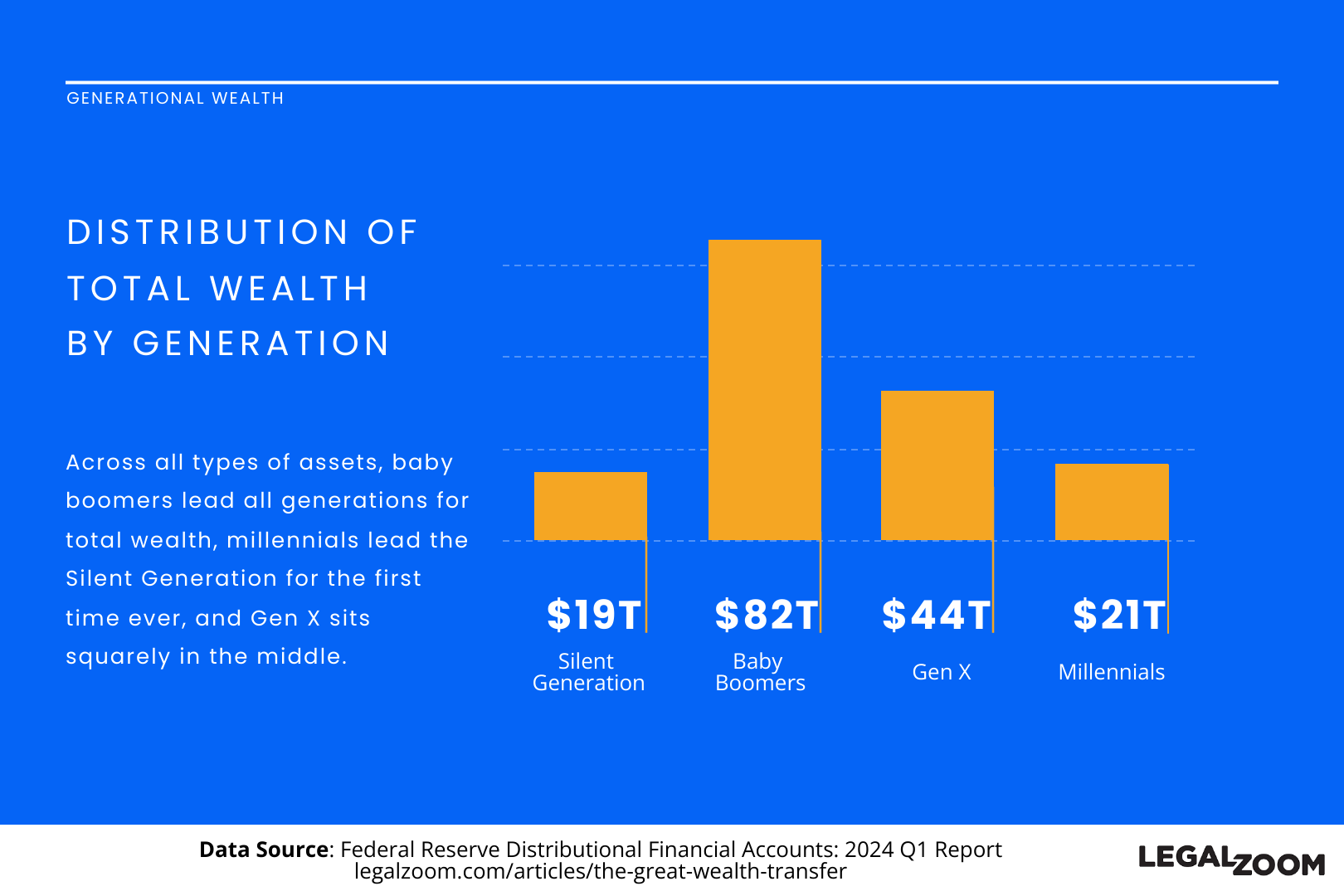

How wealth is distributed across different generations

With more than $80 trillion worth of assets as of Q1, 2024, baby boomers are, by far, the richest generation. Following at some distance behind are Generation X (~$44 trillion), millennials (~$21 trillion), and the Silent Generation (~$19 trillion).

![]()

LegalZoom

Breaking down per capita wealth by generation

Image of data visualization for “Distribution of Total Wealth by Generation”.

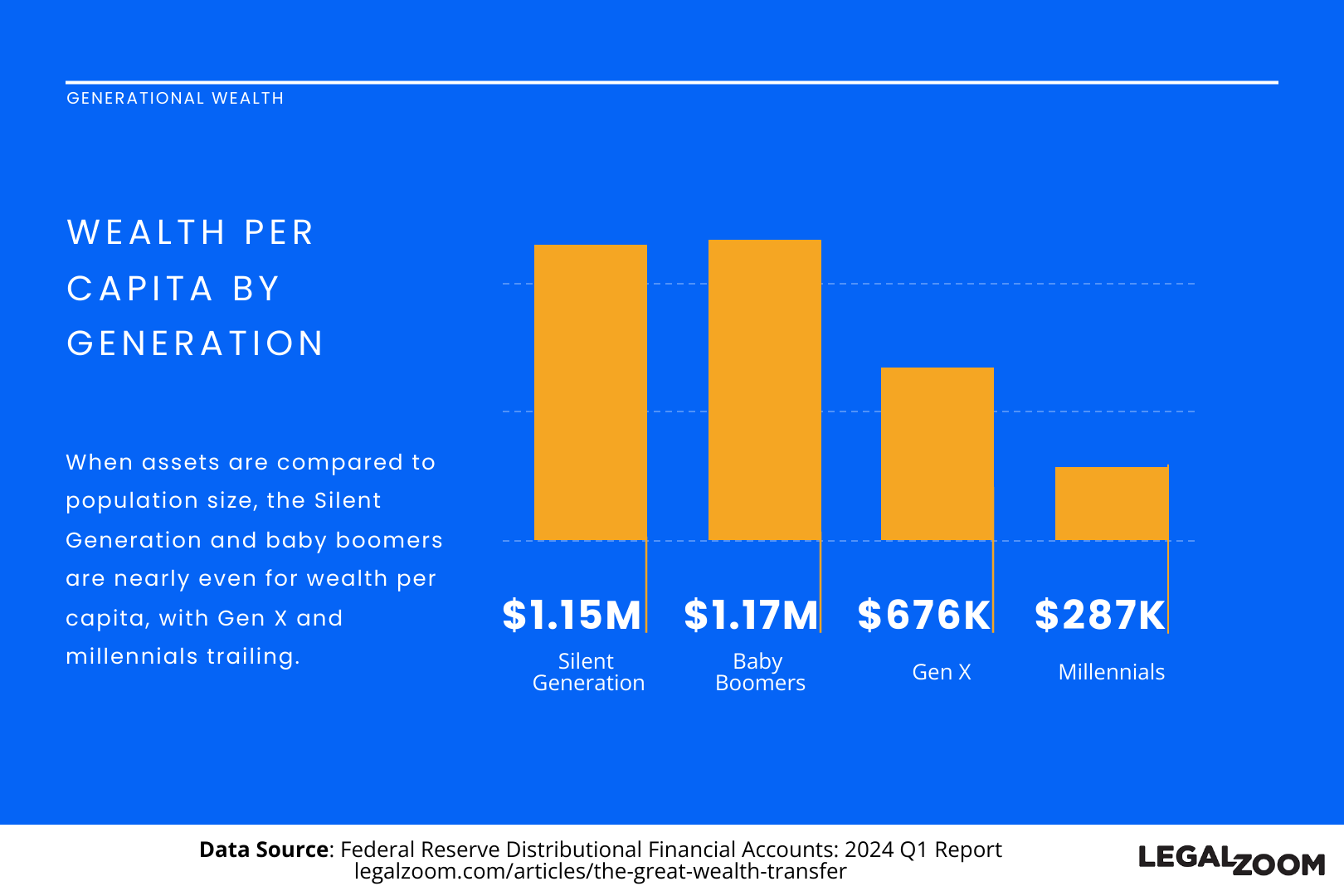

The numbers above, however, only reflect the total net worth of the generations as a whole. When standardized by the total population of each generation, we get a much clearer picture of the average wealth per capita.

LegalZoom

Why women stand to inherit more than men

Image of data visualization for “Wealth per Capita by Generation”.

While much of the Great Wealth Transfer will involve money passing to children and beneficiaries from older generations, a sizable portion will also come in the form of spousal inheritance —and most of it to women.

This is due to a few factors. First, women live about five years longer, on average, than men. This means that as married male baby boomers and Silent Generation members die, many will leave much or all of their estate to their wives. Second, the next generation expects a much higher population of female heirs, meaning that more women will come into inheritances — and will do so at a younger age than ever before.

All told, these shifting gender dynamics are set to place nearly $30 trillion worth of assets into the hands of American women by 2030. For perspective, that’s roughly the annual GDP of the United States.

How to talk to your kids about their inheritance

When most people think about leaving behind a healthy inheritance for their children, they do so with a mixture of pride and concern. On the one hand, it feels amazing to know that the work you did in life will support and protect your loved ones even after you’re gone. On the other, it’s reasonable to fear that a large inheritance may change how they live their lives — and not in a good way.

Whether it’s poor decision-making, lavish spending, decreased motivation or conflict with family members, a sudden windfall can negatively impact a beneficiary’s life — so much so that up to 70% of family wealth vanishes within the second generation.

Still, these negative effects are only made more likely by choosing to keep your children and other beneficiaries in the dark about what to expect. That’s why, even if you don’t give your children the specifics, it can pay off (literally) to frame any inheritance talk as a conversation about financial literacy.

Rather than focusing on the dollar amount that beneficiaries should expect when the time comes, try to get them to understand the work that went into building that generational wealth. Not just the hard-earned salary or wages at its base, but also the intelligent financial decisions that allowed your estate to grow into something worthy of being passed down.

By framing the conversation this way, you not only prepare your children (and their children) to benefit from their inheritances, but you also pass on the wisdom needed for true financial security. Remember, the most important part of your legacy isn’t the assets you leave behind — it’s how those assets were built in the first place. When your children learn the latter, they’ll be able to protect the assets they inherit and grow them into something even greater.

How to talk to your parents about your inheritance

Compared to their parents, adult children who will receive an inheritance have an entirely different set of delicate issues on their hands. After all, how do you begin a conversation about inheritances without sounding overly expectant, presumptuous or even callous?

Though the issues may be different, the solution here is the same as it is for parents: Don’t focus on the money. While it’s all too easy to fixate on what your inheritance contains, the real priority should be learning how that inheritance was built — and how to continue building it throughout your own life.

To that end, try asking questions about structure rather than dollar figures. What percentage of your parent’s estate is liquid? How much is in stocks or securities? What about real estate and other physical assets? The goal here is to begin learning about the overall structure of your inheritance so that, when the time comes, you can make sure that structure doesn’t crumble under its own weight.

In some cases, it may even be best to suggest sitting down with your parent’s financial advisors and hammering out a list of need-to-know subjects. Regardless of how you choose to approach the conversation, however, remember that the focus should be continuing the legacy that you will eventually inherit.

Why is estate planning so important?

According to some long-held studies on the subject, roughly 70% of all intergenerational wealth transfers fail, meaning the money is squandered before it ever has a chance to benefit a third generation. Even if you take those claims with a grain of salt, the simple truth is that many attempts to preserve wealth across multiple generations fail.

Part of this is the lack of financial literacy among inheritors discussed earlier. Another facet of this failure, however, is the lack of a proper wealth transfer plan or an estate plan when executing an inheritance.

Writing your own will

The simplest form of estate planning is, unsurprisingly, known as a simple will. In some cases, these documents can be written without the help of a financial professional (though oversight is still highly advised). Keep in mind that many digital tools exist to help facilitate this process.

If you choose to go this route, make sure you follow all of the guidelines required to make your will valid and enforceable. If any of these rules are overlooked, your will may be invalidated during the probate process, meaning that your estate is then open to be executed in a way that could run counter to your wishes.

Working with an estate planning attorney

Depending on your financial situation and the complexity of your estate, it may be best to work with an estate planning professional to intelligently structure the way your wealth will be handled after you’re gone. These experts can provide personalized advice and insights into the best ways to protect your legacy.

- Grantor Trusts

According to the same Cerulli Associates report outlining the Great Wealth Transfer, grantor trusts constitute, by far, the most common type of estate planning tool used to reduce tax liability during wealth transfer (used in 77% of estate plans surveyed).

That said, there are many types of grantor trusts, the most effective of which are usually also the most complicated. Because of that complicated nature, it’s best to work with attorneys and financial professionals to make sure your estate plan complies with federal regulations and tax codes.

- Spousal Lifetime Access Trusts

Close on the heels of the grantor trust is the spousal lifetime access trust (used in 54% of estate plans surveyed). This is a relatively straightforward type of irrevocable trust that names the grantor’s spouse as the primary beneficiary and provides generous tax exemptions for any assets included within.

- Strategic gifting

Unlike trusts or wills, which operate as financial structures or legal documents, strategic gifting is a more general method of reducing tax liability on assets you wish to be passed down. While many types of strategic gifting exist, the simplest is the IRS’ annual gift tax exclusion, which allows individuals to “gift” a certain dollar amount to qualified recipients each year — tax-free.

Frequently asked questions

Who oversees the probate process and estate tax?

In the U.S., the probate process is generally handled at the state level, rather than by any federal government agency. Specifically, probate courts are assigned to execute and, if necessary, arbitrate estates in a way that complies with state law.

How much does it cost to create an estate plan?

Estate plans can cost anywhere from $300 for an attorney-drafted simple will to many thousands of dollars for individuals with complex financial situations. That said, the money saved by reduced tax liability can vastly outweigh any fees associated with constructing an estate plan.

How many assets do you need to warrant an estate plan?

One of the most common misconceptions about estate planning is that it’s reserved for the ultra-rich. In reality, 58% of the $84.4 trillion projected to change generational hands by 2045 will come from individuals who fall outside of the “ultra-rich” category. Often, these are people with a moderate amount of assets, such as a house and stock portfolio, who simply want their wealth to be handled properly when they’re gone.

This story was produced by LegalZoom and reviewed and distributed by Stacker Media.