What to expect when buying a house in 2024

sturti // Canva

What to expect when buying a house in 2024

couple with young child views open house with realtor in the background

Buying a home is a major financial commitment, and if you have some flexibility when it comes to timing, getting a read on the local housing market can help you maximize your savings. While there aren’t necessarily good times or bad times to buy a home, understanding market conditions can help you decide the best time for you, personally, to buy.

Last year’s housing market was marked by record home prices and interest rates that reached a 23-year high—a combination that spelled widespread unaffordability. With many would-be buyers priced out of the market, mortgage originations declined last year. This dip in new loans is reflected in Experian data on mortgage inquiries, which shows 2023’s levels down throughout every month of the calendar year. Overall, mortgage debt increases lagged behind other major types of debt, rising a relatively slight 3.2% from Q3 2022 to Q3 2023, according to Experian data.

If last year’s surging prices, high rates and ongoing tight supply left you sidelined, you may be wondering if smoother market conditions lie ahead. If you’re looking to buy a house in 2024, review these market predictions first.

![]()

Experian

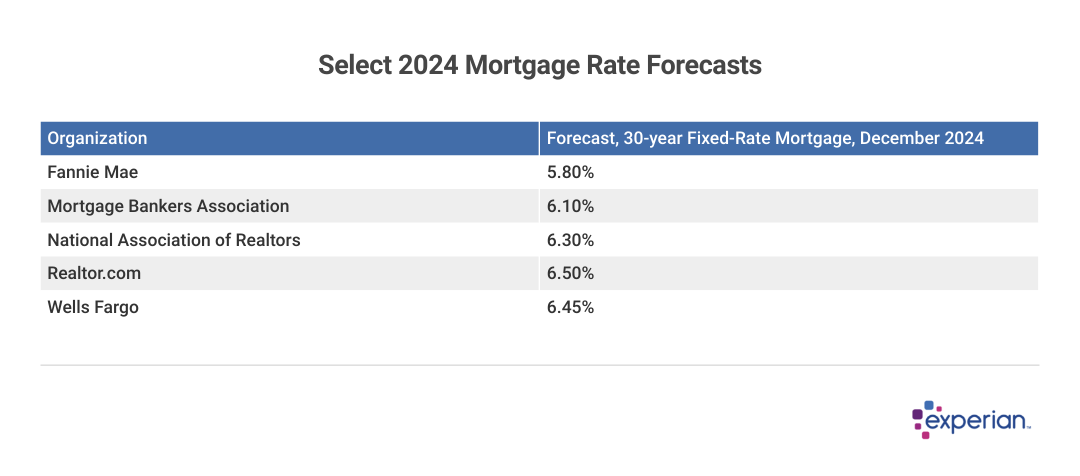

Will mortgage rates decline in 2024?

table showing 2024 Mortgage Rate Predictions

In October 2023, the average interest rate for a 30-year fixed-rate mortgage hit 8% for the first time since 2000, according to Mortgage News Daily. The expert consensus is that mortgage rates will come down in 2024, and will generally land in the upper 5% to mid 6% range by the end of the year.

Note, however, that these predictions are based on present-day economic data and projections of current trends. Nobody can say for certain where mortgage interest rates will go in 2024. Interest rates may go lower than this range or continue to remain high, depending on further developments with the inflation rate and 10-year Treasury note yield, both of which heavily influence mortgage rates.

Experian

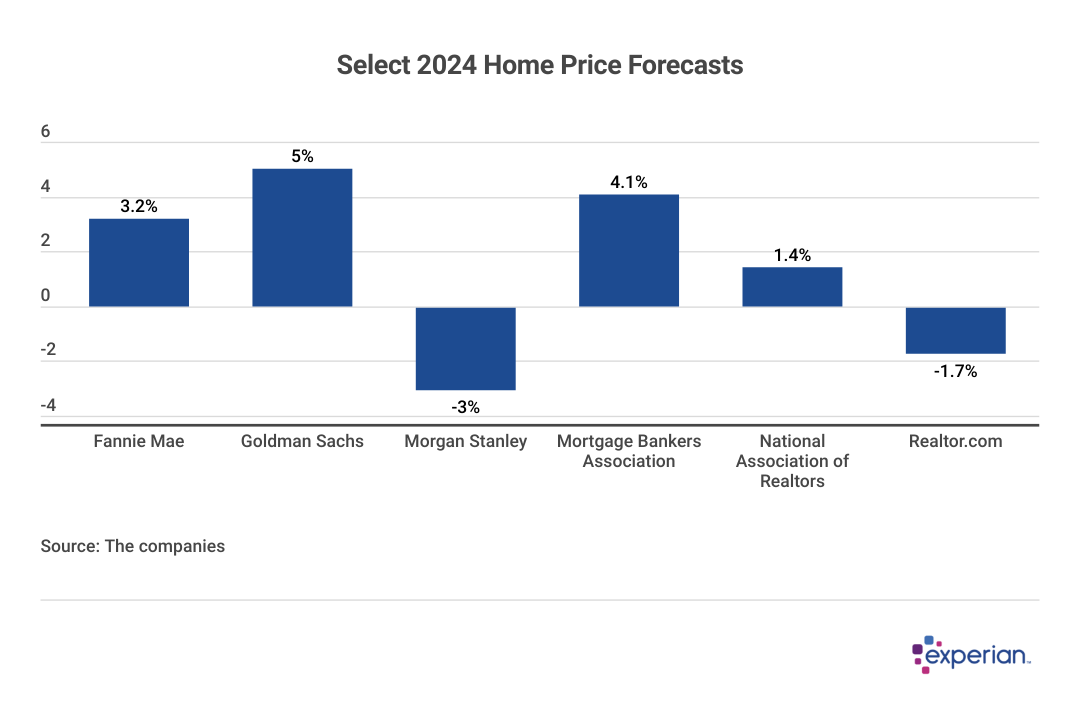

Will home prices decline in 2024?

table showing 2024 Home Price Predictions

Most experts expect home prices to continue to increase in 2024, following on the trend experienced in 2023, when according to Fannie Mae, prices rose 7.1%. This persistent rise in prices will continue to make homeownership inaccessible to many. However, some forecast the prices will drop, as can be seen in the above chart.

Will inventory increase in 2024?

Home inventory hit all-time lows in 2023, but experts expect that it will start to rebound in 2024. Many experts are mum on specifics, saying that inflation and mortgage rates must continue to drop considerably before inventory makes a meaningful recovery.

But if interest rates go low enough to persuade more homeowners to sell, inventory could increase by as much as 30%, according to the National Association of Realtors.

Will 2024 continue to be a seller’s market?

Even if home inventory increases significantly in 2024, it likely won’t be enough to keep up with demand. When supply outpaces demand like this, it’s almost always a seller’s market.

In a seller’s market, buyers face more competition and may need to make an offer above the asking price or waive certain contingencies and seller concessions to have their offer chosen.

Will the housing market crash in 2024?

Home prices rose at a blistering pace in 2020 and 2021, leading some to wonder whether a crash is on the horizon. But for the most part, experts don’t expect that to happen anytime soon.

While demand is relatively low, inventory continues to be lower, helping keep prices in check. If demand were to drop even more—for example, if the economy enters a downturn or interest rates don’t go down as predicted—then it’s possible for home prices to plummet.

Should I buy a house in 2024?

The decision to buy a home is a personal one, regardless of the state of the market. While expert forecasts can help you get an idea of what to expect, you’ll need to carefully consider your financial situation—particularly your budget—and evaluate whether you can afford to buy a home.

If current interest rates are putting home prices out of your reach—the median sales price as of the fourth quarter of 2023 was $417,700, according to the Federal Reserve Bank of St. Louis—it may be best to wait until interest rates come down more.

But if you find your dream home, and can afford it in the current market conditions, it can make sense to take a higher interest rate now and potentially refinance at a lower rate later on.

If you plan on buying, experts say that fall and winter are the best times if you’re looking for lower prices. However, inventory is typically lower during those seasons, so you may face stiff competition from other buyers. Spring and summer tend to have more inventory, especially as parents try to complete the moving process ahead of the start of the new school year. But prices are also higher at that point of the year.

With all of those things in mind, think about your situation and goals to determine the best time for you to buy a new home.

This story was produced by Experian and reviewed and distributed by Stacker Media.

This story was produced by Experian and reviewed and distributed by Stacker Media.